Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Disclosure regarding our editorial content standards.

Debt collectors send debt validation letters show what debts you owe, the amount, and to whome you owe it to.

While a debt collector contacting you can be stressful, it’s important to pause and remember your rights as a debtor. Before paying the debt collector, verify that the debt is actually yours. The debt collection industry is subject to mishaps and mistakes, with some individuals being asked to pay debts they don’t owe.

That’s why you should receive a debt validation letter from the debt collector proving the debt is yours. If you still don’t recognize the debt, you can send a debt verification letter requesting more information or disputing the debt.

In this article, we’ll discuss the importance of debt validation letters and what information they should include. We’ll also provide a debt verification letter sample and a free template to help you get started.

Key takeaways:

- Debt collectors are legally required to send you a debt validation letter within five days of initially contacting you.

- A debt validation letter should include information about the debt, such as the amount you owe and the original creditor’s name.

- If you’re unsure if the debt is accurate, send a debt verification letter to dispute the debt or ask for additional details.

Table of Contents:

- What Is a Debt Validation Letter?

- What Should a Debt Validation Letter Include?

- When to Send a Debt Verification Request

- Debt Verification Letter vs. Debt Validation Letter: What’s the Difference?

- Debt Verification Letter Template + Sample

- How Long Does a Creditor Have to Respond to a Debt Verification Request?

- What to Do If a Debt Collector Doesn’t Respond to a Debt Verification Request

What Is a Debt Validation Letter?

A debt validation letter is written correspondence that debt collectors are legally obligated to send you that provides information about the debt they’re collecting. The letter should include details about the debt, the original lender, and the debt collector’s authority to collect the money.

The creditor should send a debt validation within five days of their initial contact with you. If you don’t receive a debt validation letter, the debt collector could be an illegitimate person attempting to scam you. Therefore, you should avoid providing sensitive information to the debt collector until you’ve verified they’re legitimate.

