Covering the cost of bills, food and shelter every month can be pretty stressful. That’s especially true when inflation, potential economic instability and factors related to the pandemic have made it more difficult for many Americans to make ends meet.

Given those facts, you might think many households are carefully watching their pennies. However, you might be surprised at how many Americans use a budget—and how many don’t.

We asked more than 1,000 people why they don’t create a budget. Get the answers below, and then learn how the right budget can help you get control over your spending habits and build financial stability.

Methodology

This survey was conducted for Credit.com using Suzy.com. The sample consisted of a total of 1,028 responses per question and is not statistically representative of the general population. This survey was conducted in October 2022.

In This Piece

- 27% of Americans Don’t Think They Need a Budget

- Older and Younger Generations Alike Feel They Don’t Need to Make Budgets

- Why a Budget Is Necessary

- How to Make a Budget Work for You

27% of Americans Don’t Think They Need a Budget

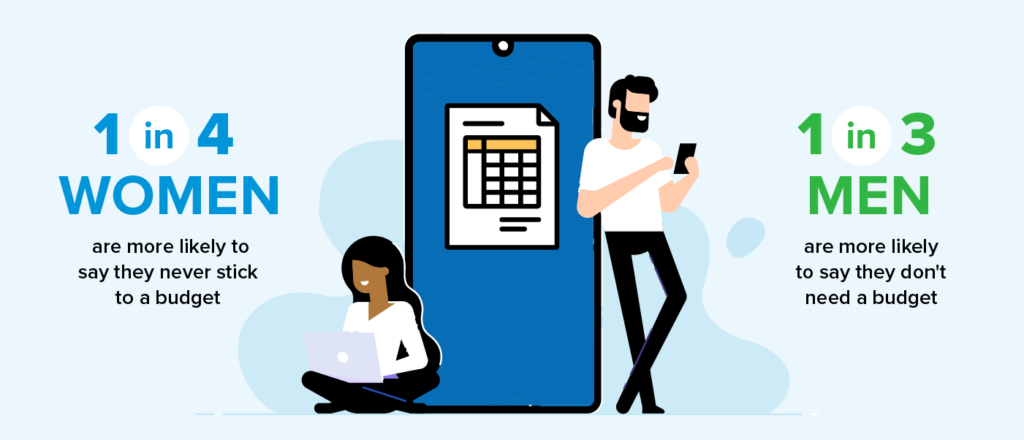

Almost 30% of Americans don’t budget because they simply don’t think they need this tool. Men are slightly more likely than women to say they don’t need a budget, but women are almost 4% more likely than men to say they won’t stick to a budget.

Here’s a breakdown of the most common reasons Americans don’t make budgets:

- They don’t think it’s necessary: 27%

- They don’t think they’ll stick to it: 24%

- They don’t feel like making one: 10%

- They don’t want to feel restricted by a budget: 15%

- They don’t know how to get started: 10%

- They’re afraid to even check their bank account: 12%

As you can see, for many Americans, a budget might look more appealing if it’s easy to make and stick to and they can see specific benefits coming from the effort.

