The Fannie Mae Flex Modification Program (FMP) is a mortgage assistance solution designed to relieve borrowers facing financial hardship.

Are you looking to improve your mortgage management but don’t know where to start? Handling mortgage payments is challenging, especially if you’re facing economic difficulties and don’t know where or how to get financial assistance. The Fannie Mae and Freddie Mac Flex Modification Program may be the solution you’re looking for.

Learn what you need to know about the Flex Modification Program: how it works, who qualifies for it, and how you can apply. This comprehensive guide will help you understand the many benefits of FMP for a more stable financial future.

In This Piece:

- What Is the Flex Modification Program?

- How Do Fannie Mae and Freddie Mac Work?

- How Flex Modification Works

- Why Should You Consider the Flex Modification Program?

- Who Qualifies for the Flex Modification Program?

- How to Apply for the FMP

- Other Mortgage Payment Help Options

- FAQS

What Is the Flex Modification Program?

The Fannie Mae Flex Modification program is a mortgage assistance solution designed to relieve borrowers facing financial hardship. This program offers a flexible framework for loans that helps eligible borrowers to modify their monthly mortgage payments and avoid foreclosure.

Modifying the loan terms can make mortgage payments more affordable and sustainable for struggling homeowners.

How Do Fannie Mae and Freddie Mac Work?

The mortgage market has a few essential entities, including the government-sponsored enterprises called Fannie Mae and Freddie Mac. Their approach allows lenders to free up funds to provide more mortgage loans to borrowers.

But how does it work? Fannie Mae and Freddie Mac helped make mortgages more accessible by buying them from lenders. This allows lenders to have more money available to provide new mortgages to borrowers or invest in other financial opportunities. For example, if a lender originates a mortgage, they can sell it to Fannie Mae or Freddie Mac, who then include it in their portfolio or package it into mortgage-backed securities.

How Flex Modification Works

The Flex Modification Program offers loan modifications to eligible borrowers experiencing financial hardship. Here’s a breakdown of how the program operates:

Eligibility Requirements:

- You must have a mortgage loan owned or guaranteed by Fannie Mae or Freddie Mac.

- The mortgage loan must be at least 60 days delinquent or at risk of imminent default.

- You must demonstrate a hardship that affects your ability to make timely mortgage payments.

Modification Terms:

- The program aims to reduce your monthly mortgage payment to 20% or more below your pre-modification.

- The modification may involve adjusting the interest rate, extending the loan term, or forbearing a principal portion.

- The goal is to make the mortgage payment more affordable while ensuring it’s sustainable for you.

Application Process:

- Apply to the Flex Modification Program through a loan servicer.

- The loan servicer will assess your eligibility and collect the necessary documentation.

- Once approved, the loan servicer will work with you to finalize the modification terms.

Why Should You Consider the Flex Modification Program?

