Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Are you one of the 16% of Americans with a low credit score? Low scores can stick around from poor financial habits when you were younger or if you’re still working up your credit score.

If you’re in that 16%, you’ve probably wondered how to get a car loan with bad credit. Your options might differ from your peers, but there are still ways to buy a car with low or no credit. Read our guide for what you should know before heading to the dealership so you can secure your new wheels, even if you’re still working on your finances.

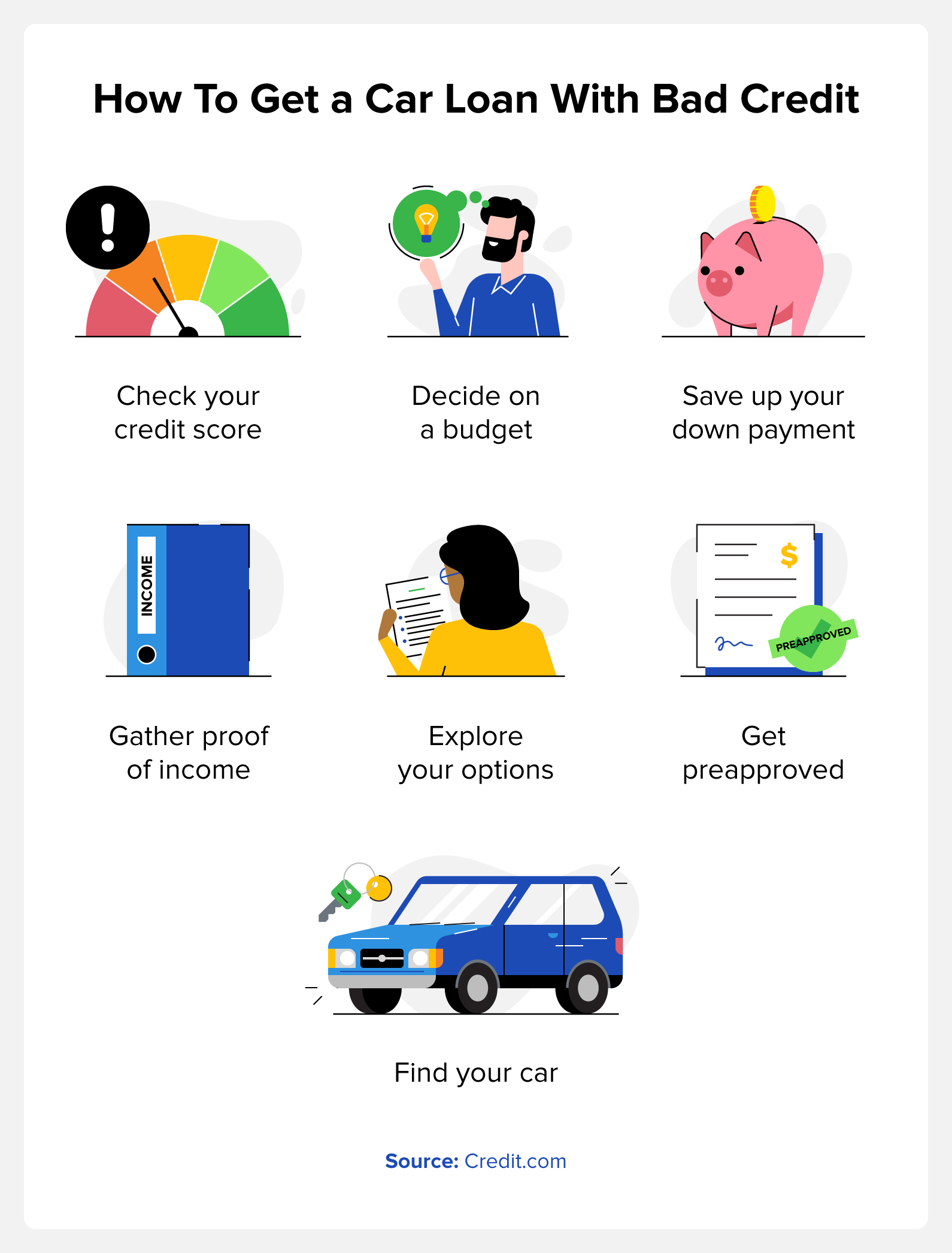

1. Check Your Credit Score

Before you start researching car loans in earnest, conduct a soft credit score check to see what you’re working with. This check won’t impact your score like a hard check will.

The average credit score in America was 714 in 2022, and you can generally categorize your score based on these ranges:

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very good

- 800+: Excellent

Once you know which category your score falls into, you’ll have a better idea how to strategize to secure your car loan.

2. Decide on a Budget

Your credit usage impacts your credit score, so it’s important to maintain a solid debt-to-income ratio (DTI). Every lender will have different DTI requirements, but it’s generally recommended to stay below 36%.

