Learning how to build credit can help if you have a bad credit score or want to improve your current score. You can start by getting a secured credit card, becoming an authorized user, or getting a cosigner on a loan.

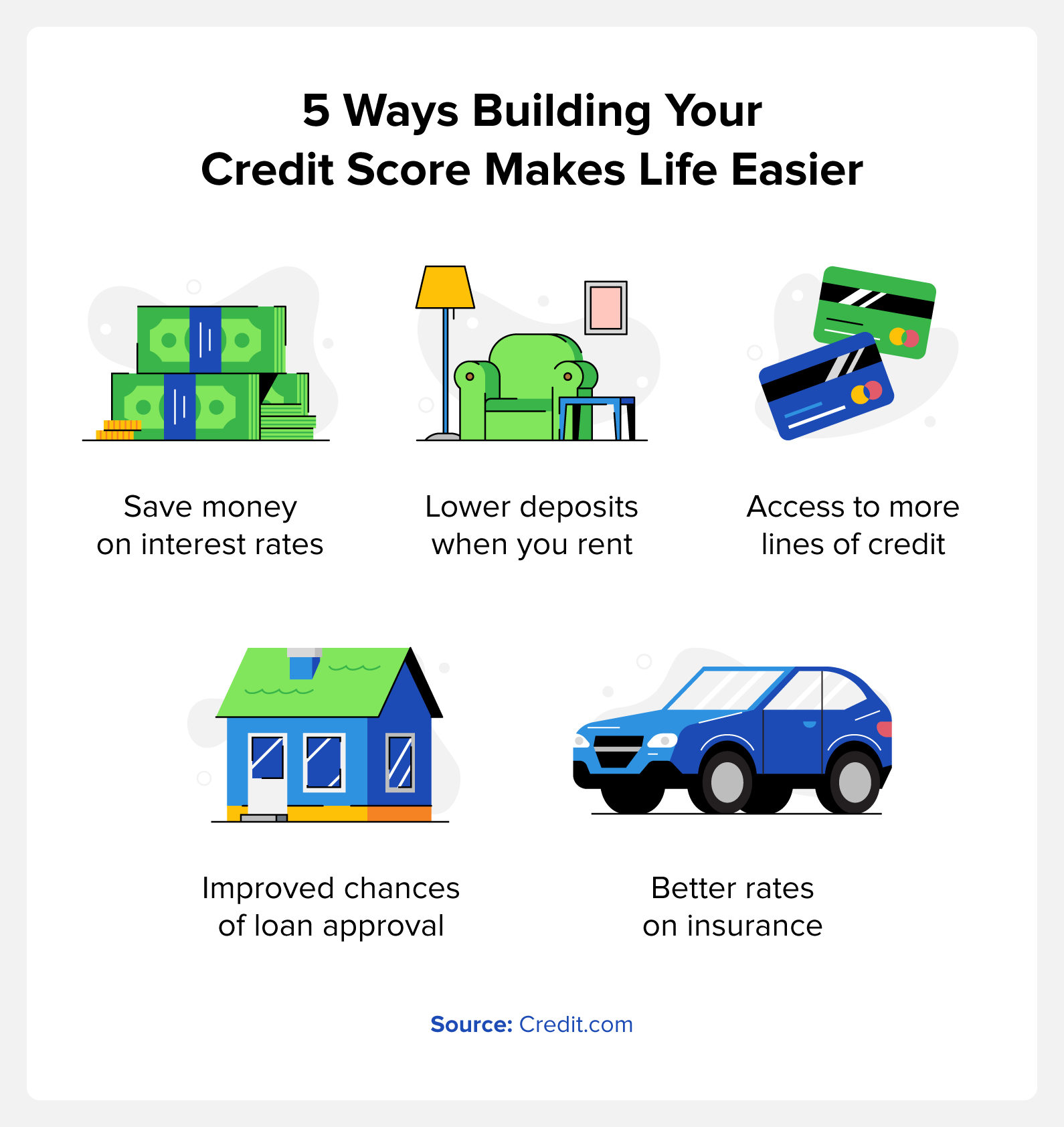

If you have bad credit due to derogatory marks, those marks can stay on your credit report for up to seven to ten years, depending on the type of mark. A low credit score leads to higher interest rates, larger deposits, and a low approval rate for loans and lines of credit. Those just beginning to build their credit will have similar challenges, but there are ways to build or work to repair your credit score.