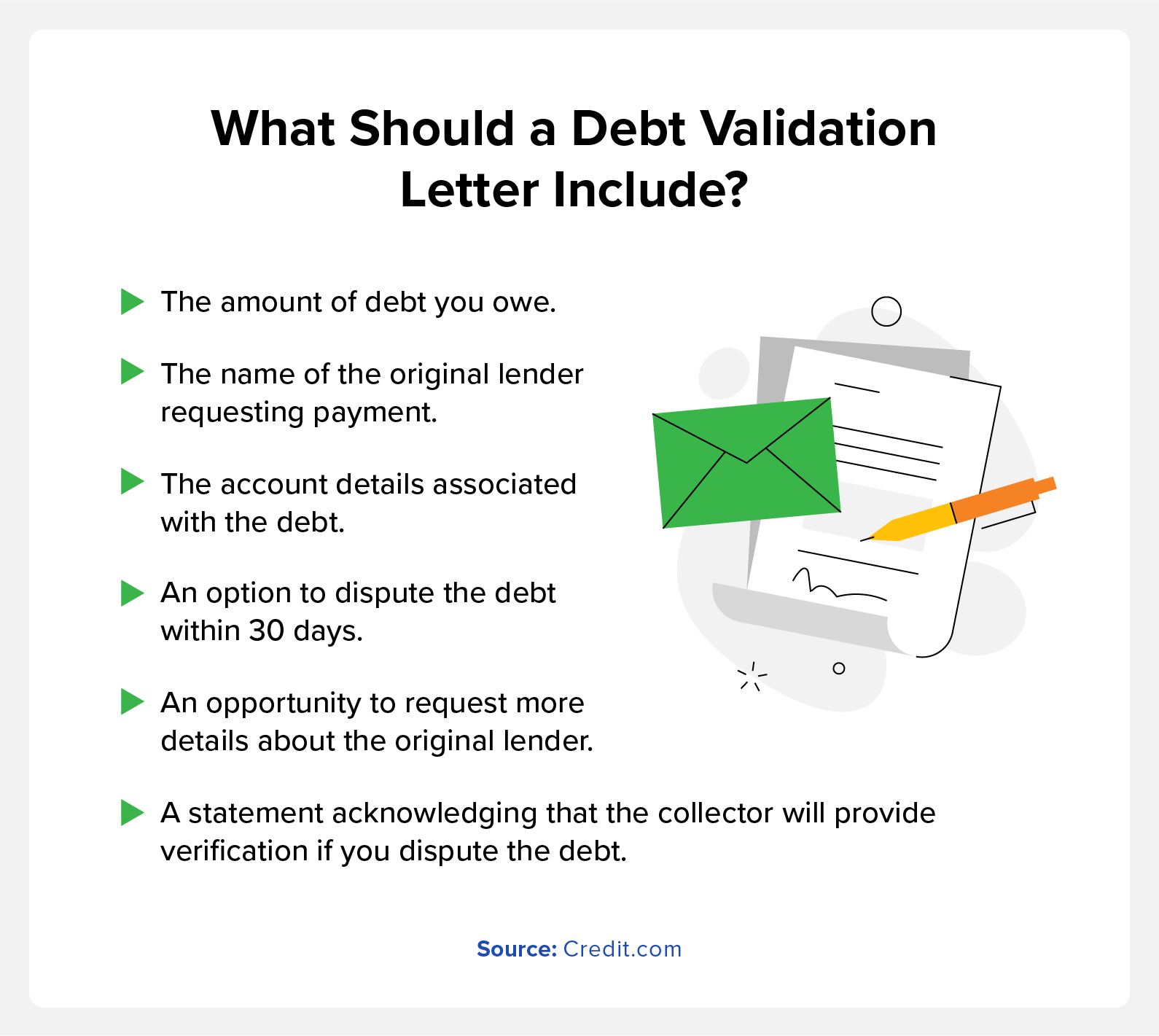

What Should a Debt Validation Letter Include?

According to the Consumer Financial Protection Bureau (CFPB), the debt validation letter should include:

- The amount of debt you owe

- The name of the original lender requesting payment

- The account details associated with the debt

- An option to dispute the debt within a 30-day time period

- An opportunity to request more details about the original lender

- A statement acknowledging that the collector will provide verification if you dispute the debt

When to Send a Debt Verification Letter

If after receiving the debt validation letter and you’re still unsure of whether the debt is accurate, you can send a debt verification request to the debt collector. A debt verification request is a letter that you, as the consumer, can send to the debt collector to ask for information about the debt they’re collecting.

Typically, you have 30 days to send your debt verification request after receiving the debt validation letter. If you don’t send the letter within this time frame, the debt collector will assume the debt is valid and legally continue their efforts to collect.

