Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations.

Whether you’re looking to buy a house, lease a car, or get a loan, lenders need to check your credit. To do this, they’ll perform a hard inquiry, which can temporarily lower your credit score. And if someone pulls your credit without approval, it may lead to more inquiries that can harm your credit unfairly. In cases like these, you need to know how to remove hard inquiries.

While hard inquiries are common during credit applications, you’ll want to limit applying for new credit and avoid unauthorized inquiries as their impact stacks up fast.

We’ll explain what hard inquiries are, what causes them, and the steps involved with disputing an unfair or inaccurate hard inquiry.

In This Piece:

- What Is a Hard Inquiry?

- How to Do a Hard Inquiry Removal

- How Hard Inquiries Affect Your Credit Score

- Common Reasons for Hard Inquiries on Your Credit Report

- How to Remove Hard Inquiries FAQ

- Prevent Hard Inquiries from Identity Theft and Fraud

What Is a Hard Inquiry on Your Credit Report?

Hard inquiries are records indicating that a furnisher reviewed your credit report as part of a credit check. Typically, lenders conduct a hard inquiry before offering you a loan or credit limit increase. Hard inquiries may drop your credit score by a few points. Remember to limit the number of new lines of credit that you apply for at once.

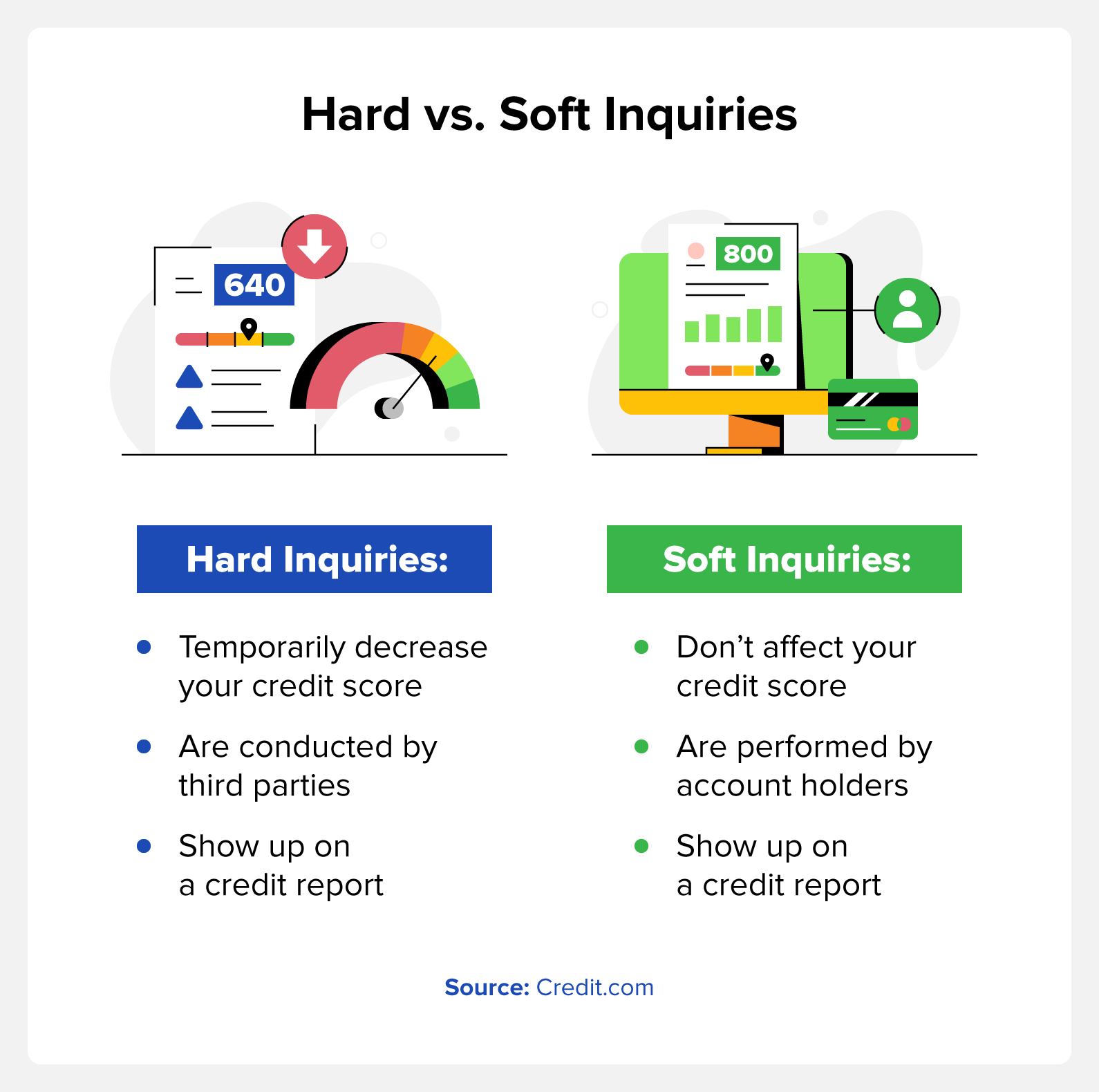

Hard Inquiries vs. Soft Inquiries

- Third parties conduct hard inquiries when they need to review your credit history. They will typically do this before issuing a loan, setting up accounts, or considering approval for housing.

- You check your own credit during a soft inquiry. A soft credit pull will not lower your credit score. You can conduct one whenever you want to review your credit. You can see your free credit score through a service like Credit.com.

Contrary to popular belief, checking your own credit score won’t lower it. That said, hard inquiries can lower your credit score. If hard inquiries occur without your consent, the Fair Credit Reporting Act allows you to remove those inquiries through a dispute.