Use our DTI calculator to see where your current payments bring you, and you can use that to estimate your ideal car payment budget. Remember that you’ll need to consider costs like the insurance, down payment, and repairs too. So, give yourself some room instead of maxing out your monthly payment.

3. Save Up Your Down Payment

As with any loan, a car loan typically requires a down payment. This ranges anywhere from 10–20%. If you have a lower credit score, you can expect to pay closer to 20% for your down payment.

Start saving up for your down payment as soon as you can. If you can save up for a larger down payment, this can help you secure a car loan even with a lower credit score.

Some common saving strategies include:

- Zero-based budget: Create a very detailed budget with a plan for each dollar you earn in a month.

- Pay yourself first: Plan to pay your bills as soon as you get paid, then put a predetermined amount aside for savings. The rest of your paycheck goes toward leisure.

- 50/30/20 budget: Allocate 50% of your take home money to necessities, 30% to any leisure expenses, and 20% to savings.

A high-yield savings account can help you reach your financial goals faster. Double-check your account minimum to ensure you don’t face fees when you withdraw for your down payment. Regardless, saving up a little extra to account for surprise costs is a good idea.

4. Gather Proof of Income

Potential lenders want to see you have a reliable source of income, especially if your credit score needs some work. Your lender might ask for multiple documents demonstrating proof of income including:

- Form W-2

- Recent pay stubs

- Schedule C

- Tax returns

- Form 1099-R

- Social Security statements

Gather these key documents ahead of time to streamline your application process. Consider keeping a folder with copies of anything you might need so everything’s in one place and ready to go.