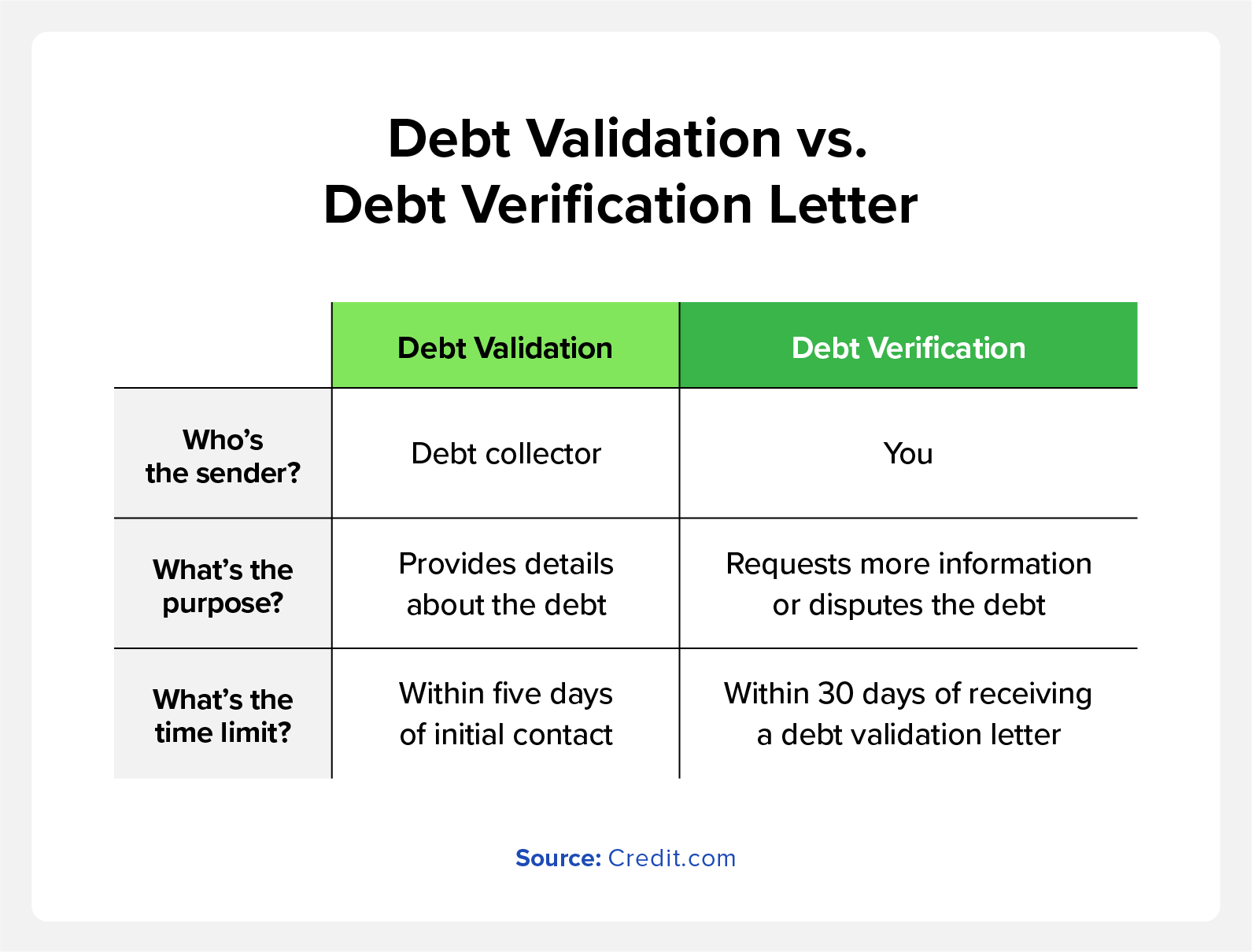

Debt Verification Letter vs. Debt Validation Letter: What’s the Difference?

It’s important to understand the difference between a debt verification letter and a debt validation letter:

- A debt verification letter is a correspondence that you, the consumer, send to the debt collector requesting more information about the debt.

- A debt validation letter is a document the debt collector sends to you, providing details about the debt.

