Jason Lowery is a typical 29-year-old. He likes hanging out with friends, loves his family and spends weekends tinkering on his hobby car, a 1969 Chevrolet Chevelle. But unlike most of his peers, he’s completely debt-free, right down to his college tuition.

Born in the “lowly little” town of Lilburn, Georgia, as he jokingly put it, Lowery did well for himself. He graduated from Baylor University, in Waco, Texas, in 2010 with a bachelor of science in Mechanical Engineering with a minor in Mathematics. He is currently in grad school at the Air Force Institute of Technology, working toward a Master of Science in Astronautical Engineering with a certificate in Systems Engineering.

While most of Lowery’s undergraduate tab was picked up by the Air Force Reserve, which he joined freshman year, he still left college owing $60,000 in student loans. Adding to that, his late mother had a whopping $20,000 in credit card debt.

For someone whose parents always viewed themselves as being on top of their finances, Lowery was stunned. “My mom lost a lot of pride by having to handle that,” he said.

So he came up with a plan. “I said, ‘Tell you what. If you pay off $20,000 of my loans in your name, I’ll pay off your credit cards, and do it quickly,” Lowery recalled. In a year and a half, he would consolidate all his mother’s credit cards. Then, as his parents assumed his loan for $20,000, Lowery prepared to spend the next three years of his life paying off the remaining $40,000 in student loans — as well as those credit cards.

“I paid off all debts, including my mom’s, between January 2011 and February 2014,” Lowery said. “I paid my last bill 25 days after she died. It felt like kind of a proud tribute to her and all she taught me. Also served as a huge perspective change — life after debt corresponds with life after Mom.”

Here’s how Lowery did it, and what he can teach you about managing money.

A Crash Course in Differential Equations

To tackle his mother’s credit card debt, Lowery listed all her cards, noting their balance and interest rate. It’s a differential equations trick, he said. “I figured out every possible equation and chose the one that would amount to me paying the least amount in interest.” In the end, he went with the snowball method, paying off her debts in order from the smallest balance to largest, regardless of interest rate or monthly payment requirements.

“She had one card with $2,500 and a 29% rate, and I just nuked that card in two-and-a-half months,” Lowery said proudly.

At one point, he noticed an offer for a balance transfer credit card with a 0% interest rate. Though he knew it’d cost 4% to move his mother’s debt to the card, he “did the math,” realized “this is how much I’ll lose” and decided it’d be cheaper to take the 4% hit than risk paying more interest on the other cards. “My mom had severe interest rates,” he said. “They were really trying to crush her.”

Though Lowery’s typically wary of those offers, he worked diligently to pay the card off in 12 months before its higher interest rate kicked in. He was also realistic: “I knew I could pay it off before then,” he said.

Cutting Variable Costs

Since he works in the military, Lowery is fortunate to have a predictable income and some of his living costs covered, like healthcare. Certain tax exemptions also help. Still, Lowery fast-tracked paying back his debt by accounting for every dollar he spent.

“Less than 10% went toward eating,” he said, and since he was “used to poor living conditions because I was a college kid,” he skipped the fancy apartment with a dishwasher and electric stove. “It’s not like I was living horribly,” he assures, but he certainly adopted a penny-pinching mentality. He paid $550 each month for an apartment with internet and bought a used car to avoid monthly payments.

His mother, it seems, did just the opposite. “She was just constantly sending me stuff, even though she was recovering from this debt,” Lowery said. “I guess she was just used to a certain way of life, and when the recession hit and her investments tanked, she didn’t adjust her habits.”

He added, “I knew if I didn’t get my act together, that would happen to me.”

Once he finished paying the credit cards, Lowery continued putting the same amount toward his student loans. “I had already developed the habit of paying a lot each month,” he said. “And I was comfortable with living above a grandma’s house.”