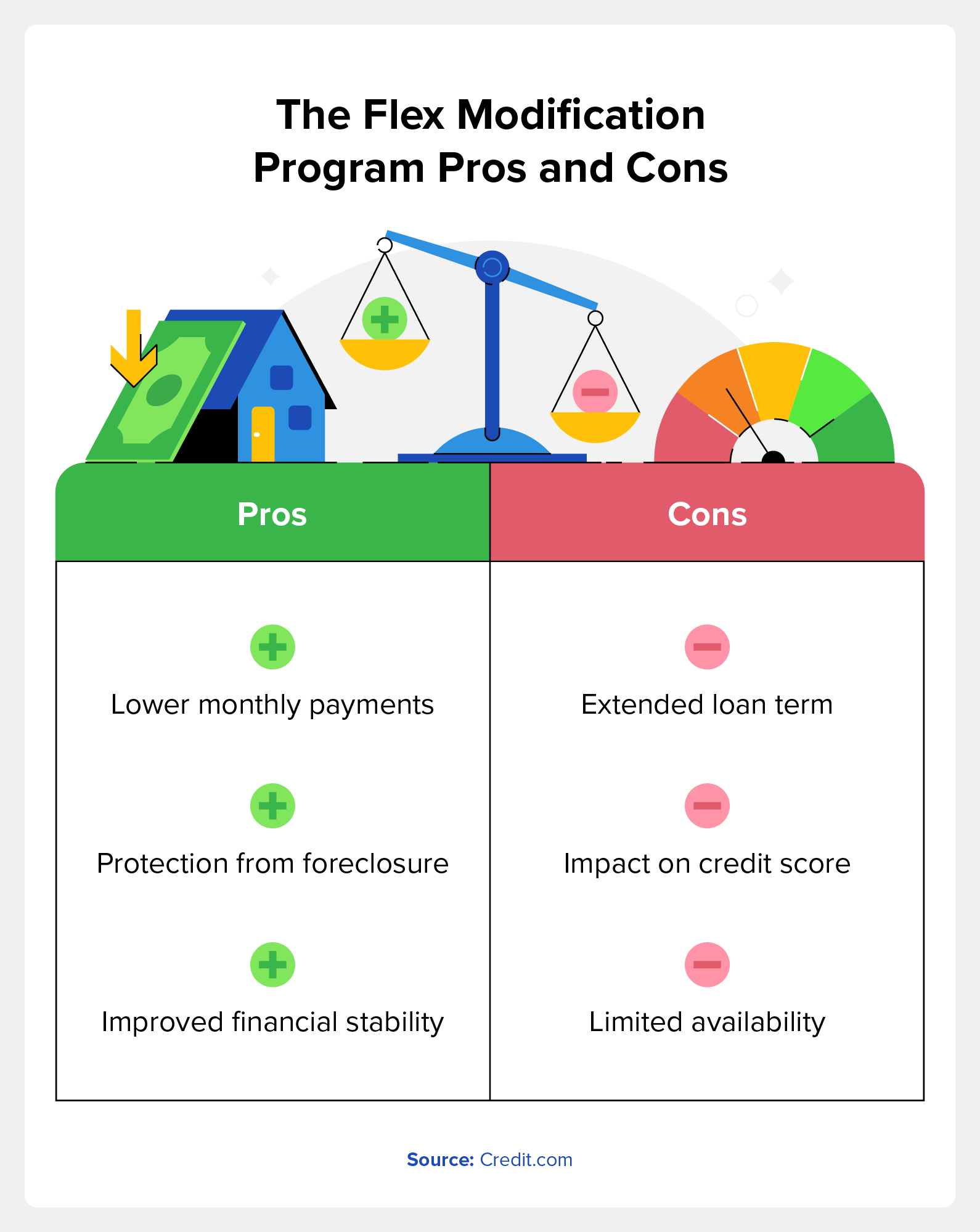

Before considering the Flex Modification Program, it’s essential to understand its potential pros and cons.

Pros:

- Lower monthly payments: The program aims to reduce your mortgage payment to a more affordable level, making it easier to manage your finances on time.

- Protection from foreclosure: By modifying your loan, the program can help you avoid the devastating consequences of foreclosure.

- Improved financial stability: By participating in the Flex Modification Program, you can regain control of your financial situation. Providing you with a sense of stability and peace of mind, allowing you to focus on rebuilding your financial health.

- Simplified application process: Applying for the program is relatively straightforward, and you can work directly with your loan servicer to navigate the process.

- Potential principal reduction: The FMP may offer this, which means that a portion of the outstanding loan balance could be forgiven or deferred, reducing the overall amount owed. This can be particularly beneficial if you owe more on the mortgage than your current property value.

- Preservation of homeownership: One of the primary goals of the FMP is to help borrowers preserve their homeownership. The program offers a viable alternative to foreclosure by providing a framework for loan modifications.

Cons:

- Extended loan term: Modifying your loan may result in a more extended repayment period, meaning you’ll make mortgage payments for longer.

- Impact on credit score: While participating in the program doesn’t directly affect your credit score, the delinquency prior to modification might be reported on your credit report.

- Limited availability: The program is specifically for Fannie Mae or Freddie Mac borrowers with owned or guaranteed loans. You won’t qualify for this program if either entity doesn’t back your loan. However, other programs may exist. Contact your lender if you’re struggling to make your mortgage payments.

Remember, these pros and cons will vary based on your circumstances. It’s essential to consult with your loan servicer and thoroughly review the modification terms to understand the potential benefits you may receive from participating in the program.

Who Qualifies for the Flex Modification Program?

The Flex Modification Program is designed for borrowers struggling with mortgage payments due to financial hardship.

