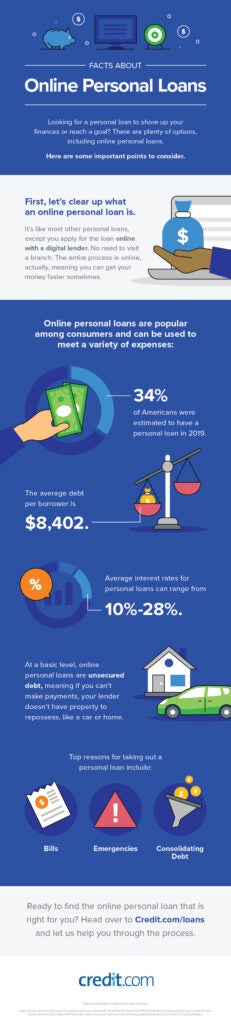

Around 176 million Americans hold at least one credit card, but only around 19 million have a personal loan. Despite their lower numbers, personal loans can be valuable tools for those who need cash to cover expenses now. Find out more about when to consider a personal loan and how to apply for one.

What Is a Personal Loan?

Personal loans are a type of installment loan. If you’re approved by the lender, you receive a lump sum of cash to use for whatever you need. You then repay the loan—plus interest—in an agreed-upon manner. That’s typically in installment payments of a certain amount each month for a specific period of time. This is different from revolving credit, like credit cards or home equity lines of credit.

Personal loans are often unsecured, which means they do not require collateral. The lender doesn’t have a way to recover value if you default on the loan as they would with a secured loan like an auto loan. To make up for the added risk, an unsecured personal loan may have a higher interest rate than a secured loan. If you have good enough credit, though, you can find personal loan options with competitive rates—even lower than using credit cards. According to Experian, the average annual percentage rate for persona loans was 9.41% as of Q2 2019.

Have bad credit? Check out our article on how to get a personal loan with bad credit.

When Should I Consider a Personal Loan?

You can use a personal loan for just about any reason, but they are typically used to make big purchases or fund an emergency expense. There are a lot of scenarios where a personal loan might come in handy:

- A home improvement project

- Financing for a business purchase

- A vacation or getaway

- Payment for a medical procedure

- Financing for a wedding or other big event

- An appliance purchase

- Debt consolidation

- Covering regular expenses during a short-term emergency

You should also consider whether a different type of loan might be better for your situation. For example, you might be better off with a home equity loan for home improvement projects. In some cases, a low introductory APR credit card might be a better option—as long as you can pay off the balance before the introductory offer expires.

Personal Loan Options During COVID-19

The world turned topsy-turvy when COVID-19 hit, and personal loans are no exception. Some lenders have responded by doubling down on their approval requirements, while others have introduced loans specifically to help those in need or are offering loan deferment options for existing customers impacted by the coronavirus.

If your financial situation has been impacted by COVID-19, research your loan options carefully. A personal loan could help you out—just make sure you don’t fall into the payday loan trap. If you already have a personal loan, reach out to your lender to see if they have any financial programs to help.

How to Apply for a Personal Loan

If you think a personal loan might be the right option for you, follow these steps to apply for a loan.

Step 1: Check Your Credit

Before you do anything else, you need to know where you stand. Whether or not you qualify for a personal loan will largely depend on your creditworthiness. Your credit score will impact your loan interest rate and other terms.

You can start reviewing your credit by checking your credit score and signing up for Credit.com’s free Credit Report Card. The credit report card lets you know how you’re doing in each of the five areas that make up your credit score. If your score is low and you’re not sure you’ll qualify for a loan, you might be able to make some positive changes that improve your score before you apply for an unsecured personal loan.

Step 2: Decide How Much to Borrow

Now that you know your credit standing, you’ll have a better idea of what you can get approved for. But before you start shopping, you need to know how much you can afford to borrow. You may get offers later for larger amounts, but if you can’t afford the payments, those loans aren’t for you. You don’t want to go into unnecessary debt when you can help it.

Carefully consider your financial situation before jumping into any personal loan. Review your own finances, think realistically about where you think you’ll be financially in the future and understand how your credit and other factors will impact the cost of a personal loan.

Consider the loan amount that you need and the monthly payment that you can afford. Larger loan amounts may be harder to qualify for you if you have less-than-excellent credit, while lower a loan amount with a lower interest rate will ultimately be easier to pay off when finances are tight.

Step 3: Know Your Consumer Rights

Under the Truth in Lending Act, you have specific rights when it comes to financial transactions—including personal loans. According to the act, lenders are required to disclose the APR, finance charges, amount financed, fees and penalties and total payment of personal loans. If you come across a lender that does not want to share this information with you, you will want to find a different lender to work with.

Step 4: Gather Everything You Need for the Loan Application

In addition to checking your credit score, a potential lender might want to ascertain your annual income as well as your debt-to-income ratio. Other details you might have to share on a loan application include your Social Security number, recurring monthly debt (like your monthly housing payment), whether you rent or own your primary residence, the name of your employer and how long you’ve worked there. Having this information on hand can speed up the process of applying for a personal loan whether in person or online.

If you have poor or bad credit, you might need a cosigner for your loan. If that’s the case, make sure you’ve discussed your options with your cosigner so you both understand the risks and requirements.

Step 5: Research Loan Options

Now comes the fun part: researching all the loans out there. Every time you apply for a personal loan, it triggers a hard inquiry into your credit. This nudges your credit score down a little bit. So before you start applying, you need to research as much as you can into the terms and conditions of potential loans.

Consider asking lenders in advance about the minimum credit score they require for personal loans. Some lenders will even list this information on their websites. A good place to start is the bank or credit union that you already have an account with. They may be willing to share their general minimum requirements with you so you can determine whether you meet their criteria before you apply.

Here are some of the details you should look into to determine which personal loan is the right one for you.

Loan details: Make sure you understand the loan amount, APR, monthly payments, and loan term.

Penalties and fees: Does the loan have an origination fee? What are the penalties for late or missed payments? Is there a penalty for paying off the loan early? Are there any other charges you should be aware of?

Type of interest: Is there interest rate fixed or variable? Is it precomputed or simple? This can have a big impact on your total amount paid.

Secured or unsecured: Is this a secured or unsecured loan?

Fine print: Look over the rest of the fine print—there’s always some fine print—with a financial adviser. How do they handle arbitration? What are the ACH terms?

Step 6: Apply for a Personal Loan

After doing your research and choosing a loan that looks like a match, complete the application. Consider setting aside some quiet time so you can avoid any typos or mistakes that might impact your loan approval chances. In many cases, when you apply for personal loans online, you get an answer back quickly, so you know within a day or two whether your needs are covered.

If you decide to apply for multiple loans, try to batch your applications together so that multiple hard inquiries will be treated as one on your credit report and affect your credit score less.

You’re Ready: Apply for Your Loan

Researching loan options can be daunting even in the best of times. If you’re dealing with a personal financial emergency or facing regional or national economic issues—such as those related to COVID-19 or a recession—you might already be stressed and unsure where to turn. Check out the personal loans at Credit.com to quickly compare options and see potential APR, terms and maximum loan amounts.

Remember that your situation is unique to you, and your credit history is also unique. Whether or not a personal loan is right for you and which one might be best is a decision you have to make yourself. But you can start with Credit.com’s listings to make research less daunting.

You Might Also Like

March 8, 2021

Personal Loans

April 8, 2020

Personal Loans