In September 2010, then-California Governor Arnold Schwarzenegger vetoed a bill that would have significantly restricted the use of credit checks by employers in California. If the same bill were put before the American people, though, more than half of them would have likely signed it into law. According to a recent Credit.com survey, the majority of Americans approve of the idea of banning the use of credit reports for employment screening.

In a January 2011 Credit.com survey conducted by GfK Roper, 1000 consumers were asked:

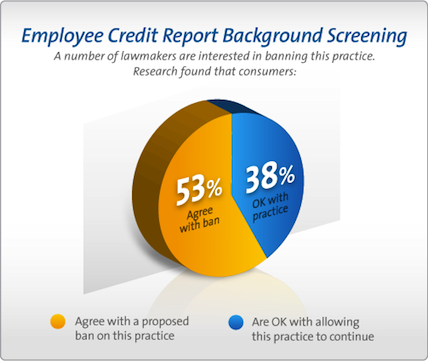

Employers have the right, with your permission, to check your credit report as part of background screening for employment. A number of lawmakers are interested in banning this practice – do you…

– Agree with a proposed ban on this practice?

– Or, are you OK with allowing this practice to continue?

More than half (53.5%) said they agreed with a proposed ban, with slightly more women than men in agreement (55% as opposed to 51.7%) — 39.3% stated they were OK with employers using credit reports to screen job applicants, and 8.2% said they didn’t know.

According to a Society for Human Resource Management (SHRM) survey of its members, 60% perform some type of credit report screening on job candidates, but only 13% check the credit of all job candidates.

[Related: Employer Credit Reports: What You Should Know]

Credit checks by employers have become a hot button issue. According to the National Conference of State Legislatures, 33 bills in 18 states and the District of Columbia were introduced in the 2010 legislative session to restrict the use of credit reports by employers. While most were defeated, two became law, and could serve as a model for other federal legislation:

Illinois: Beginning January 1, 2011, the Illinois Employee Credit Privacy Act prevents employers in that state from reviewing job applicants’ or employees’ credit reports, except in specific circumstances such as jobs that provide access to personal, financial or confidential information, trade secrets, or state or national security information.

Oregon: A law passed in 2010 prohibits employment discrimination by employers on the basis of information contained in a worker’s credit history, with exceptions, including permission to use that information when it is “substantially job-related.”

Are you worried that your credit could cost you a job you need to pay your bills? Here are some tips:

- Review your reports. If you are job hunting, make sure you at least know what’s in your credit reports. Visit AnnualCreditReport.com to get copies of your credit reports from all three major credit reporting agencies. If you are unemployed, you are entitled to an additional free copy of your credit report. Follow these instructions. Then use Credit.com’s free Credit Report Card to help you understand what that information means. (Keep in mind, employers do not get or use credit scores.)

- Be proactive. Under federal law, employers must get an employee or applicant’s specific written permission before obtaining his or her credit report. If you know there are problems, provide an explanation with your application. Many employers say they would rather a candidate be upfront about problems than hide them.

- Monitor your credit. Wonder whether an employer is checking your credit? Monitor your credit reports. Anytime your credit information is obtained by a third party, an “inquiry” will appear on your credit report. Just remember that the name of the company inquiring may be different than that of the prospective employer, since many use third-party background screening services.

[Product Spotlight: Get all 3 Credit Reports with Equifax’s 3-in-1 Monitoring with Credit Score]

Weigh In! If you believe your credit has kept you from getting a job, share your story in the comments section below. Or maybe you’re an employer and you’ve found credit reports helpful when screening applicants. We’d like to hear from you.

This national RDD Probability Sample telephone poll was conducted for Credit.com by GfK Custom Research North America from January 14-16, 2011. A total of 1,004 interviews were completed, with roughly 531 female adults and 473 male adults. The margin of error is +/- 3 percentage points for the full sample.

You Might Also Like

June 4, 2024

Credit Score

March 7, 2023

Credit Score

January 4, 2021

Credit Score