If there’s anything to know about budgets, it’s that everyone does them differently. First, it’s important to have one — many Americans do not — and second, it’s crucial that it suits your needs.

Budgets differ from person to person because they reflect personalities, which are unique. Yes, differences in financial situations contribute to budget differences, but one budgeting method may not work for two people, even if they have similar incomes and expenses.

The other night, I was introduced to a new budgeting approach, and it made me want to explore the different ways people manage their money.

Credit.com will present a series of personal budgeting stories, starting with the one I heard recently: The Courtney Method.

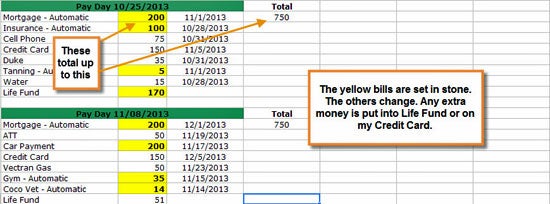

Courtney’s budgeting spreadsheet

Who is Courtney?

Courtney is a twenty-something college graduate with a full-time job and a wedding to plan. Before merging finances with her fiance, Courtney used a budgeting system involving multiple accounts with the same bank. Her fiance, Nick, transitioned to the Courtney Method before they combined their money, and they now have eight accounts between them.

The Courtney Method

The eight bank accounts between Courtney and Nick are as follows: Courtney checking, Courtney savings, Nick checking, Nick savings, joint checking for bills, joint checking for spending, joint savings and joint checking for the mortgage.

They don’t have a debit card for the bills account so they don’t spend it on other things. The joint savings serves as a wedding fund for now, and they pay extra into their mortgage account to build up for emergency home expenses. They each have a debit card for the joint spending account for things they do together, and after the wedding, the joint savings will be for vacations and other life events.

“It was important for us to each maintain a personal checking and savings account,” she said. “I just didn’t feel right about taking money out of a joint account to get a pedicure. I also wanted the freedom to save for trips with my girlfriends or Christmas gifts for Nick.”

When she and Nick combined finances, they each brought three accounts to the table and have since started the wedding fund and bought a house. They split their paychecks across multiple accounts, and since all but the mortgage checking account are with one institution, they have automatic transfers set up to keep everything balanced.

Why She Does It

When she first took sole responsibility for her finances, Courtney tried keeping track of her budget mentally, but didn’t like calculating everything out of one checking account. That’s when she switched to two accounts, one for bills and one for spending — and found it was the best way for her to keep things organized.

She has never been late on a bill or overdrawn an account, and she said Nick’s credit score went up 70 points in the year he changed to her budgeting method.

Things to Note

That’s a lot to manage, and it takes an exceptionally organized person to stay on top of it. Personality aside, there are many financial factors to consider here.

It isn’t easy to get a free checking account these days, so if having multiple accounts opens you up to more expenses, it’s not a practical choice. Fees can be waived under some conditions, like keeping a minimum balance or having direct deposit, but it’s important to know the terms of every account you have.

When Courtney started figuring her budgets out, she just had a checking and a savings. She was penalized for making too many withdrawals from her savings account (there are restrictions on that sort of thing), and that prompted her to change to two checking and one savings account. She has since avoided fees, but this highlights the importance of knowing the rules of banking. It can be frustrating (and costly) to learn those things the hard way.

If you have an effective budgeting system you’d like to share, we’d love to hear it and maybe present your method on the blog. Tell us a bit about your strategy in the comments.

Image: iStock

You Might Also Like

April 17, 2023

Budgeting and Saving Money

April 3, 2023

Budgeting and Saving Money

March 8, 2023

Budgeting and Saving Money

![Average Electric Bill by State [2023]](https://www.credit.com/blog/wp-content/uploads/2024/10/average-electric-bill-hero.webp)