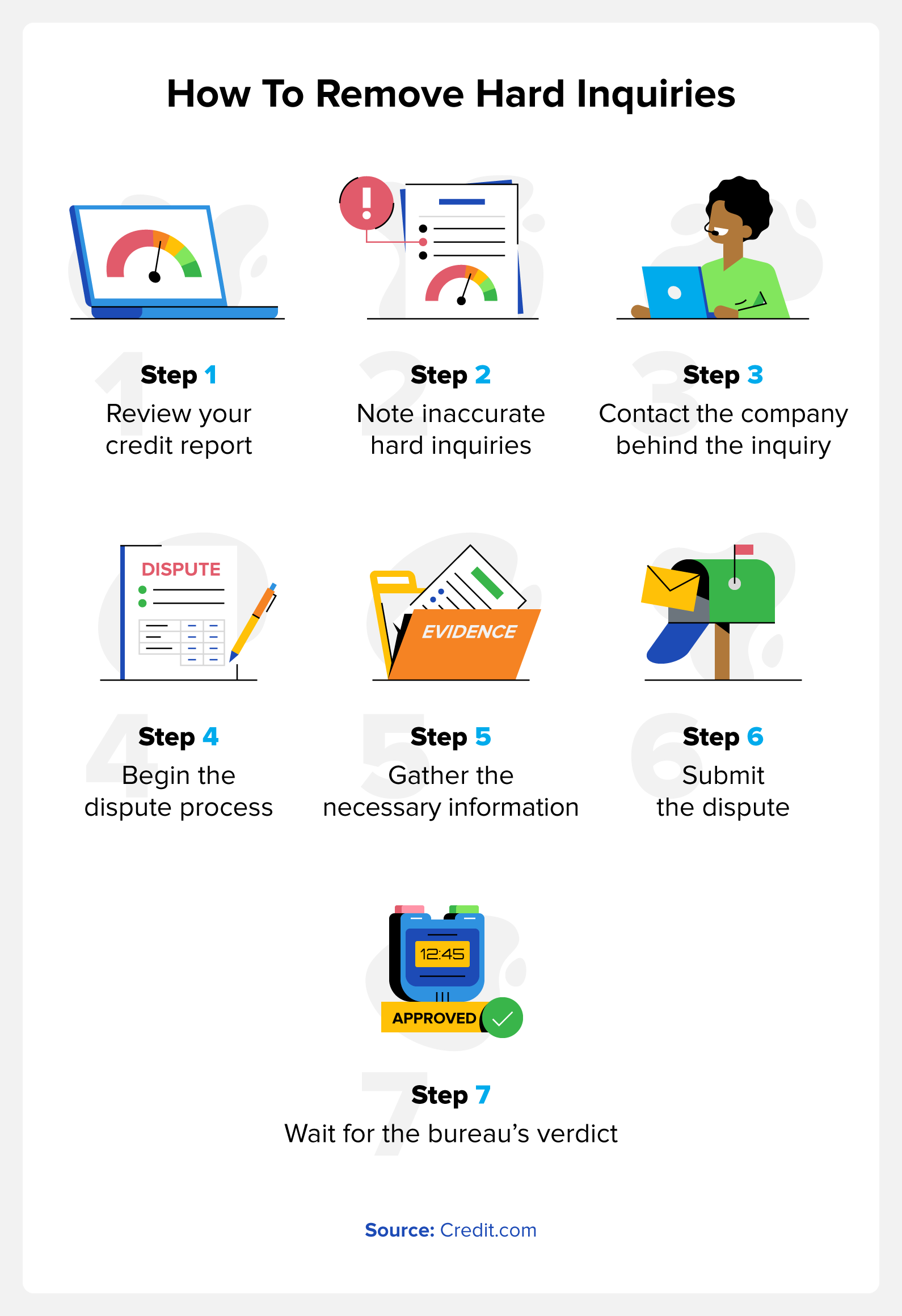

How to Do a Hard Inquiry Removal

You can dispute a hard inquiry if you run into evidence of fraudulent pulls or reporting errors. By asking for the removal of these unauthorized inquiries, you protect your credit score. You can go through the dispute in seven steps:

1. Review Your Credit Report

The Consumer Financial Protection Bureau (CFPB) recommends reviewing your credit report at least once a year to note unexpected changes. A sudden drop might indicate that unauthorized pulls impacted your credit.

You should also cross reference different credit reports for discrepancies. You can request free copies of your credit reports from Experian®, Equifax®, and TransUnion® at annualcreditreport.com.

Since 2020, and at the time of writing this post, the three main credit bureaus have allowed people to check their credit reports once a week for free as well. To access those weekly reports, you’ll need to request one with each credit bureau individually.

2. Note Any Inaccurate Hard Inquiries

Review the “Hard Inquiries” section of your report for signs of a credit check you didn’t authorize. If you see anything suspicious, be sure to:

- Note the furnishers or companies conducting hard inquiries you don’t recognize.

- Cross-reference those names across different reports to make sure they line up.

- Keep track of when each inquiry occurred.

- Note all inquiries you did authorize.

3. Contact the Company that Performed the Inquiry

Contact the furnishers responsible for illegitimate inquiries. In some cases, these lenders will remove the reports without conducting a formal dispute. To stay prepared, make sure you:

- Get in contact with the right departments or personnel for credit report disputes.

- Share all evidence of fraud or a mistake on the lender’s part.

- Make it clear that you want them to remove the inquiry from your report.

- If you have a past relationship with a furnisher, leverage your trust.

4. Begin the Dispute Process

You can file a formal dispute if the lender doesn’t respond to your request. Even if a furnisher rejects or ignores your request, you have grounds to push back. To get the ball rolling, you should:

- Review your dispute options. Some lenders use automated online systems, while others push you toward a formal dispute letter.

- Avoid handling your dispute over the phone. While this route is faster, it leaves fewer records you can use in case of legal action.

- Keep copies of every letter, email, or online submission you send regarding the dispute.

5. Gather All the Necessary Information