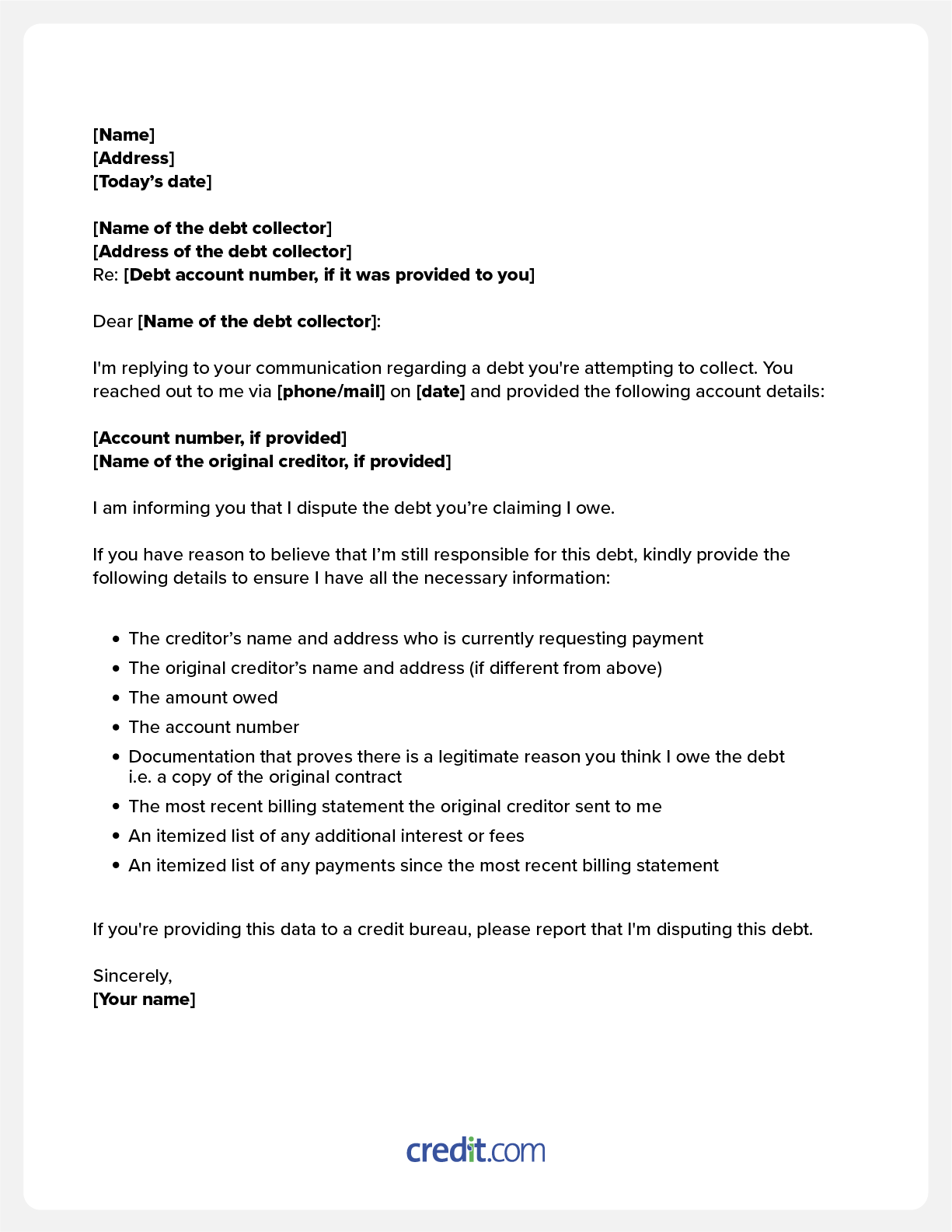

Debt Verification Letter Template + Sample

When writing a debt verification letter, it’s important to be clear and concise. State that you’re disputing the debt and list what information you’re requesting from the debt collector.

Below is a debt verification letter sample and a template to help you get started. Remember to use your own information where there is bolded text.

[Name]

[Address]

[Today’s date]

[Name of the debt collector]

[Address of the debt collector]

Re: [Debt account number, if it was provided to you]

Dear [Name of the debt collector]:

I’m replying to your communication regarding a debt you’re attempting to collect. You reached out to me via [phone/mail] on [date] and provided the following account details:

- [Account number, if provided]

- [Name of the original creditor, if provided]

I am informing you that I dispute the debt you’re claiming I owe.

If you have reason to believe that I’m still responsible for this debt, kindly provide the following details to ensure I have all the necessary information:

- The creditor’s name and address who is currently requesting payment

- The original creditor’s name and address (if different from above)

- The amount owed

- The account number

- Documentation that proves there is a legitimate reason you think I owe the debt, i.e., a copy of the original contract

- The most recent billing statement the original creditor sent to me

- An itemized list of any additional interest or fees

- An itemized list of any payments since the most recent billing statement

If you’re providing this data to a credit bureau, please report that I’m disputing this debt.

Sincerely,

[Your name]

How Long Does a Creditor Have to Respond to a Debt Verification Request?

There isn’t a specific time frame in which creditors must reply to a debt verification request. However, if you send the debt verification letter within 30 days of receiving the validation letter, they must cease all collection efforts until they respond to your letter and provide verification.

What to Do If a Debt Collector Doesn’t Respond to a Debt Verification Request

If the debt collector doesn’t respond to your debt verification request, it could be due to one of the following reasons:

- The debt collector requires additional time to gather the information you’ve asked for.

- The debt collector cannot verify the debt.

- The debt is beyond the statute of limitations, so the debt collection agency cannot file a lawsuit.

- You were dealing with a debt collection scammer.

If you sent the debt verification letter within the 30-day time frame, the debt collector cannot attempt to collect until they provide the information you requested. If the debt collector continues with attempts to contact you, you can submit a complaint with the CFPB, your state’s attorney general’s office, or the Federal Trade Commission.

Debt validation and verification letters can help you exercise your rights and avoid potential debt collection scams. If the debt collector fails to verify your debt, be aware that it may be wrongfully hurting your credit. Check your credit report for inaccurate information and report errors to the credit bureaus to potentially remove the accounts from your credit report.

It’s important to monitor your credit so you can get alerted if inaccurate information is hurting your credit. Try ExtraCredit® for free today for help managing your credit.

You Might Also Like

November 20, 2024

Managing Debt

September 7, 2021

Managing Debt

December 23, 2020

Managing Debt