I am a lucky girl. Throughout high school and college, my parents kept me on their car insurance policy. I was an expensive item to add! I kept the cost as low as possible by earning the good student discount, driving a 14-year-old Subaru, never having a speeding ticket and being born a girl. However, when my fiancé James and I were preparing to get married, one of the financial conversations we had was about the car insurance policy. My parents gave me the title to the car (they owned it) and it became my responsibility, my car … and my turn to get insurance.

I set out to find a policy, and did all of my research online. I soon found out, however, that some of my pre-conceptions turned out to be misconceptions. Here’s what I learned along the way.

Where to Start?

I looked online and compared premiums from three difference companies, which I will refer to as Insurance Co. A, which my parents have, as well as Insurance Co. B and Insurance Co. C. My preference was to stick with the familiar — my parents’ insurance company – but it turns out it was far beyond my budget.

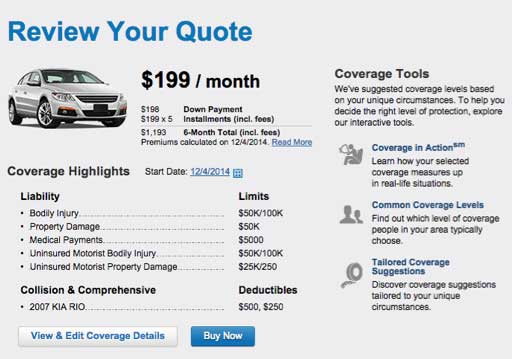

Here is the quote I was offered:

It was like the story of the Three Little Bears. Insurance Co. A cost too much. My parents have the advantage of bundling their policies (homeowners, etc.) and saving that way, in which case I recommend it. However, I’m not at that place in life where I need anything other than car insurance.

Which Option Is the Best Fit for Me?

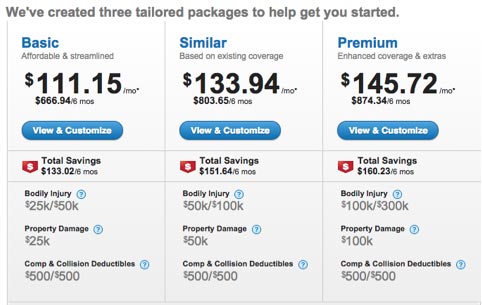

The rates offered by Insurance Co. B were affordable but I needed to investigate exactly what I was paying for or missing out on.

I plugged in my price to see what coverage options were available. Insurance Co. B’s most highly recommended package cost less than Insurance Co. A’s basic option. I didn’t feel comfortable enlisting in the most basic option because I don’t yet have a fully stocked emergency fund in case of a serious accident. So I compared the mid-range option at Insurance Co. B with what I could get from Insurance Co. C.

I was impressed. The premium Insurance Co. C package offered more and cost less than the equivalent from Insurance Co. B. The same was true of the mid-range package. Continuing my research, I called upon several important sources: my mom, Google, and the Insurance Co. agent (in that order). I needed to clear up some confusing lingo I was experiencing and get an opinion. I’m generally skeptical, and believe that if a deal sounds too good to be true, it probably is.

What Does a Comprehensive Deductible Cover?

I asked my mom (and Google) about the comprehensive coverage. Basically, that means the non-accident damage that will be covered. Hail and flood damage are some examples.

The collision deductible is what you’re willing to pay as cash out of pocket after an accident for repairs.

Bodily injury and property damages are the amount insurance will pay if you cause harm to another person or property with your vehicle.

What Happens If I Total My Car?

I learned that a totaled car means the total loss of a vehicle. A vehicle is considered a total loss when the repairs needed exceed 50-70% of the value of the car, depending on the insurance policy. The insurance company will give you the market value of the car before the crash. So a $600-800 repair would be a total loss for the Subaru because it had a market value of $1,200 (optimistically). In my case, if that happened, I would receive about $1,000 from my insurer to then go and find a new car.

Can I Get Additional Discounts?

It never hurts to ask for a discount. You might be surprised at what you’re offered.

All things considered, I chose the Insurance Co. C “similar” (mid-range) policy, but was able to bring my cost down to $79.96 each month. After going into the office, my agent asked me about my qualifications for other discounts, which brought it down even further. For example, I have a diploma, which still qualifies me for a good student discount. It’s not paying off my debt, but hey, I’ll take a discount when I can get one.

Also, in most states, insurers may check your credit — essentially a credit-based insurance score — when determining your monthly premium. That’s when working toward, or maintaining, good credit over time can help you out. By looking at your credit reports regularly, you can spot errors or other problems that are dragging down your credit, and resolve them. Checking your credit scores regularly can also give you an idea of where you stand, too. You can get your credit reports for free once a year from AnnualCreditReport.com, and you can get your credit scores for free, updated every 14 days, on Credit.com.

More on Auto Loans:

- Are There Car Loans for People With Bad Credit?

- What to Do If You Can’t Make Your Car Payments

- Top 5 Worst Car Buying Mistakes

Main image: iStock

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance