About 90% of Americans engage in some sort of personal financial planning, but few have a clear, well-rounded approach to reaching their goals. This month, the Certified Financial Planner Board of Standards and the Consumer Federation of America released the 2013 Household Financial Planning Survey and Index, which detailed the four categories of planners among American consumers.

The study followed the 2012 Household Financial Planning Survey, released by the same organizations, which tied the time and effort put into planning to better financial outcomes. The 2013 survey was conducted April 12 to 24 by Princeton Data Source and has a margin of error of plus or minus 3.5 percentage points. The index awarded consumers points for specific financial behaviors that fell into three categories: comprehensive financial planning, basic financial planning and credit card debt management.

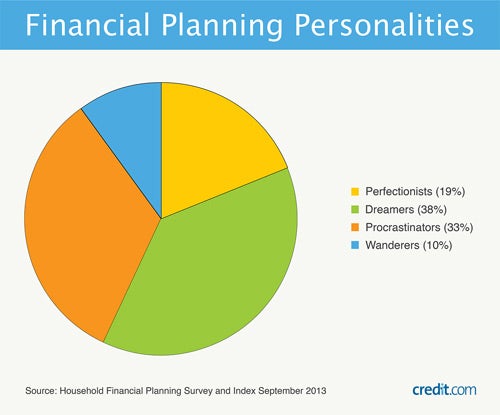

Based on scores from those criteria, Americans fell into one of four groups. In the report, they are called the comprehensive planners, basic planners, limited planners and non-planners. Here’s who they are:

The Perfectionists — (Comprehensive Planners) 19% of Americans

These consumers know the exact route to their financial goals, whether they drew the map themselves or sought professional planning guidance. Not only do they have a household budget, which includes retirement savings and insurance, but they work toward specific savings goals.

- Two-thirds use a Certified Financial Planner or registered investment adviser for planning assistance.

- 88% have a specific plan for retirement.

- 80% have a plan for emergency savings.

- More than half have a household income greater than $100,000.

The Dreamers — (Basic Planners) 38% of Americans

Most consumers fall in this category. They have some goals worked out and have an idea of what they’d like to achieve — they just haven’t yet worked out all the details. For instance, Dreamers may have savings plans for retirement or education, but they haven’t pulled everything together to form an overarching plan.

- Two-thirds have a household budget.

- Less than half of them write down their budget or store it electronically.

- 35% have a comprehensive plan.

- 31% are likely to make that plan within the next year.

The Procrastinators — (Limited Planners) 33% of Americans

These consumers put forth the bare minimum and might get to the rest of planning later. Most in this group have a budget or plan to address savings goals, but not both. Their comprehensive financial planning behaviors don’t differ much from non-planners — they’re nearly nonexistent in both groups — but some Procrastinators keep a written budget, and they tend to avoid racking up credit card debt.

- 31% plan for retirement, but only 7% save for emergencies, and only 7% save for anything else.

- 11% are likely to make a comprehensive plan within the next year.

- 44% have a household budget (only 15% write it down).

The Wanderers — (Non-Planners) 10% of Americans

In this group, consumers just kind of float from bill to bill without any strategic approach to money management. They exhibit nearly no comprehensive financial planning behaviors, with less than 1% likely to create a comprehensive plan in the next 12 months. Wanderers are about as likely as Perfectionists to take on $5,000 or more in credit card debt, while 45% of them have a household income of less than $25,000.

- 90% have no plan in place for specific savings goals.

- 40% have significant credit card debt.

- Half of them have no plan to pay down that debt.

In general, planners exhibited more confidence in financial decision-making and saved more money. For comparison: 53% of Perfectionists feel very confident in their financial decisions, while only 26% of Wanderers felt that way. On the flip side, 41% of Wanderers said they had little or no confidence, and only 6% of Perfectionists expressed that sentiment.

Such confidence comes from understanding one’s financial situation. With the wealth of planning tools available online, from budgeting to student loan management, anyone can set financial goals. A great way to take stock of your financial picture is to check your credit health using a free tool like Credit.com’s free Credit Report Card. It allows consumers to check their credit score and identify areas that need work on a monthly basis. Free tools like that help make financial planning accessible for consumers of any money mindset.

The bottom line? Yes, planners tend to make more money, but good decision-making doesn’t come with cash. Regardless of income level, planners achieved better financial outcomes than non-planners.

Image: Zoonar

You Might Also Like

March 11, 2021

Personal Finance

March 1, 2021

Personal Finance

February 18, 2021

Personal Finance