If you’re dieting, you’d no doubt love to step on the scale and see a big drop in the numbers displayed. But when it comes to things financial — the money in your retirement account, your paycheck, or even your credit scores — seeing those numbers go down is generally not welcome news.

When it comes to your credit scores, a drop in your scores may mean higher rates or even a rejection letter when you apply for a loan. The question is how much — and how fast — can your credit score drop?

In fact, changes in your credit information happen more often than you may realize. And sometimes those changes result in large fluctuations in credit scores, as these Credit.com readers have shared:

- I returned an item and the creditor never updated my account so now I am being hit with a 30 days no payment…That mistake sent my credit score from 800 to 720.

- I don’t understand how my credit score dropped 43 points when I paid off an auto loan…

- I check my credit score frequently, and noticed a negative report (collection account) to my credit. My credit score dropped 100 points when that hit.

The Ever-Changing Credit Score

Information is constantly being reported to the credit reporting agencies, and every time new information is used to calculate a score, the resulting score may be different than the one previously calculated.

“In theory, if a consumer has 10 accounts in their credit files, that consumer’s score might change 10 times a month if a score is pulled after each single account is reported,” warns Sarah Davies, Senior Vice President, Analytics, Product Management and Research for VantageScore. “There are roughly 200 million consumers with credit files in the United States, and approximately 36 billion pieces of credit data are recorded on their credit files every year. That’s an average of more than 15 changes to a credit file each month for each consumer.”

Of course, many changes won’t result in a significant difference in your scores. An inquiry, for example, will usually shave off only a few points, and some inquiries don’t count at all. But there are some events that can drop your scores significantly. These include the addition of a very negative item such as a collection account, judgment, bankruptcy or tax lien. Even a single late payment can cause a double-digit drop in your score.

Ironically, the better your credit, the bigger the decrease may be. If you’ve always paid your bills on time and have an excellent score, a new negative item can have a big impact.

It’s Not All Bad News

But what goes down can also go up. Davies explains that in many cases, changes are positive:

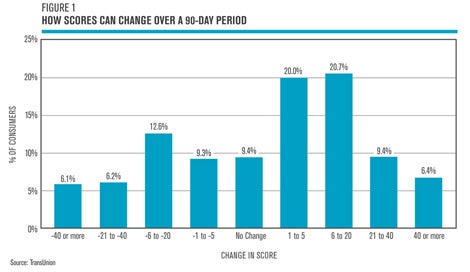

Roughly 70% of credit scores change by up to 20 points in any given 90-day window. A 20-point change isn’t very significant most of the time; a 40-point drop is more of a concern. As the chart shows below, most consumers experience a score improvement rather than a score drop. In fact, 56% of credit scores shift higher, while 34% drop, and the remaining 10% stay the same. Of those that experience a score drop, 6% see a drop of more than 40 points.

Whether you already have good credit and want to keep it that way, or you are trying to work your way up, you’ll want to get your free credit reports to make sure they are accurate. Then get a free credit score to see where you stand (which you can do using a tool like Credit.com’s Credit Report Card) and to find out what areas of your credit you may need to work on.

The fact that more than half of credit scores improved over a 90-day period should offer you hope. When it comes to your credit, there are almost always things you can do to help move those numbers in a positive direction.

More on Credit Reports and Credit Scores:

- The Credit.com Credit Score Learning Center

- What’s a Good Credit Score?

- How to Get Your Free Annual Credit Report

- How Do I Dispute an Error on My Credit Report?

- What’s a Bad Credit Score?

- How Credit Impacts Your Day-to-Day Life

Image: Purestock

You Might Also Like

June 4, 2024

Credit Score

March 7, 2023

Credit Score

January 4, 2021

Credit Score