You can get an apartment with bad credit, but it may take some strategizing. Apartment applicants with low credit scores can boost their odds by applying with a cosigner, paying more upfront, offering references, or changing the type of units they apply to.

In today’s housing market, you want every possible advantage on a rental application. While letters of recommendation and a solid rental history will get you far, more and more landlords want a high credit score. As a result, it isn’t uncommon to ask if you can get an apartment with bad credit.

While it takes some strategizing, you can get an apartment with low credit. To help you along, we’ll explain how credit impacts your application, explain steps you can take to compensate for low credit, and share tips on boosting your score.

How Credit Impacts Getting Approved for an Apartment

Many landlords and renters run a credit check as part of their rental application process. Like lenders, landlords check your credit to see if you can pay your bills on time. Because renting is an investment, property owners want to minimize risk. So, they assume tenants with high credit are more likely to pay their bills on time.

Remember that your credit score isn’t the only factor on a rental application. While a high score helps, the details on your credit report matter, too. How you got a high or low score can sway property managers one way or the other.

What Credit Score Do You Need to Rent an Apartment?

The score you need depends on the unit. Some rental companies provide an ideal range for their listings. A score of 620 or higher will generally keep landlords from denying your rental application. However, some landlords will expect more, while others don’t look at your score at all.

What Do Landlords Look for on a Credit Report?

