Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

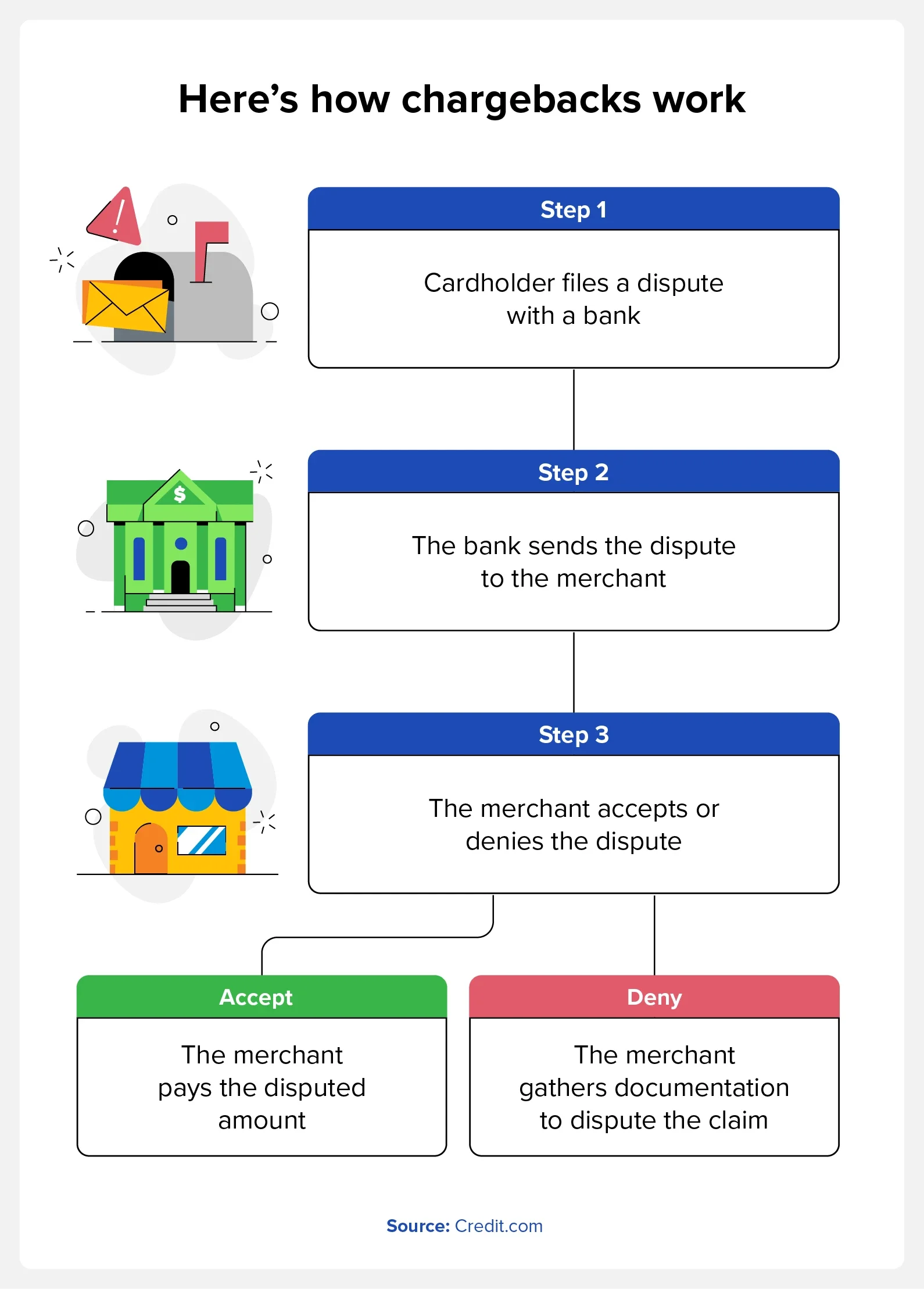

If you successfully dispute a charge, the bank will notify the merchant and return funds to the issuing consumer via a chargeback. From here, merchants can decide if they want to dispute the chargeback or not.

If you file a dispute for a credit card charge with a bank, that bank will quickly notify the corresponding merchant that you’ve initiated this process. From here, the merchant can review your claim and decide whether or not to accept or deny your dispute.

Disputing a credit card charge can be a lengthy process with sweeping ramifications. That’s why it’s important to understand what a credit chargeback is and whether this tool is the best option at your disposal.

Key Takeaways:

- Merchants may want to cancel a chargeback even if your bank sides with you.

- Your bank will initially cover the cost of a chargeback until the matter is settled.

- It’s often best to contact a merchant before initiating a chargeback.

What Is a Chargeback?