By learning ways to build credit, you will not only improve your financial health, but it can reduce your stress around finances as well. In this article, we go over 12 tips that can help regardless of your specific credit situation.

Table of contents:

- Get Added as an Authorized User

- Try a Secured Credit Card

- Find a Cosigner

- Report Utilities and Bills

- Get a Credit-Builder Loan

- Pay Your Bills on Time

- Regularly Check Your Credit Scores and Reports

- Dispute Errors on Your Credit Report

- Pay Off Collections

- Open New Lines of Credit

- Request a Credit Limit Increase

- Have a Good Credit Mix

1. Get Added as an Authorized User

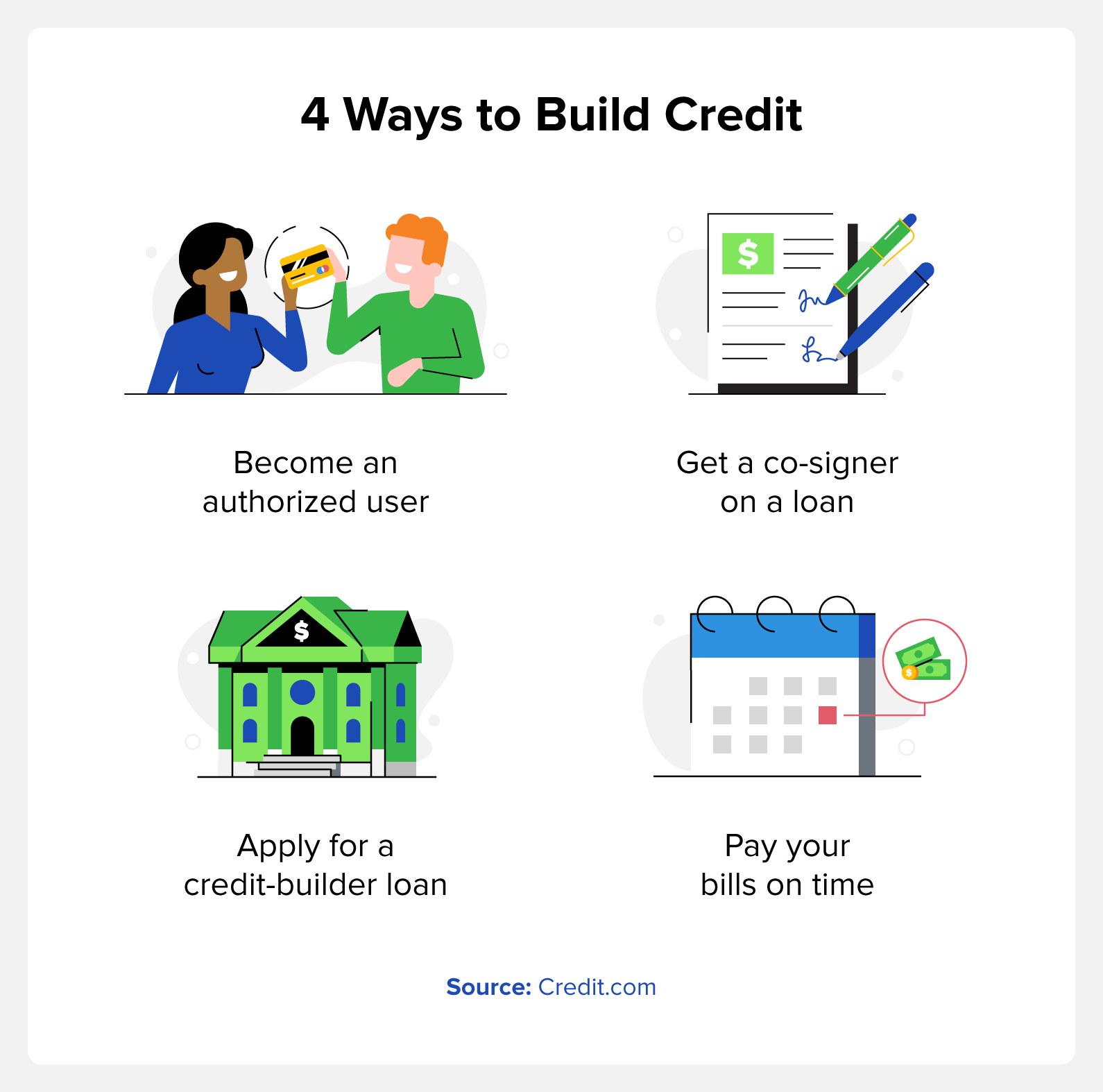

Becoming an authorized user is one of the most popular ways to build your credit score because you benefit from someone else’s good, established credit history. Also known as “piggybacking,” becoming an authorized user is when someone adds you to their credit card account.

The odds of approval on a credit application are lower if you have a low or bad credit score, so this is a way to start building credit and improve your ability to get your own card later. When you’re an authorized user, the card company will also report the payment history for your credit report when the primary account holder uses and makes payments on their credit card.

You can have a friend or family member add you as an authorized user. While this can be a great way to build credit, it’s useful to know that this can also negatively affect your or the other person’s credit should either of you miss payments or over utilize the credit line.

2. Try a Secured Credit Card

A secured credit card is a type of credit card that most people can acquire through their bank regardless of their credit score. The primary challenge of getting a credit card with a low credit score is that your credit score is one of the wayslenders evaluate risk. If you don’t have a credit history to show that you know how to manage credit or have derogatory marks on your report, credit card companies may be reluctant to loan you money via a credit card.

Secured credit cards are different because rather than borrowing from a financial institution, you borrow from yourself. You do this by depositing money into the credit card account, which becomes your credit limit. For example, if you opened a secured credit card with a $500 deposit, you will have a $500 credit limit. As you use the card and make regular payments, these will be reported to the credit bureaus to help build your credit history and potentially help improve your score.