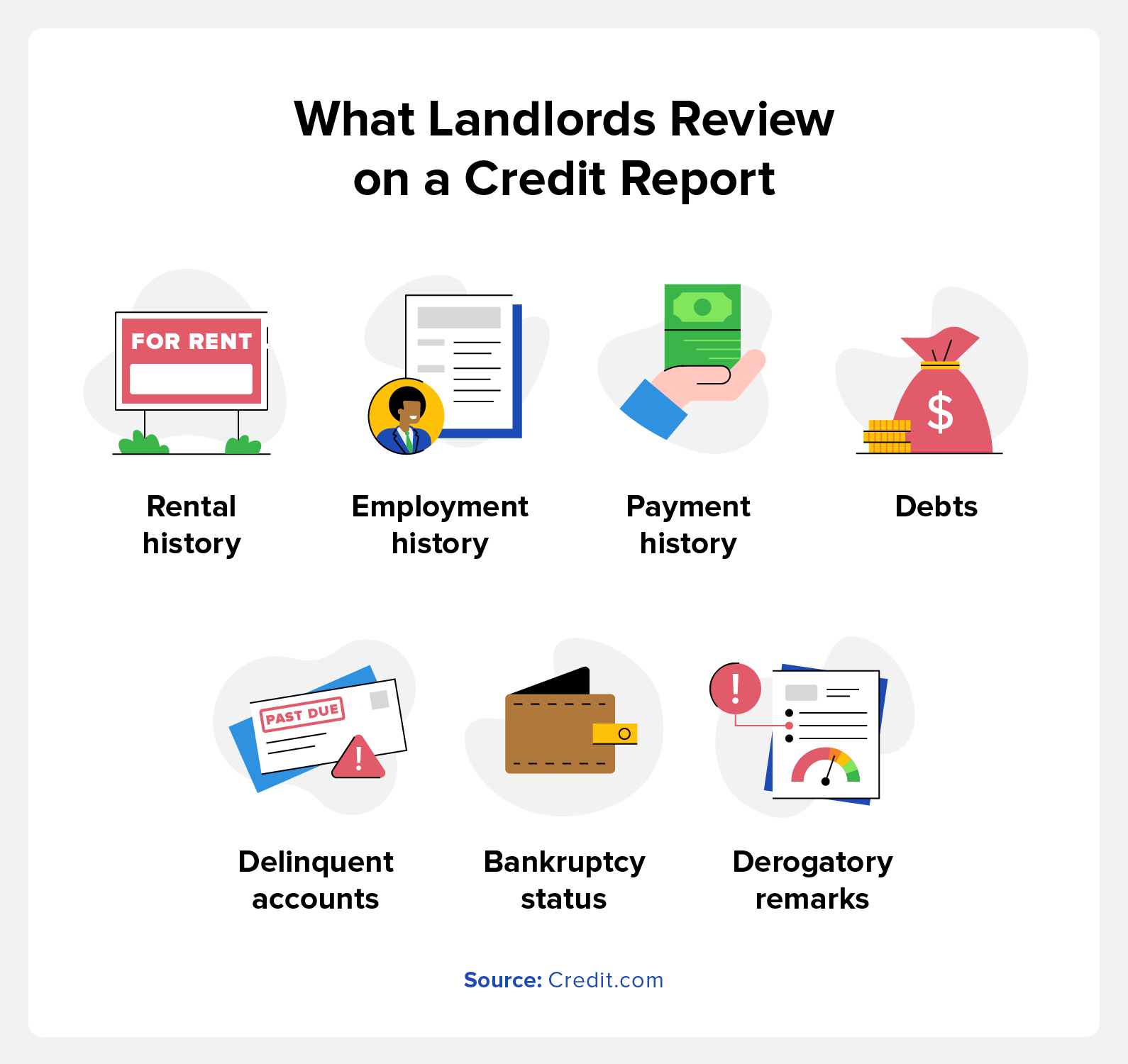

Renters may treat your credit score like a headline, but there’s more to a credit report than a number. Credit reports tell a story about your spending habits and income. To help landlords pick reliable tenants, a rental credit check includes:

- Rental history: Some landlords report rent payments to credit bureaus. As a result, evictions, broken leases, and late or missing payments may appear.

- Employment history: Current or past employers may show up on a credit report. Typically, they only appear if you listed them on a credit card application or loan.

- Payment history: Credit reports show your history of payments to lenders. Late or missing payments will lower your score and work against your rental application.

- Debts: Current and past debts show up on your credit report. By providing payslips, landlords can calculate your debt-to-income ratio. If you make enough to repay your debts responsibly, that improves your application.

- Delinquent or collections accounts: An account is delinquent if you miss a payment due date. If you miss enough payments for lenders to transfer your account to a collection agency or sell it to a debt buyer, it becomes a collections account. Both of these hurt your credit score.

- Bankruptcy status: Bankruptcy filings will affect your credit score. Landlords may take recent bankruptcies as a sign that you’re a high-risk tenant.

- Derogatory remarks: These remarks refer to negative items on your credit report. They include auto repossessions or foreclosures. They hurt your score and hamper a rental application.

Landlords gauge the risk they pose by looking at how applicants spend their money. Someone with a high income but a history of late payments may not make the cut. On the other hand, someone who filed for bankruptcy years ago may be more responsible now.