A chargeback occurs when you successfully dispute a charge on your credit card. The charge is taken off your credit card account and the money paid to the merchant is reversed (or “charged back” to the merchant). Many people dispute credit card charges for services not rendered. For example, there was a strong link between COVID-19 and chargebacks throughout 2020 as many companies struggled to keep up with demand.

A chargeback can be a powerful tool for consumers who do not receive products or services they paid for, but it comes with several caveats. Even if the credit card company sides with you, the merchant may not—and they may try to collect the chargeback funds.

What Happens When You Dispute a Charge?

The Truth in Lending Act is the federal law that gives consumers the legal right to dispute credit card charges if there is a billing error, as outlined in the Federal Reserve’s Consumer Compliance Outlook. This law defines a card issuer’s responsibilities when cardholders file disputes.

When you dispute a charge with your credit card company, it must conduct what the law calls a “reasonable investigation” to determine whether the charge was correct. It must also present you with the result of the investigation within 90 days.

During that process, the credit card company typically reaches out to the merchant involved in the charge. It requests documentation from the merchant regarding the transaction in question, and the merchant may be able to state why the charge was correct.

If the credit card company sides with you, it removes the charge from your credit card statement, and you do not need to pay the charge on your credit card.

Can a Merchant Try to Collect the Money From You After a Chargeback?

The Truth in Lending Act covers your right to dispute a credit card charge, but it doesn’t define what merchants are obligated to do—nor does it bar a merchant from trying to collect the money from you later. Instead, merchant agreements outline what actions a merchant can and can’t take concerning a dispute.

A chargeback means that the credit card company decides in your favor regarding the dispute. It doesn’t mean the merchant agrees or that they’ll return your funds.

Merchants can engage in “chargeback representment” to challenge your chargeback request and prove the original payment was valid. This process can be challenging, and merchants must decide if the potential loss of revenue is worth it—or if they might lose consumer trust with an aggressive approach without evidence.

The merchant might also seek to recover its loss by invoicing you for the charges. If you don’t pay, it might threaten collections activity or even sue you. Understanding your debt collection rights is pivotal if legal action seems imminent.

What’s the Difference Between a Refund and a Chargeback?

Chargebacks are granted by card issuers, while refunds come directly from merchants. While chargebacks can become lengthy and complicated processes, refunds are often straightforward.

So long as your claim aligns with a merchant’s terms and conditions, you’ll likely receive a refund shortly after the merchant receives the product you wish to return.

How Do You Manage Chargebacks?

No one wants to deal with an issue only to have it pop up unexpectedly in the future—especially financial issues that could affect credit scores. Here are some tips to avoid future issues when you request a chargeback.

Only Dispute Credit Card Charges If You Have a Legitimate Reason

Unfortunately, some people request chargebacks even if they received the goods or services in question. They might do so because they have a problem with the vendor or simply because they don’t want to pay for the products. That last instance counts as fraud, and it could lead to your credit card account being closed or other legal consequences.

Reach Out to the Vendor First

Before you file a chargeback, give the merchant a chance to make the issue right first. Many merchants are willing to work with you and might refund the money, offer an exchange, or work to resolve your specific grievance.

As part of your chargeback process, you’ll want to demonstrate that you attempted to contact the merchant about the issue. If you file a chargeback without working with the vendor first, you give the vendor more of a reason to insist that you still owe the money.

Act Quickly

You must dispute a credit card charge in writing, and your letter should reach the credit card company within 60 days of the first bill or statement with the error on it. This short timeline means knowing how to read a credit card statement is critical.

Keep an Eye on Your Account

According to the Federal Trade Commission, you can withhold payment for disputed charges while the investigation is underway. Your credit card company can’t penalize you with late fees, interest, or reports to the major credit reporting agencies regarding nonpayment of those charges.

That doesn’t, however, extend to your account in general. Implementing relevant tips for improving your credit history can keep your score from falling during the investigation. If you do pay your credit card charges and then realize something isn’t right, you can dispute that error. A decision in your favor might result in a credit to your account.

Save the Documentation

Don’t toss receipts, emails, or other evidence just because the chargeback occurred. You might need the documentation again if the merchant decides to try to collect from you. Typically, the higher the amount in question, the more important it is to maintain your documentation.

Monitor Your Credit With Credit.com

Chargebacks won’t affect your credit score alone, but there’s a margin for error while investigation is underway. In addition to reviewing your statements regularly, ensure you’re familiar with the laws that protect you and how you can assert your rights.

If any type of inaccurate negative reporting dings your credit—whether it’s related to a chargeback collection or not—tools like credit repair letters can be vital. One way to help protect yourself is to stay on top of your credit and invest in products and services that let you easily monitor your credit, such as ExtraCredit®.

You Might Also Like

June 14, 2023

Credit 101

January 25, 2022

Credit 101

February 19, 2021

Credit 101