5. Explore Your Options

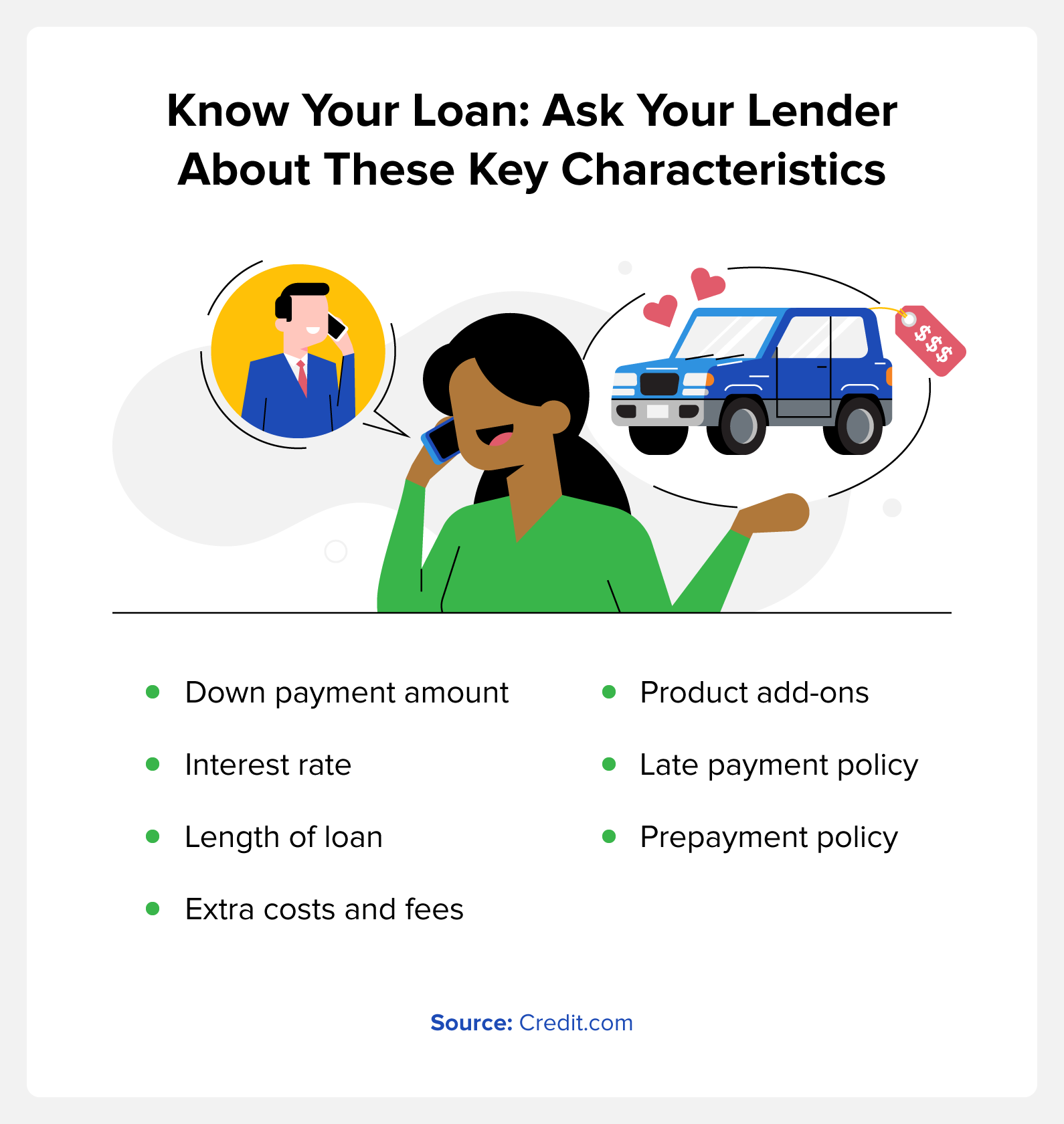

We wish financing a car was as easy as checking out one lender, but you should always shop around to find the best deal. Each lender will offer different loan terms. When you’re looking over a multi-page contract, you might not know what to look for.

Here’s what you should ask about before you agree to borrow from a lender:

- Down payment amount

- Interest rate

- Length of loan

- Extra costs and fees

- Product add-ons

- Late payment policy

- Prepayment policy

Each state has different rules for taxes and fees on car loans. Check out this state-by-state resource from Edmunds to ensure your lender isn’t tacking on extra fees.

6. Get Pre Approved

The final step before you start shopping for your car is to secure a preapproval from a lender. A pre-approval letter doesn’t guarantee that a lender will give you a loan. However, it’s the closest you can get to one without performing a hard credit check, which typically lowers your credit score.

Compared to a prequalification, a pre-approval is a stronger sign that you can get a loan. Pre-approval is key to negotiating financing with a dealership. So, you’ll want to have one before you find your car.

7. Find Your Car

Finding a car loan with a lower credit score doesn’t have to be stressful. When in doubt, follow these tips to streamline the process and find a car and loan provider that works for your budget:

- Follow your gut: If your lender feels shady, don’t ignore that instance. When in doubt, stick with a well-known lender to avoid subprime or predatory lending.

- Avoid unnecessary fees: Many dealerships will try to sell you dealership-based insurance or extra warranties. These are generally much more expensive. Therefore, hold off on making these extra purchases until you have time to find a better deal.

- Get an insurance estimate: Ask your rep how your insurance may change based on the car model you’re looking at. A less expensive model might bump up your rate more than it saves you in the long run.

- Do your research: Most people walk into a dealer unprepared to negotiate. Research the true value of the car you’d like and practice negotiating if it makes you nervous. This will help you get the best deal for your car.

Tips for Buying a Car with Bad Credit

If you’re buying a car with a lower credit score, you might be worried about people taking advantage of you at the dealership or lender. Use these tips to educate yourself along your car-buying journey.