How to Get an Apartment with Bad Credit

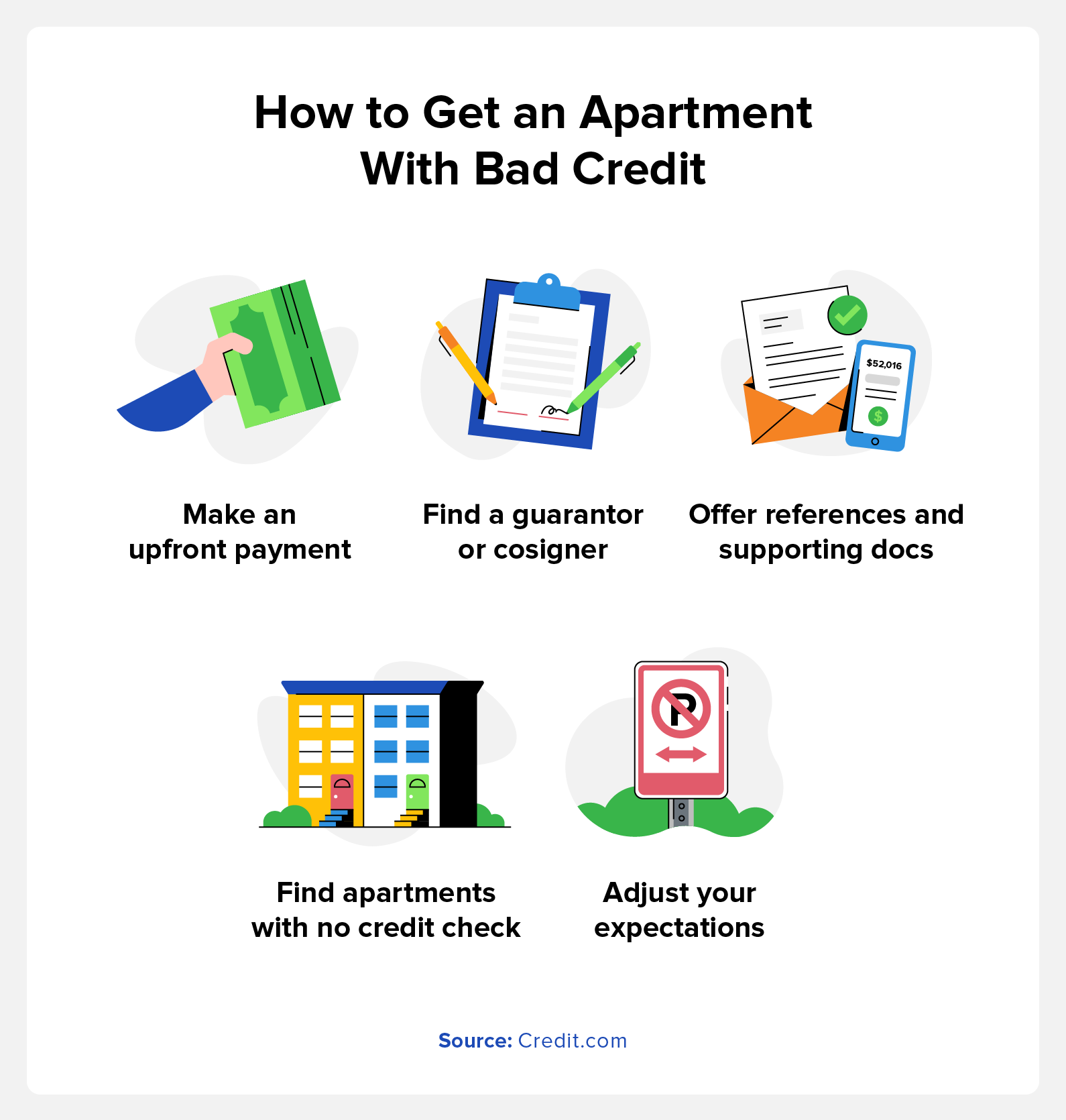

While a low score sets you back, you can learn how to get approved for an apartment with low credit. By following these methods, you can get a leg up in rental applications:

Make an Upfront Payment

Putting down more money upfront can give you an edge on rental applications. Landlords will usually request a security deposit or the first and last month’s rent upfront. To sway a landlord’s opinion, offer the first three months’ rent or put down a higher security deposit.

At the end of the day, renting is an investment. If you can show your landlord that you’ll give them a reliable ROI, it’s all the more likely they’ll accept you. As a bonus, paying more in advance saves you a financial burden for the next few months.

Find a Guarantor or Cosigner for Your Apartment

If a landlord can’t trust you to make payments, you can get someone to sign your lease with you. Someone with a great credit score who signs on with you can assuage a property manager’s worries. However, remember that the person who helps you takes on financial risk. You have two options for this approach:

- Cosigners sign a rental agreement with you and share the financial responsibility for it. They must do so on your behalf if you can’t or won’t pay rent.

- Guarantors share cosigners’ responsibilities, but they have fewer rights. More specifically, they vouch for you and can make payments on your behalf. However, they aren’t entitled to reside in your unit.

Offer References and Supporting Documents

While credit reports outline your financial history, you aren’t the sum of your spending decisions. You can offer other documents to show your responsibility in an apartment application. Additionally, these documents can prove you can pay rent each month. Some examples of supporting documents include:

- Payslips: Offer pay stubs that show you make enough money to pay rent each month.

- Letters of recommendation: Reference letters from a friend or employer can attest to your character and responsibility.

- Proof of reliable rental history: Account statements and landlord testimonials can prove you always pay rent on time.

- A snapshot of your savings account: If all else fails, you can show landlords you have the money to make rent. Be sure to censor sensitive information on your snapshot.

- Utility payments: A history of on-time utility payments shows your trustworthiness.

Find Apartments to Rent with No Credit Check

While credit checks are common, not all landlords require one. While these properties aren’t the most competitive, that isn’t always a problem. Apartments with no credit check tend to cost less than ones with one.