The Color-Coded Budget

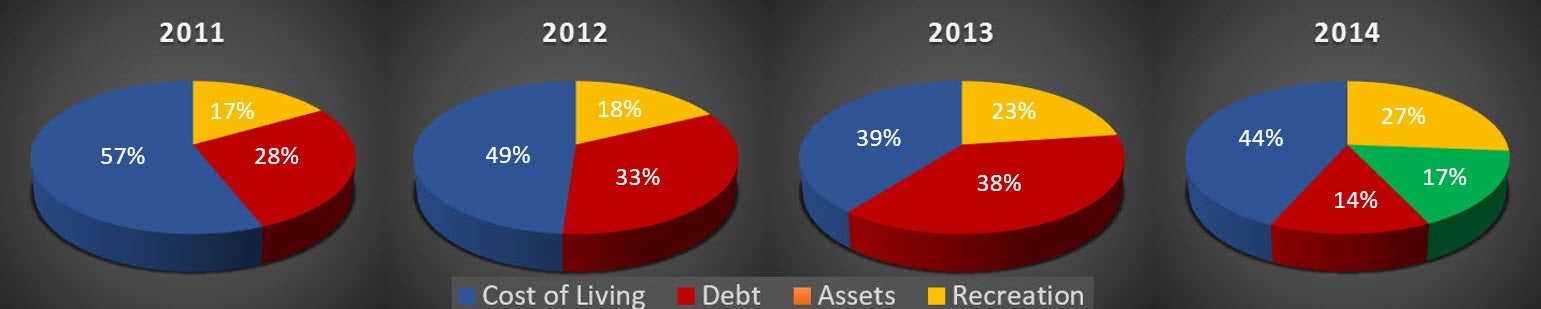

Lowery views money as colors. Whatever he spends is colored one of four ways: Green indicates assets that will gain value over time, such as retirement funds; red is for debt; blue is for costs of living, such as mortgage payments, home insurance and utilities; gold is for fun. The system, he said, forces him to be honest: “If you want to go out and have a nice meal, is that cost of living — i.e., food that’s necessary to eat — or is it recreation?”

Using Empirical Data

As soon as Lowery gets paid, he records that information in his budget on Excel. (The charts shown here were all done with the software.) Next, he breaks down how much he’ll pay this month for things like insurance, rent and fun and then plugs in those numbers, repeating the process the following month.

As you may guess, he’s amassed a wealth of data on his spending behavior. “I don’t do automatic payments,” he said. “There’s a bias — you get too reliant on using computers — you don’t really know what’s going toward bills. If something were to creep, you wouldn’t have any way of understanding how it creeps.”

Put another way, if your electricity bill rises, “do you have empirical data on that?” If not, Lowery said you’re depriving yourself of information you could use to make smarter decisions. (Another great way to keep track of how your finances affect you is keeping an eye on your credit score. You can do this by viewing two of your credit scores, updated every 14 days, on Credit.com for free.)

Keeping a Script

“When I get my bills or buy anything, nothing I’m doing is against a script that I’ve already set for myself,” Lowery said of his budgeting mindset. “I even have money set away for wasting.” He continued, “it’s easier to plan stuff out and make the decisions when it’s not urgent. You’ll make the smart decisions when there’s no emotion involved.”

Whenever he finds himself going off track, he refers to his spreadsheet to see where to make adjustments. He also uses the spreadsheet to estimate costs for his goals, such as starting a family, taking a trip or souping up his Chevelle. Lowery’s budget guides his lifestyle, not the other way around.

“Everyone thinks engineers are nerds who work on one stupid thing, but military engineers are forced to think about things holistically,” he said. “When we think about how much something will cost to build, we’re brainwashed into not just thinking of unit costs but about life-cycle costs and how much it will cost to train someone to use it.”

When spending, ask yourself if your choices align with your big-picture goals.

A Heuristic to Live By

In Lowery’s chart above, there is a quote that reads, “They say a hammer tends to view everything as a nail.” Expanding on this, Lowery said, “engineers naturally develop rules to explain things,” and this quote “reminds you that you are biased.”

That could be due to your education, your beliefs or what you’ve been told all your life. “If you’ve been told you’re a hammer, you’re going to view everything as a nail,” he said. “That’s how it relates to your personal debt — you have to recognize that you’ve probably been viewing things incorrectly.”

It’s a good guideline to live by — and like his budget, a helpful reminder.

More Money-Saving Reads:

Main Image and Inset Images courtesy of Jason Lowery

You Might Also Like

September 13, 2021

Uncategorized

August 4, 2021

Uncategorized

January 28, 2021

Uncategorized