3. Find a Cosigner

Similar to becoming an authorized user, you can benefit from a cosigner with a good credit score. On your own, you may not receive approval on a personal loan or car loan. When you have a cosigner with a good credit score, the lender sees loaning to you as less of a risk because the cosigner is also attached to the loan.

Although a cosigner can help with the loan approval process, like becoming an authorized user, your credit can also affect that of your cosigner, so it’s important to make full and on-time payments.

4. Report Utilities and Bills

When learning how to build credit, many people don’t realize that most utilities and bills are not reported to the three major credit bureaus. Fortunately, you can purchase services that will report your utilities and bills. Services like Credit.com’s ExtraCredit® subscription help build credit history for people with no credit history or low credit scores.

5. Get a Credit-Builder Loan

Credit-builder loans do just what you think they do—they are loans that help you build credit. Unlike typical loans, where you fill out an application and receive the funds, credit-builder loans are a sort of savings program. When a bank or financial institution provides you with a credit-builder loan, the funds go into an account, and you make payments on the amount. As you make your payments, the lender reports them to the credit bureaus to help build credit history and potentially improve your score with your on-time payments.

Many credit-building programs have higher interest rates than traditional loans due to the higher risk, but they can help your score in the long term. Once you pay the credit-builder loan off with interest, you receive the full loan amount.

6. Pay Your Bills on Time

If you already have lines of credit or loans, paying your bills on time is one of the best ways to continue building your credit score. Your payment history is 35% of your FICO® credit score, which is why paying your bills on time is helpful.

One of the best ways to ensure you never miss a payment is to set up automatic payments for the minimum amount on your credit cards and bills. You can always make additional payments, but when the money comes out of your bank account automatically, you no longer have to worry about forgetting a payment.