To qualify for the program, you must meet the following criteria:

- Loan ownership: The mortgage loan must be owned or guaranteed by Fannie Mae or Freddie Mac.

- Delinquency or imminent default: Borrowers must be at least 60 days delinquent on their mortgage payments or at risk of imminent default.

- Demonstrated hardship: Borrowers need to demonstrate a hardship that affects their ability to make timely mortgage payments. Hardships may include job loss, income reduction, medical expenses, divorce, or other significant life events.

Additionally, you must comprehend what a “hardship” entails to be considered for a loan modification. Each situation is evaluated individually, but common examples of hardships include loss of income, disability, serious illness, divorce, or the death of a co-borrower.

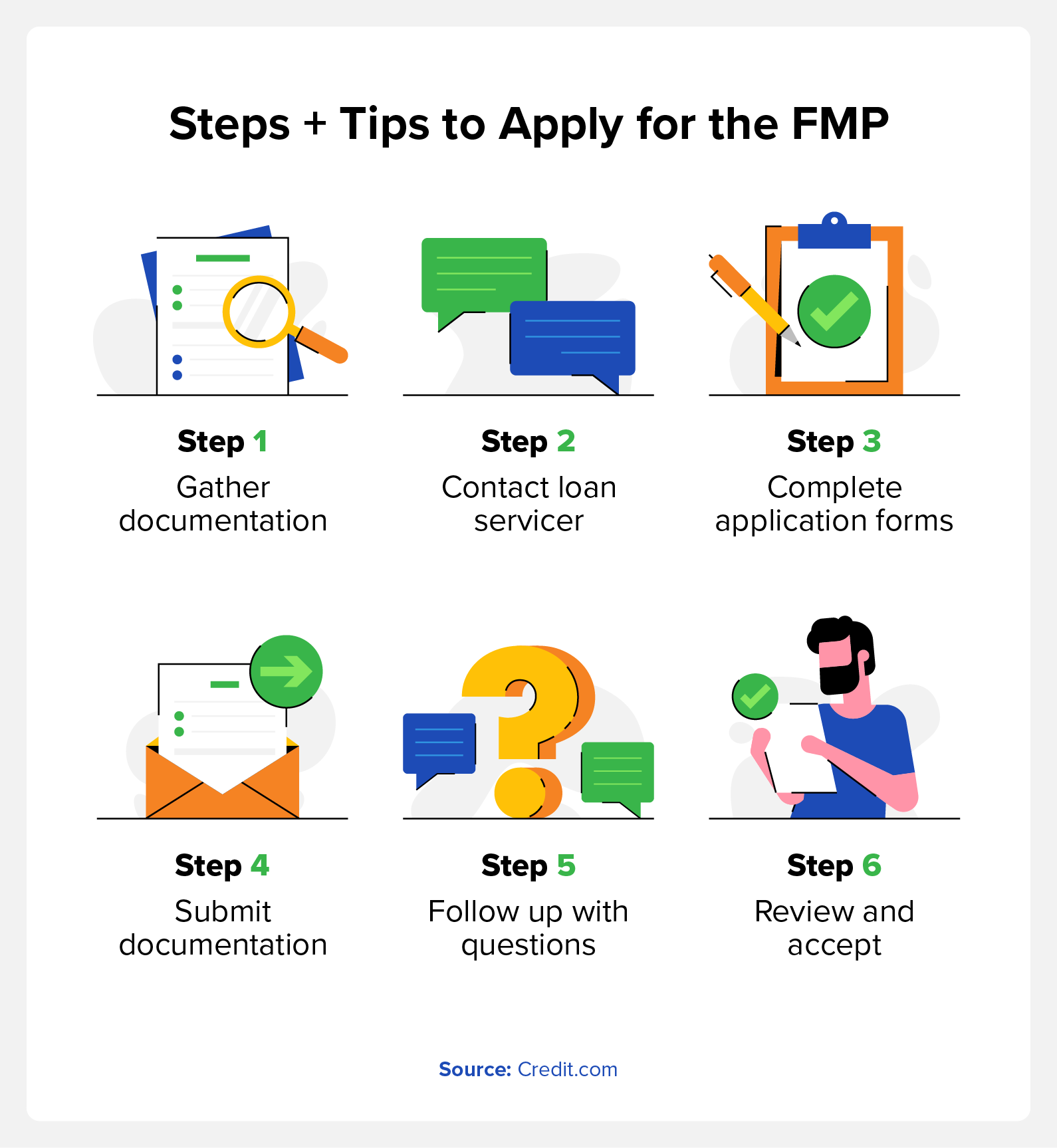

How to Apply for the FMP

If you believe you meet the eligibility requirements for the Flex Modification Program, you can follow these steps and tips to apply:

- Gather documentation: Prepare the necessary documents, such as proof of income, bank statements, tax returns, and any other documentation required by your loan servicer.

