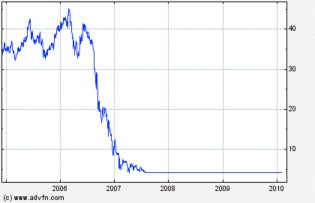

We’re in still the throes of the mortgage meltdown, and it’s becoming apparent that the long-term damage done by Countrywide has still not fully unfurled. Looking back, as 2007 came to a close, Countrywide Financial was reeling from liquidity problems, rumors of a potential bankruptcy, and a severe loss of market value. This is a chart of the Countrywide stock price. Here, you see that the immediate damage was just a prelude to greater damage that would not unfold until later.

A cash infusion by Bank of America of $2 billion in late 2007 kept the company afloat but the writing was on the wall. Early in 2008, BofA announced that it would purchase Countrywide for $4.1 billion. Obviously, this appeared to be an attractive price to BofA because of the 60,000 plus employees, the 900 branches, and its position as the leading mortgage lender in the United States. It gave BofA instant market share it could never have grown itself and it appeared possible that BofA could leverage that into greater market share for many of its other financial services as well.

A cash infusion by Bank of America of $2 billion in late 2007 kept the company afloat but the writing was on the wall. Early in 2008, BofA announced that it would purchase Countrywide for $4.1 billion. Obviously, this appeared to be an attractive price to BofA because of the 60,000 plus employees, the 900 branches, and its position as the leading mortgage lender in the United States. It gave BofA instant market share it could never have grown itself and it appeared possible that BofA could leverage that into greater market share for many of its other financial services as well.

What was not obvious at the time were the grenades hidden off the balance sheet that were to explode at regular intervals over the next three years just ended. And there are more in which the pin may have been pulled.

The first of these was the settlement of suits by the attorneys general of most states alleging deceptive sales practices by Countrywide employees. In October 2008, BofA agreed to set aside $8.69 billion in a fund to pay for re-writing the terms of those mortgages. At issue were subprime loans, Alt-A loans to less creditworthy borrowers, and adjustable rate mortgages with a pay-option feature that allowed interest payments of less than the amount of interest owed.

Note that this feature figured prominently in a re-statement of earnings whereby Countrywide had been accruing as income the interest that was owed but not yet collected on this type of loan. A more conservative accounting method would have been to count interest as income only when it was paid but that would have lowered earnings.

As the market crashed, it was obvious that the interest would likely never be collected and neither was it possible to collect the principal balance. You may see the court order here. How many were helped? Who knows because there have never been any reports by BofA as to how many homeowners received modifications under this program and what, if any, of the $8.68 billion has still not been distributed.

BofA announced previously that it had paid $3.5 billion to Fannie Mae and Freddie Mac to resolve claims about the quality of loans previously sold to them by Countrywide. Then as the year came to a close they made a further payment. They announced in early January the payment of a further $2.8 billion to Fannie and Freddie and announced that it had reduced the book value of the Countrywide operation by another $2 billion.

Not included in this settlement were some loans that were sold and called “private label securities.” Obviously, this is a snake that could still bite. And also left unresolved are claims in relation to loans actually originated by BofA, not Countrywide, as well as the claims of other purchasers of such loans outside the Fannie-Freddie channel. These claims were some $6 billion at last count. And in a suit filed just days ago, for example, Allstate Insurance sued BofA for $700 million over loans they bought beginning in 2005.

So if you add up what BofA paid for Countrywide, $4.2 billion, the $8.68 billion settlement, the $3.5 billion payment, and the $2.8 billion payment, it adds up to $19 billion. There are certainly more similar settlements that have been below my radar screen so it is likely that the final number likely will be higher than any analyst at BofA thought possible back in late 2007. It is equally obvious that there is more to come in the future and we have yet to understand the true scope of the aftermath.

Personally, I don’t think much of anything gets settled in Court and I hope that all of this gets settled soon so we can all move along and get housing back on a healthy track. To that point, BofA announced in mid-December that they were reassigning some 2,500 employees in their loan origination centers to work on loan modifications. That’s probably not enough to deal with a problem of this magnitude and, indeed, I understand that BofA is actually considering reassigning significantly more people than that to address modifications more aggressively. We’ll see.

You Might Also Like

December 13, 2023

Mortgages