You’ve heard that not having a great credit score can be costly, and you probably know intuitively that it’s true. But how much can it cost you? An extra $4,000 a year? That’s not an exaggeration.

Let’s take a look at some of the ways your credit score can directly impact your pocketbook. We’ll use purely hypothetical borrowers: Jerry has excellent credit, Elaine’s credit score is fair, while George’s is poor. But the examples of the money they may save (or pay) are very real.

Auto Loans

Credit scores aren’t the only factors that affect auto loan payments, of course. They will also vary depending on the amount borrowed, the length of the loan and whether financing is for a new or used vehicle. Based on data from Experian Information Solutions, though, you’ll see there can be a dramatic difference between what someone with poor credit and someone with excellent credit pays, on average, for their vehicle loans.

In one year, Elaine pays an extra $500 compared to Jerry, while George pays a little more than $1,000 extra!

Auto Insurance

Your auto insurance payments depend on a lot of factors, including where you drive, what you drive and your driving record. Very often one of the factors evaluated is the driver’s credit-based insurance score. (A few states, such as California, Hawaii and Massachusetts, don’t allow auto insurers to use credit information.)

When it comes to auto insurance, “yes, you are rewarded for having good credit,” says Rory Joyce, chief product officer for the national independent insurance agency and comparison website CoverHound. But he also points out that the differences in rates between someone with good credit and someone with stellar credit are likely to be small. “You are penalized more for having poor credit than rewarded for having excellent credit,” he explains.

Joyce also encourages consumers who are shopping for insurance to enter accurate information in order to get an accurate quote. If you enter fake information into a comparison website like CoverHound, for example, then your credit information won’t be taken into account. “Carriers will rate you as if you have no credit, which is the same as having the worst possible credit,” he warns.

In our example, Elaine’s credit score will cost her an additional $36 a month — or $435 a year — while George’s costs him $77 more a month, or $932 a year.

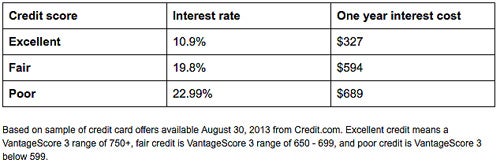

Credit Cards

For those who carry a balance from time to time, rates climb quickly for those whose credit isn’t good or excellent.

Here we’ll pretend each person is carrying a credit card balance of $3,000. (We’ll simplify it a bit and just use an annual interest rate. In real life, monthly payments will change the average daily balance and the interest paid.)

And of course, with an excellent credit score, most consumers can snag a 0% offer for 12 – 18 months if they need to borrow or transfer a balance, so all they may have to pay is the balance transfer fee.

When shopping for a credit card, it can be very helpful to first check your credit score (Credit.com’s free Credit Report Card is a good resource that lets you monitor your score and see a snapshot of your credit report). Then apply for cards for which you are more likely to be approved. Not only does this help you avoid the sting of rejection, it can also help avoid further inquiries into your credit history, which affects your credit scores.

In our example, George pays twice as much as Jerry in interest, and Elaine isn’t far behind.

Mortgages

Suppose each of our borrowers takes out a home loan for $175,000. Credit scores are just one of the factors that will come into play in determining what their rate will be. Others include income, debt ratios and the size of the down payment.

Of all the factors used to qualify for a mortgage, “credit score is perhaps the most important one,” says Joe Kelly, President of Arcloan.com. Close enough doesn’t cut it either. “When it comes to qualifying there is no ‘rounding up,’” he warns. “A score of 679 is not treated as 680, and a score of 619 vs. 620 could mean the difference of being approved for a mortgage.”

In this example, Elaine pays $41 a month more than Jerry, while George pays $169 a month more. But the differences become even more dramatic over time. If they each take 30 years to pay off their home loans, Elaine will pay a little more than $14,750 extra in interest compared to Jerry, while George will have to shell out almost $61,000 more!

Adding It Up

When you add together the higher mortgage, credit card, auto loan and auto insurance premiums our borrowers with less than stellar credit pay, the figures are pretty eye-popping:

Elaine, who has fair credit, pays $1,702.32 more than Jerry, who has excellent credit, in a year. That’s about $141 a month — enough to pay for a decent cellphone plan or cable TV in most places.

And George, with poor credit, pays $4,331.72 more in a year than he would with excellent credit. That’s $361 a month more!

While building better credit takes time and some effort, this goes to show that it can really pay off.

Image: iStockphoto

You Might Also Like

June 4, 2024

Credit Score

March 7, 2023

Credit Score

January 4, 2021

Credit Score