- Contact your loan servicer: Inform your loan servicer about your interest in the Flex Modification Program.

- Complete application forms: Your loan servicer will provide the necessary forms and guidance to complete the application process.

- Submit documentation: Submit all the required documentation and the completed application forms to your loan servicer.

- Follow up and provide additional information: Be proactive in promptly following up with your loan servicer and providing any additional information they request.

- Review and accept the modification terms: Once your loan servicer evaluates your application, they will provide you with the proposed modification terms. Review them carefully and, if acceptable, sign and return the necessary paperwork to proceed with the modification.

Remember, each loan servicer may have a specific application process, so it’s crucial to communicate directly with them to ensure you have all the necessary information and are following the correct steps. Having to redo the application process due to easily-avoided mistakes is the last thing you need.

Other Mortgage Payment Help Options

What if I don’t qualify? What can I do? Other mortgage payment assistance options are available if the FMP is not the right fit.

Fannie Mae and Freddie Mac offer additional programs catering to different circumstances. Some of these options include:

- Home Affordable Modification Program (HAMP): This aims to help homebuyers struggling with financial hardship and mortgage payments.

- Repayment plan: Allows you to catch up on missed mortgage payments by adding a portion of the past-due amount to your regular expenditures over an agreed-upon period.

- Forbearance: Temporarily suspends or reduces your mortgage payments with this program. It can be for a specific period, providing short-term relief during financial difficulties, so you can reassess the situation.

But before you move forward with one of these, it’s essential to analyze your alternatives and consult with your loan servicer to determine the best course of action based on your specific circumstances.

FAQs

Let’s address some frequently asked questions about the Flex Modification Program:

Does the Flex Modification Program Affect Your Credit Score?

Participating in the Flex Modification Program doesn’t directly impact your credit score. However, the delinquency prior to modification might be reported on your credit report

What if Fannie Mae or Freddie Mac Doesn’t Own My Loan?

If your loan isn’t owned or guaranteed by Fannie Mae or Freddie Mac, you won’t be eligible for the Flex Modification Program. However, you should contact your loan servicer to inquire about other available mortgage assistance options or loan modification programs specific to your loan type.

How Long Does the Flex Modification Program Last?

The duration of the Flex Modification Program varies depending on the specific terms of the modification. Typically, the program aims to provide long-term mortgage relief by modifying the loan terms to make payments more affordable and sustainable for the borrower.

The revised terms may involve extending the loan term or adjusting the interest rate. It’s important to discuss the duration of the modification with your loan servicer, as it will depend on your circumstances and the terms agreed upon.

Can I Qualify for the Flex Modification Program if I’ve Previously Received a Loan Modification?

If you have previously received a loan modification, you may still be eligible for the Flex Modification Program. However, the specific requirements and eligibility criteria may change depending on your previous modification and the current guidelines set by Fannie Mae and Freddie Mac.

It’s crucial to communicate with your loan servicer and provide them with all the necessary information regarding your previous modification. They will assess your eligibility based on your unique circumstances and guide you through the application process.

Remember, these answers are general guidelines, and you must consult with your loan servicer to get accurate and personalized information based on your situation.

What Are the Next Steps?

The Fannie Mae Flex Modification Program provides borrowers with a potential lifeline during financial hardship. It aims to make mortgage payments more manageable and sustainable by offering loan modifications. If you’re facing challenges with your mortgage payments, exploring the Flex Modification Program and other mortgage payment help options can help you find the assistance you need.

To take control of your mortgage management and improve your financial well-being. Consult with your loan servicer for accurate and personalized information based on your situation, and research different mortgage rates to make informed financial decisions.

You Might Also Like

December 13, 2023

Mortgages