If you’re looking for another option, some landlords advertise units with low credit requirements. Again, these properties set a low credit requirement for a reason. That said, if you inspect the unit and it looks good, this route can save you a headache. As you live in low-credit apartments, you can build your score for future applications.

Adjust Your Expectations

If you can’t get around a credit check, reassess the kinds of apartments you can apply for. This isn’t to say you should only apply to units in poor condition. Instead, consider what you’re willing to compromise on. You may have an easier time qualifying for an apartment:

- Farther away from your work or downtown area

- Without amenities like a gym or pool

- That doesn’t include parking

- With less square footage than you’d prefer

- If you apply with a roommate

Bear in mind that compromising on these points means the apartment may cost less. While living in a less-than-ideal unit, you can save and rebuild your credit while renting. When it comes time to look for a new apartment, you’ll have better odds of getting the one you want.

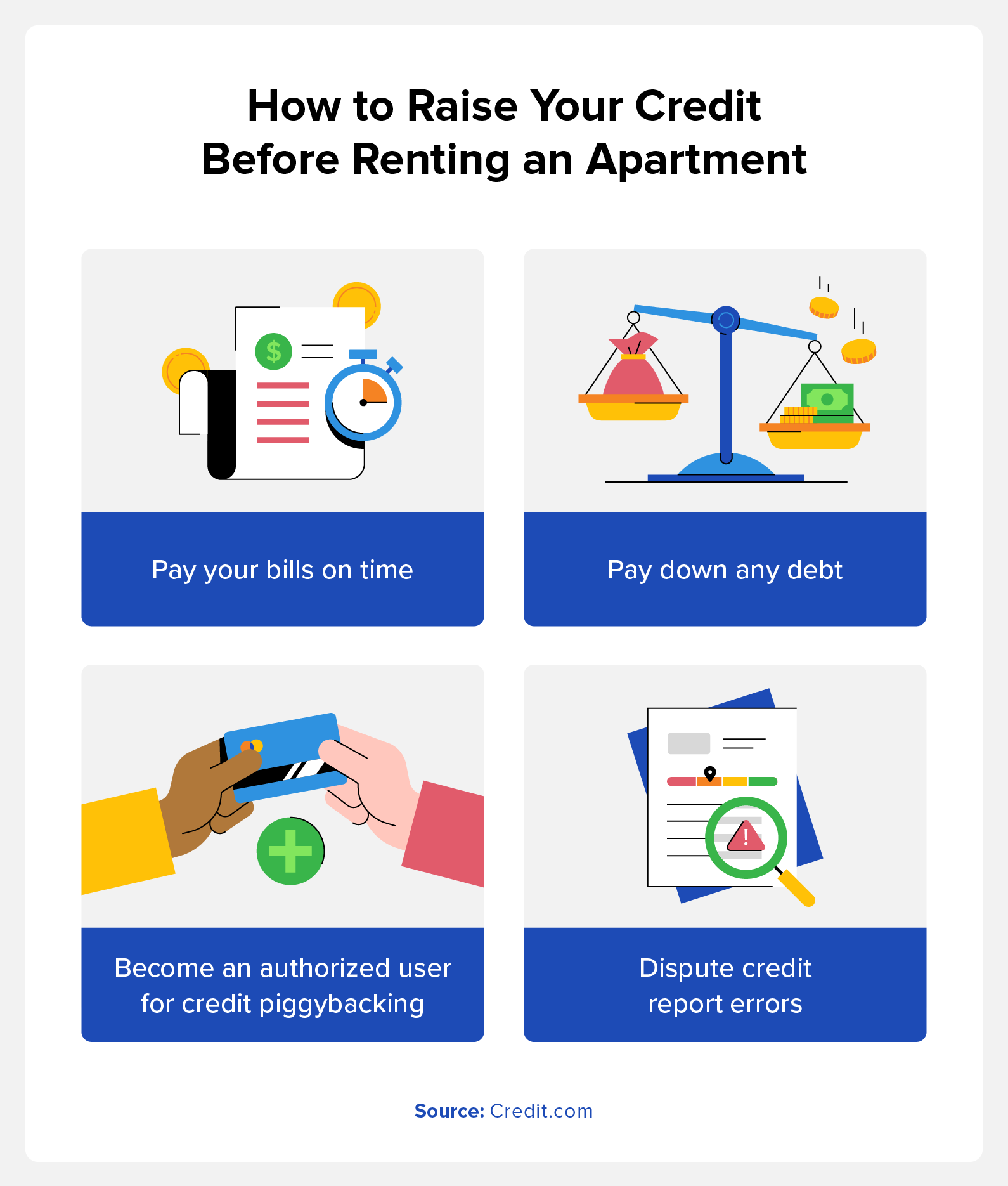

Tips to Raise Your Credit Before Renting an Apartment

If you plan to send rental applications down the line, you should work to improve your credit. Bear in mind that increasing your credit score takes time. To see a major change, expect months or even a year of work. In that time, follow these tips to improve your credit:

Pay Your Bills on Time

A person’s payment history can make or break their credit score. Central to that payment history: whether you paid your bills on time. Making timely and consistent payments plays a big role in improving your credit score. On top of that, timely payments prove your reliability to a landlord, boosting your chance of getting approved.

Pay Down Any Debt

Paying down debts is one of the best ways to improve your credit score. For this reason, someone who takes on and pays off debt won’t get punished for the debt they take on. Paying off debts shows your fiscal responsibility and proves your finances are on an upward trajectory.

Paying off any kind of debt can improve your score. The main ones to look out for include:

- Credit card debt

- Student loans

- Medical debt

- Auto loans

Become an Authorized User for Credit Piggybacking

If you don’t have the resources to boost your credit alone, you can try credit piggybacking. Credit piggybacking lets you benefit from a friend or family member who pays down their debts. By becoming an authorized user on their account, your credit report reflects their payoffs.

You can break the process into a few steps:

- Find a friend or family member you trust to spend responsibly.

- Become an authorized user on one of their credit cards or lines of credit.

- As they pay down their debts, this will show up on your credit report.

- By piggybacking on their credit payoffs, your score will improve.

Dispute Credit Report Errors