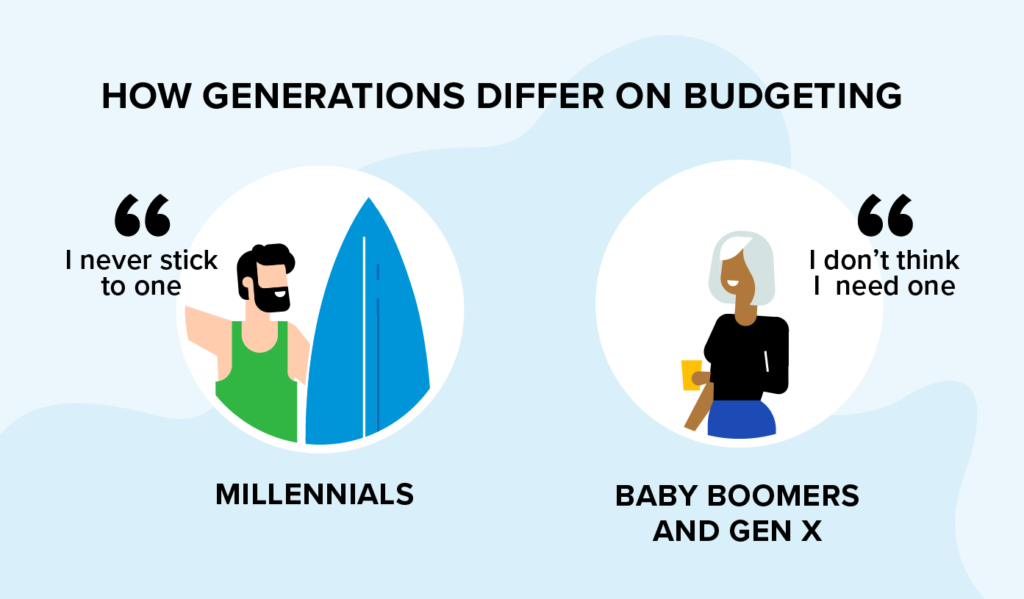

Older and Younger Generations Alike Feel They Don’t Need to Make Budgets

Individuals in the older and younger groups in the survey were more likely to say they didn’t need a budget than those who were middle-aged. More than 80% of individuals aged 50 and older said they don’t see the need, and just over half of those aged 18 to 34 said the same.

One reason this might be the case is that they haven’t found the right approach. Without a clear understanding of the many budgeting tools and strategies available, it can be easy to see budgeting as a restrictive, one-size-doesn’t-fit-all tool that isn’t right during various phases of life, such as college or retirement.

However, there are many budgeting methods you can use to get on the right track.

Why a Budget Is Necessary

One of the biggest takeaways from these statistics about budgeting is that a good number of Americans don’t see the point. Here are some benefits of budgeting to help you understand why you might need one:

- Budgets can alleviate financial stress. Around 12% of Americans are so unsure about their financial status that they’re afraid to look at their bank accounts. That number is higher for those aged 18 to 34, which means many young Americans are living with a lot of financial uncertainty. A monthly budget ensures you’re in the know and in control of your finances, which removes uncertainty and reduces stress.

- Budgets help you reach financial goals. When you take control of your finances with a good budget, you can create and work toward goals. Common goals include paying off debt, increasing credit scores and saving for the future.

- Budgets reduce the financial strain associated with unexpected expenses. Budgets help you set money aside for emergencies, drastically reducing the stress you might encounter when an unexpected expense arises. If you can create a budget that helps you save, even a little at a time, you create a strong financial foundation for your future.

How to Make a Budget Work for You

There’s no one-type-fits-all budget. If you’ve ever tried to create a budget and failed, maybe it wasn’t the right one for you. Whatever your reason for not budgeting, try some of these methods to find one that works for you. Start with a beginner budget as a first step to taking control of your finances.

Then, follow the steps below to make your preferred budgeting plan work for you.

1. Check Your Finances

Get the lay of the land, so to speak. Rip the bandage off and log into all your accounts. Find out how much you have in your checking and savings accounts. Make a list of all the debts you owe and how much you need to pay on them each month.

Then, look at your income. Create a list of all your income for the month. You need to know all this information to create a budget.

2. Track Expenses

If you have trouble sticking to a budget, challenge yourself to record all the purchases you make in a week or month. It may seem tedious, but it will give you a better picture of where your money’s going. There’s something to be said about the act of physically writing something down. If you’re worried about keeping track of a piece of paper, you can also do this in a notes app or spreadsheet.

3. Use Apps or Budgeting Platforms

Paper and pen work for budgeting, but it can be a cumbersome process to repeat each month. Consider using budgeting apps and other digital tools to automate your budget as much as possible. This helps streamline the process and can increase the chances you stick to your budget.

4. Use Creative Assets

In our survey, 15% of respondents said they don’t budget because they don’t like feeling restricted. If detailed budgeting doesn’t work for you, get creative with it. A planner or bullet journal system may be just what you need. Creating pages in your journal for things like expense trackers, debt trackers and bill reminders helps keep you accountable, and you can make them as visually pleasing and pretty as you like.

Related read: Kakeibo: The Mindful Japanese Budgeting System

Learning how to manage your money is one of the best things you can do for yourself. It’s never too late to take a look at your budget and make the changes you want. Paying down debt, saving for a rainy day and improving your credit score are all possible when you take control of your finances.

You Might Also Like

April 17, 2023

Budgeting and Saving Money

April 3, 2023

Budgeting and Saving Money

March 8, 2023

Budgeting and Saving Money

![Average Electric Bill by State [2023]](https://www.credit.com/blog/wp-content/uploads/2024/10/average-electric-bill-hero.webp)