7. Regularly Check Your Credit Scores and Reports

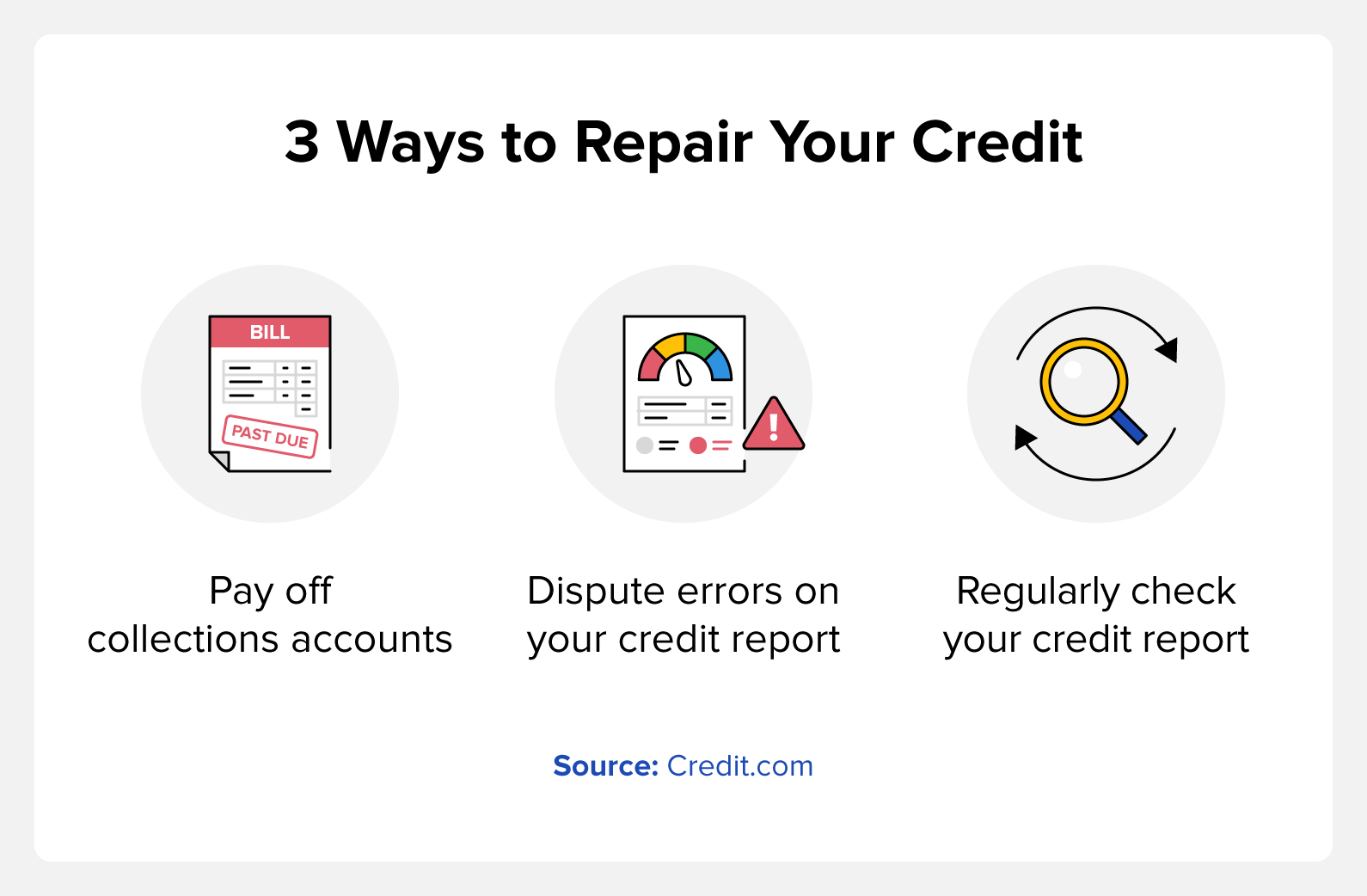

A great habit for building credit or trying to maintain a good credit score is to check your credit score and report regularly. Unlike a car experiencing mechanical issues, there are no warning lights or alarms that go off when your credit score drops or a negative mark appears on your report.