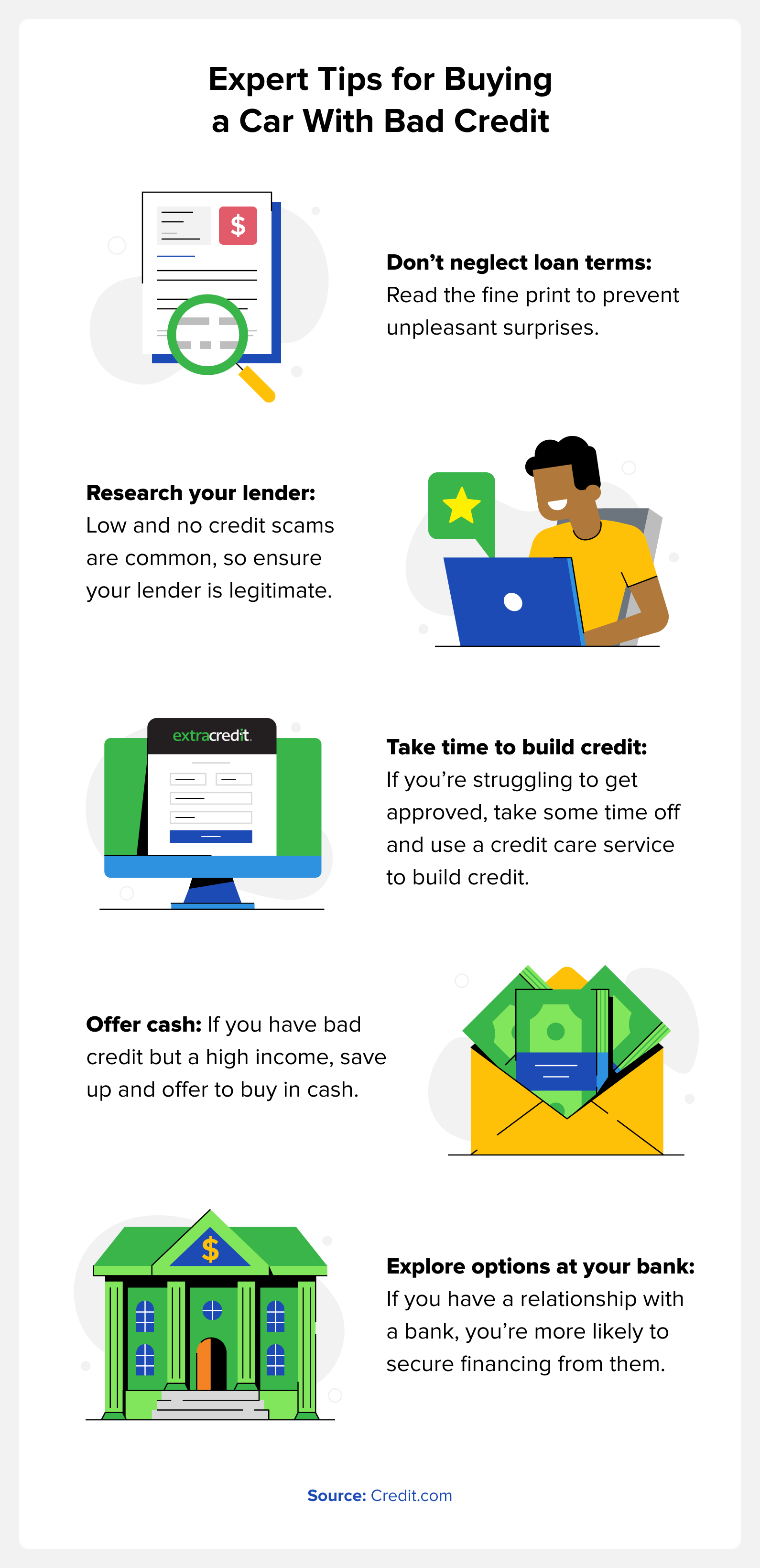

Don’t Neglect Loan Terms

While low monthly payments are a priority for most car buyers, a low monthly payment isn’t always the best deal. Carefully review your loan terms to know what you’re getting into to find the best loan for you.

Many people with lower credit scores choose the longest loan terms because it means lower monthly payments. If you need a very long loan term, consider lowering your car budget so you’re not saddled with more interest.

Research Your Lender

Unfortunately, scammers often target people with low credit. Especially if you’re using a nontraditional lender, research to ensure your offer is legitimate.

Some red flags to look out for in a potential lender include:

- Not being registered with the Federal Trade Commission (FTC)

- Guaranteeing approval with little information

- Charging a large application fee

- Requesting a nonconventional form of payment (e.g., gift card)

Take Time To Build Credit

Sometimes, it’s unavoidable that you need to take some time to rebuild your credit before buying a car. When you have a low credit score, can’t afford a down payment, or can’t afford to pay cash, you might want to work on your credit score and revisit purchasing a car later.

In the meantime, you can do the following to improve your score:

- Pay down your debts

- Set bills to auto pay to reduce late payments

- Double check credit reports and dispute errors

- Use a credit care service, such as ExtraCredit

Offer Cash

Some people are relatively high earners who have a lingering low credit score from the past. In this case, you can offer to pay part or all of the car off in cash. While securing a loan can be tricky with a low credit score, purchasing a car with cash is relatively easy, especially if it’s used.

Explore Options at Your Bank

If you have bad credit, check if your primary bank offers car loans. Many times, banks will lower some requirements for a loan if you have a relationship with that bank. You have the best chance of securing a car loan from your bank if you’ve used them for a while and have a reliable past making payments.

FAQ

Do you have some questions about getting a car loan with bad credit? You’re not alone. Check out answers to people’s most common questions when trying to secure an auto loan.

What Credit Score Is Too Low for a Car Loan?

There’s no minimum credit score to get a car loan, but with a lower score, you might have a harder time finding a lender. To improve your chances of getting preapproved with a low credit score, save up for a down payment or take steps to improve your credit score.

Will I Get Denied a Car Loan with Bad Credit?

With any credit score, it’s possible to be denied a car loan. Many factors go into whether a lender will offer you a loan, including:

- Payment history

- Outstanding debts

- Credit score

- Employment status

Improving Your Credit Score

Building better financial habits takes time—it’s hard to be patient if your credit score gets in the way of big purchases like car loans or mortgages.

At Credit.com, we work hard to help everyday Americans secure financing and feel empowered to improve their credit score for financial success. Sign up for ExtraCredit today to work on your credit and build a better tomorrow.

You Might Also Like

October 20, 2020

Auto Loans

July 20, 2020

Auto Loans