You must include all relevant information when drafting your formal dispute letter. This may include:

- Personal information like your name, date of birth, address, and Social Security number

- The dates of all disputed inquiries and the date you sent the letter

- The entities responsible for recording the disputed hard inquiries

- The reasons why you believe agencies should remove the inquiry

- Any related documents that point to evidence of fraud or identity theft

6. Submit the Dispute

With all the documentation in order, you can submit your dispute to a credit bureau. While you can contact bureaus by phone, mail, and online submissions, leave a stronger paper trail.

For credit disputes by mail:

- Equifax: Equifax Information Services, LLC, P.O. Box 740256, Atlanta, GA 30374

- Experian: Experian, P.O. Box 4500, Allen, TX 75013

- TransUnion: TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA, 19016

For credit disputes by online submission:

- Equifax: online dispute page

- Experian: online dispute portal

- TransUnion: online dispute page

For credit disputes by phone:

- Equifax: 888-378-4329

- Experian: 855-414-6048

- TransUnion: 800-916-8800

7. Wait for the Bureau’s Verdict

Credit reporting bureaus are required to resolve your dispute within 45 days. During this time, credit agencies will contact furnishers to determine whether the credit check was fraudulent. The Fair Credit Reporting Act also holds that businesses reporting to credit bureaus must investigate disputes.

If a credit agency can’t verify the inquiry, they should remove it from your report. On the other hand, they may keep the inquiry if the furnisher insists it’s valid. If this occurs, you can:

- Pursue legal action using your past documentation as evidence.

- Look for assistance from a credit counseling company. They could help you resolve the dispute.

- Request that the bureau includes a statement on your credit report detailing the dispute. Lenders who make hard inquiries in the future will note this statement and take it into consideration.

How Hard Inquiries Affect Your Credit Score

Hard inquiries impact 10% of your FICO® credit score. However, its exact impact on the total score depends on:

- Your credit history

- Your current standing

- The time since your last inquiry

A few hard inquiries won’t lead to any long-term consequences. Additionally, the amount each hard inquiry drops your score depends on your overall financial health. Most pulls will drop the score by just a few points111. Unless a lender pulls your score multiple times by mistake, you can rest assured the credit drop will only last a few months.