Checking your scores and reports lets you know if there are any issues sooner rather than later. It can also help you stay motivated as you work to build your score as you see the number start to rise.

Although your credit report doesn’t notify you about changes automatically, Credit.com’s ExtraCredit® offers credit monitoring as part of the subscription service. Credit.com also offers a free service whereyou also get your free credit report card to analyze your current score for issues that need your attention.

8. Dispute Errors on Your Credit Report

If you regularly check your credit score and credit report, you may find errors. Sometimes, bill and credit card companies don’t properly report your payments, which can hurt your credit. Credit card fraud and identity theft are also more common than you may think, and this can also cause your credit score to drop. Should you find errors on your credit report, it’s your right to challenge them. To file a formal dispute, you need to write a dispute letter showing documentation of payments and other information to the creditor reporting the error. If you have other potential errors, you can request a verification of the reporting from the credit bureaus. They will investigate then respond with the results, typically within 30 to 45 days.

9. Pay Off Collections

As you now know, derogatory marks on your credit report can have a negative impact on your credit score. When someone doesn’t pay their bills, the account becomes delinquent and a collection agency could buy it. You can find the information about the collection agency on your credit report and then contact them to pay off the debt.

In some cases, a collection agency will let you settle the debt for a fraction of what you owe. When you agree to pay off or settle the debt, you can ask for a pay-for-delete letter. After you pay off a collection agency, the derogatory mark can stay on your credit report for years. A pay-for-delete letter is an agreement that the collection agency will have the collection item removed from your report once you pay it. Get this agreement in writing!

Before negotiating with a collection agency, it’s helpful to also know your debt collection rights.

10. Open New Lines of Credit

For those with an established credit score, a good way to continue improving your credit score is to open new lines of credit. In addition to your payment history, credit utilization is the second-most important factor for your credit score. Your credit utilization is worth 30% of your FICO credit score, and new lines of credit can help keep your utilization low as long as you don’t use them.

Credit utilization is the amount you owe compared to your overall credit limit, and ideally, your utilization should be under 30%. For example, if you have five credit cards with a combined $5,000 credit limit and owe $2,500, your utilization is at 50%. If you open up a new line of credit for an additional $5,000, raising your total limit to $10,000, your utilization is now only 25% if you owe $2,500.

11. Request a Credit Limit Increase

If you don’t want to open new lines of credit but still want to build your credit, you can request a credit increase from your credit card company. This accomplishes the same thing with regard to credit utilization as opening new lines of credit. If you have a good payment history with your credit card company, they are more likely to increase your credit limit, lowering your utilization rate.

12. Have a Good Credit Mix

Your credit mix shows that you can handle multiple types of credit. The two primary credit types are installment and revolving credit. Revolving credit is a line of credit that allows you to spend up to the credit limit, make payments, and then use the credit again. Some common forms of revolving credit include:

- Credit cards

- Personal lines of credit

- Home equity lines of credit (HELOC)

Installment loans are lines of credit that give you an amount you pay down to $0 over time, and then the account closes. Examples of installment loans include:

- Auto loans

- Home loans

- Student loans

- Personal loans

Check Your Credit and Start Building It Today

Checking and monitoring your credit scores and credit reports is the key to building your credit and maintaining a positive score. As you continue to build your credit, you may begin to save money on interest rates and have additional financial freedom as you can access more opportunities.

If you want to begin your credit-building journey, Credit.com’s ExtraCredit subscription offers credit monitoring, bill reporting, personalized credit and loan recommendations, and more. You can also access your free credit score and free credit report card through Credit.com today.

You Might Also Like

June 4, 2024

Building Credit

April 30, 2024

Building Credit

April 30, 2024

Building Credit