Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Those with a credit score of over 780 have an average car loan interest rate as low as 4.75 percent and individuals with a score below 500 pay an average interest rate as high as 20.62 percent.

Many people don’t realize how their low credit score impacts other financial parts of their life. One of the prime examples is when you’re getting a car loan. When buying a car, your credit score is one of the primary factors for how much the car will cost, as well as how much you’ll pay each month.

While discussing the 2022 interest rate hikes, Sarah O’Brien from CNBC reported that the difference someone can save thousands of dollars on a car loan’s interest by having a FICO® credit score of 720 rather than 670.

Here, we’re going to go over the average car loan interest rate by credit score and the other factors that can affect your auto loan. By understanding these factors, you’ll be more likely to get a better deal on your auto loan and potentially save quite a bit of money.

Average New and Used Car Loan Interest Rates

Each quarter, the credit bureau Experian® releases the State of the Automotive Finance Market Report, and it tracks a variety of new and used car finance trends. The most recent data comes from their fourth quarter report in 2022.

They found that year-over-year, the interest rates for used car loans rose for all credit scores, with prime scores having the highest increase of 2.42%. The year-over-year trend was the same with new cars as well, with the highest increase also coming from prime borrowers at 2.29%.

The following table with the average new and used car loan interest rates as of Q4 2022 can give you an idea of what you may be paying when financing a car:

|

Credit score |

Average used car APR |

Average new car APR |

|---|---|---|

|

Superprime (781 to 850) |

5.99% |

4.75% |

|

Prime (661 to 780) |

7.83% |

5.82% |

|

Nonprime (601 to 660) |

12.08% |

8.12% |

|

Subprime (501 to 600) |

17.46% |

10.79% |

|

Deep subprime (300 to 500) |

20.62% |

13.42% |

For new cars, the average car loan interest rate is 6.07% and 10.26% for used cars. As you can see from Experian’s data, the best rates come from having a score of over 780, but you may have an interest rate as high as 20.62% with a score of 500 or below.

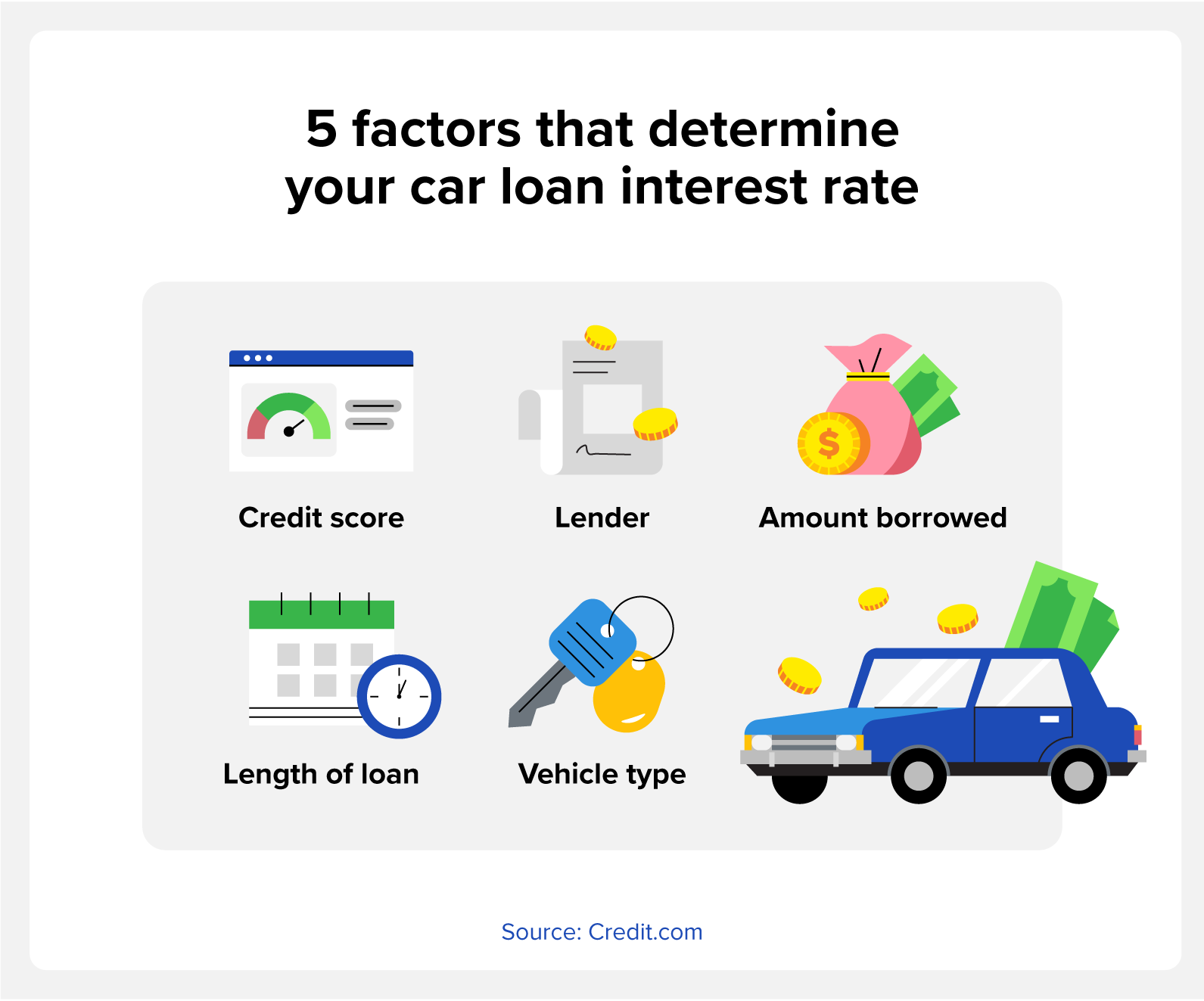

What Affects Your Auto Loan Interest Rate?