This doesn’t necessarily mean you need to worry about hard inquiries impacting your credit score. It just means you’ll want to be mindful of the number of applications you submit and when you submit them.

Common Reasons for Hard Inquiries on Your Credit Report

Lenders perform hard inquiries to check your financial standing. Depending on your credit score, they may find you more trustworthy and offer loans, credit limit increases, or rentals. In general, there are seven reasons you’ll see hard inquiries on your credit report:

- Credit card applications: When applying for your first credit card at a financial institution, assume they’ll conduct a hard inquiry. When applying for a second or third card, the lender may only run a soft credit check if you’re in good standing. Soft credit checks shouldn’t hurt your credit score.

- Home and auto loan applications: Lenders perform a hard inquiry before offering a large home or auto loan. However, when shopping around for favorable rates, inquiries made within 45 days of one another will only count as one inquiry.

- Rental applications: Applying to rent a home or apartment may result in a hard inquiry. While soft inquiries are more common, ask the housing manager about their approach before you apply.

- Loans: Applying for personal lines of credit or debt consolidation loans will likely involve a hard inquiry.

- Credit limit increase requests: Some financial institutions perform a hard inquiry before raising your credit limit. While most only look at your credit utilization history and conduct a soft inquiry, it’s worth asking a lender about their process.

- Reporting errors: Credit agencies can mistakenly add hard inquiries to your report. These mistakes can result from account errors, identity mismatches, or data management mistakes. Those errors can cause otherwise good credit scores to drop needlessly.

- Identity theft: Unauthorized inquiries may point toward fraud. Consult lenders with unauthorized inquiries to rule out identity theft.

How to Remove Hard Inquiries FAQ

Still have questions about hard inquiry removal and when hard inquiries fall off? We have the answers you need.

Can You Request to Have Hard Inquiries Removed?

If you applied for credit and authorized a hard inquiry from a lender, you can’t remove it from your credit report. Hard inquiries only leave your credit report if:

- Two years pass and they age off

- The inquiry wasn’t correctly authorized, and you

Does Removing Hard Inquiries Increase Your Credit Score?

Removing a hard inquiry can raise your credit score if it’s recent, but it may have no impact at all. While hard inquiries stay on your credit report for around two years, they only affect your score for about six months to a year. So, removing a hard inquiry over a year old may not raise your score.

Because of the timing, a hard inquiry falling off a credit report usually doesn’t boost the score, either. By the time an inquiry ages off, its impact on your credit score has probably passed.

How Many Hard Inquiries Are Too Many?

There isn’t a hard and fast limit to the number of hard inquiries that can be on your credit report. One or two credit pulls may only drop your credit score for a short time, but many hard inquiries in a short time frame may cause worse damage.

As a general rule, don’t apply to multiple lenders all at the same time. If you handle one reasonable credit application at a time, you’ll maintain a healthy score.

How Long Do Hard Inquiries Stay on Your Credit Report

Hard inquiries stay on your credit report for around two years. However, you can still improve your credit score even if hard inquiries are on your report. Make payments on time, avoid applying for more loans or lines of credit until your score recovers, and try to pay down the debt you already have.

How Many Points Does a Hard Inquiry Affect Credit Score?

It depends. For many people, a hard inquiry can cause your score to drop by just a few points. However, if you have multiple hard inquiries close together, your score may drop more.

Can You Check Your Credit Score Without Hurting It?

It’s possible to check your credit score without causing it to drop. When you do a personal credit check to see where your score is, it’s considered a soft credit pull, which won’t hurt your score. And if a lender performs a soft credit check to see if you should be preapproved for a loan or a credit card, it won’t hurt your score either.

Prevent Hard Inquiries From Identity Theft and Fraud

While a few hard inquiries won’t tank your credit, they can point to financial risks. Learning the basics of cleaning your credit report and reviewing hard inquiries helps keep you aware of your credit and keep your accounts safe from fraud. While going through a dispute involves some stress, the peace of mind you get from going through the process pays for itself.

With the risk of an unauthorized inquiry, it pays to stay on top of your credit score. You can find the credit monitoring tools you need with ExtraCredit. With our service, catching errors and preventing identity theft has never been easier. You can also request a free credit report card to see where your score stands.

You Might Also Like

March 7, 2023

Credit Repair

March 6, 2023

Credit Repair

May 10, 2022

Credit Repair