Sometimes, a low credit score isn’t your fault. Credit reporting errors can come from major credit reporting agencies or the companies giving them information. Credit reporting errors aren’t uncommon, so you should review your report for issues.

Credit reports may contain errors related to:

- Accounts held by another person with a similar name to you

- Accounts opened by fraudsters who committed identity theft

- Closed accounts that still read as open

- Accounts incorrectly labeled as delinquent or in collections

- Payments that don’t get reflected in your report

- Multiple listings of the same debt

- Accounts with inaccurate balances or credit limits

To dispute credit report errors, contact the credit bureaus and the company that reported inaccurate information to them. You want to provide supporting documentation that proves the report contains errors. While you can send a dispute by phone, this doesn’t leave a paper trail. Instead, mail a dispute letter or use an online form.

FAQs on Renting an Apartment with Bad Credit

You may still have questions about getting approved for an apartment. To help you out, we’ve answered FAQs on renting apartments with bad credit.

Is 500 a High Enough Credit Score for an Apartment?

You can rent an apartment with a credit score of 500. While it might take you out of the running for expensive units, you should still have a good chance of renting:

- Apartments with low credit requirements

- Apartments with no credit requirements

- Apartments you apply to with a cosigner or roommate.

Can I Reapply for an Apartment After I Get Denied for Bad Credit?

You can apply for the same apartment after getting denied on your first attempt. That said, some renters may throw out your application or ignore it. If you reapply, try to improve your credit and finances between applications.

Do Landlords Need Permission to Run a Credit Check?

Landlords need your permission to run a credit check. The Fair Credit Reporting Act calls rental applications a “permissible purpose.” This gives them the right to view your credit. However, that doesn’t mean landlords can check your score without your consent.

Improve Your Credit for an Apartment with Credit.com

Managing apartment applications is hard enough, even without a low credit score. However, you can get an apartment with bad credit by following the right steps. You’ll see more housing opportunities by learning how credit works, reviewing strategies for getting an apartment with low credit, and following tips to boost your score.

If you’d like a way to streamline raising your credit for rental applications, Credit.com can help. Our rent and utility reporting services ensure that your on-time payment gets reflected on your report. Even if your landlord doesn’t report payments, our tool helps build your credit with every rent payment reported.

You Might Also Like

June 14, 2023

Credit 101

January 25, 2022

Credit 101

February 19, 2021

Credit 101