A credit score plays a large role when lenders determine vehicle interest rates, but it’s not the only factor. The following are other aspects that may lower or increase your interest rate and overall cost of the vehicle.

Credit Score

Credit scores are a quick way for lenders to determine the level of risk when lending money. The two most common scoring models used are FICO® and VantageScore® Lenders are more likely to use FICO® scores and these scores may differ from Vantagescores, which are more used for credit education.

Regardless of which model the lender uses, your score represents various areas of financial wellness, and each one’s weighted differently. The FICO scoring model is more common, and the following are its five factors and weighted percentages:

- Payment history: 35%

- Credit utilization: 30%

- Credit age: 15%

- New credit 10%

- Credit mix: 10%

Lender

When shopping for a car, it’s helpful to shop around lenders as well. Different lenders may offer better rates, depending on your score. For example, some lenders specialize in working with people with lower credit scores.

In addition to your credit score, lenders will also look at your debt-to-income ratio to ensure you have enough money coming in and not too much debt to make your payments. Depending on the lender, they may also take into consideration other factors like your job, education and other criteria.

Amount Borrowed

One way to lower your car payments and potentially your interest rate is to lower the amount borrowed. In order to do this, you’ll need to put down a larger down payment. When the down payment is small, the overall borrowed amount is larger, which a lender may see as an increased risk and may charge a higher interest rate.

Length of Loan

A longer loan term can raise your interest rate, which makes the overall cost higher than the original price. It’s common for people to mainly look at the monthly payments because it impacts what they can afford. While the longer loan term lowers the monthly payments, the interest rate is often higher.

This means that not only are you paying a higher interest rate, but you’re paying it for a longer period of time as well. It’s ideal to pay off the vehicle as quickly as possible to lower the overall cost.

Vehicle Type

In the table above, you may have noticed that the average car loan interest rate by credit score also differed based on whether the vehicle was new or used. Since the value of vehicles depreciates, a used car will often be worth less than a new car. The lender may also consider the make, model and mileage as well.

3 Ways to Get Better Auto Loan Interest Rates

There are some simple ways to get better interest rates when buying a new or used car. When looking at the percentages, they may seem small, but they can either cost you or save you quite a bit of money.

As an example, we’ll take a look at the overall cost of a $30,000 new car with a loan term of 60 months. With a subprime credit score of 550, the average interest rate of 10.79% would make that vehicle cost you $38,948. If you raised your score by 50 points, you would save about $2,000 at an interest rate of 8.12%. With a score over 780, you would save roughly $4,000.

This is why it’s so beneficial to improve your credit score.

1. Compare interest rates

Similar to the way you shop around car dealerships for the best price of a car, you can do the same with lenders to find the best interest rates. Check with multiple lenders to see which one will give you the best interest rate. If you have a bank or credit union you’ve been with for a long time, they may give you the best rate based on your history with them.

2. Get a co-signer

If you have a low credit score, getting a co-signer for your auto loan can help you get a better interest rate. A co-signer is someone with a better credit score who signs the auto loan agreement with you. This is similar to someone vouching for you, but be sure to make your payments on time because missed payments can lower the co-signers credit score along with your own.

3. Make a larger down payment

If possible, make a larger down payment because it lessens the risk for the lender due to the lender lending a lower amount.

Where to Find the Best Auto Loans

When searching for a good interest rate for a car loan, the following are places you can start:

- Banks

- Credit unions

- Online lenders

- Car dealers

Remember, if you have been with a bank or credit union for multiple years, you may be able to get a better interest rate due to your relationship with them. Although you may have a lower credit score, they have detailed information about your financial history such as direct deposits, so they may work with you.

Car dealerships sometimes have their own financing to provide an auto loan. But, they sometimes come with higher rates than banks or credit unions.

A Better Credit Score Can Get You Better Interest Rates

Your credit score isn’t the only factor when it comes to your car loan interest rate, but it’s one of the main factors. As you learned, a 50-point difference in your credit score could either cost you or save you thousands of dollars. Many people with low credit scores either don’t know they have a low credit score or how to improve it.

Credit.com has a variety of credit tools that allow you to discover the areas of your credit that need improvement and much more. You can sign up and get your free credit report card here, and this will give you a credit snapshot with a grade to show you where you stand in each of the credit scoring factors. You can also sign up for a free seven-day trial of our ExtraCredit service that helps you know how to build, guard and track your credit score.

You Might Also Like

October 20, 2020

Auto Loans

July 20, 2020

Auto Loans