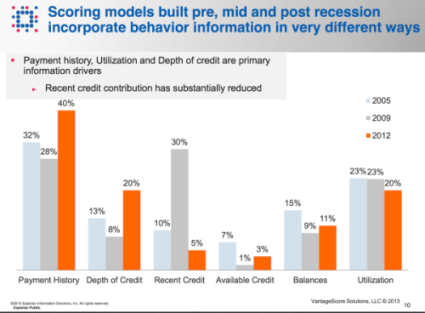

A consumer’s payment history, credit utilization ratio and depth of credit have always a significant impact on credit scores, but for some types of credit scores, the scale of that impact has changed considerably in the years following the Great Recession.

In 2009, immediately after the recession, recent credit contribution carried the most weight in the VantageScore credit scoring model, accounting for 30% of a credit score while payment history determined 28%. Now those portions are 5% and 40%, respectively, the company explained in a webinar last week.

The challenge for credit score modelers lies in weighing customer behaviors in a way that generates scores as reliable, predictive tools for lenders. Thus, credit scoring models have to adapt to both changing consumer data and changing economic realities. Context is important.

“We live in a post-recessionary environment and the way consumers behave and the data that is most predictive has shifted,” said Sarah Davies, Senior Vice President of VantageScore Solutions. “There has been a shift in credit asset classes exemplified by the growth in the student debt market. And there was a laser-light focus on recent credit versus a consumer’s entire credit history, which in the current environment is much more predictive of future default. More granular data takes these shifts into account and a model that leverages this data provides significantly increased predictiveness.”

Why Credit Scoring Accuracy Matters

Determining a consumer’s creditworthiness goes deeper than just the five major scoring categories, as discussed in the webinar. Davies explained how the new VantageScore model more deeply analyzes consumer behaviors as a means to generate more accurate, predictive scores.

Other credit scoring models, including the well-known FICO model, require a consumer to have at least 6 months of recent credit history, leaving some infrequent and new users of credit without a credit score. According to VantageScore Solutions, VantageScore 3.0, launched in March, scores 30 million to 35 million more users than previous VantageScore models. It turns out that many of those previously unscoreable consumers may in fact be very credit-worthy.

“About 10 million of those consumers are near prime or higher,” Davies said in the webinar, which educated lenders on the details of the new model. “I was very surprised that we would see that much.”

Greg Harned, vice president of decision analytics and credit policy for department store Kohls, said VantageScore allowed the company to gain insight into those previously unscored consumers. Kohls implemented VantageScore in 2007.

“It allows for much more confidence,” Davies said. “We’re able to rank consumers against a population of their peers.”

VantageScore 3.0 temporarily excludes negative credit information resulting from natural disasters, and paid-off collections accounts are not included in the score either.

Consumers can obtain their VantageScore 3.0 by using Credit.com’s free Credit Report Card. By knowing the behaviors that impact one’s score, consumers can take strides to improve credit health, Credit.com CEO Ian Cohen said in last week’s webinar, which he moderated.

“If you can get someone from near prime to prime, that’s a substantial change in their life,” Cohen said.

Image: iStockphoto

You Might Also Like

June 4, 2024

Credit Score

March 7, 2023

Credit Score

January 4, 2021

Credit Score