A hard credit inquiry is when a credit card issuer or another lender reviews a credit report as part of your credit application. Their request to review your credit will be shown as a hard inquiry on your credit report and will affect your credit score.

Let’s say you’re looking to apply for a new credit card. Whether you want to expand your available credit, create a credit mix, or simply apply for a credit card online with your desired rewards, you’ll often encounter a hard inquiry.

A hard credit inquiry—or a hard credit check—is a natural part of the credit card application process. It happens when the lender or bank associated with your credit card company checks your credit report to see if you are eligible for acceptance.

What Are Hard Inquiries?

Hard inquiries—or hard credit checks—occur whenever a lender or bank accesses your credit account. The credit bureaus log the activity, recording the date and the name of the company or entity that accesses it.

Hard inquiries refer to when a lender accesses your credit report to evaluate your merit as a borrower. In other words, hard inquiries happen when lenders look at the information in your report to decide whether to approve or deny your credit card application.

How Do Hard Inquiries Impact Your Credit?

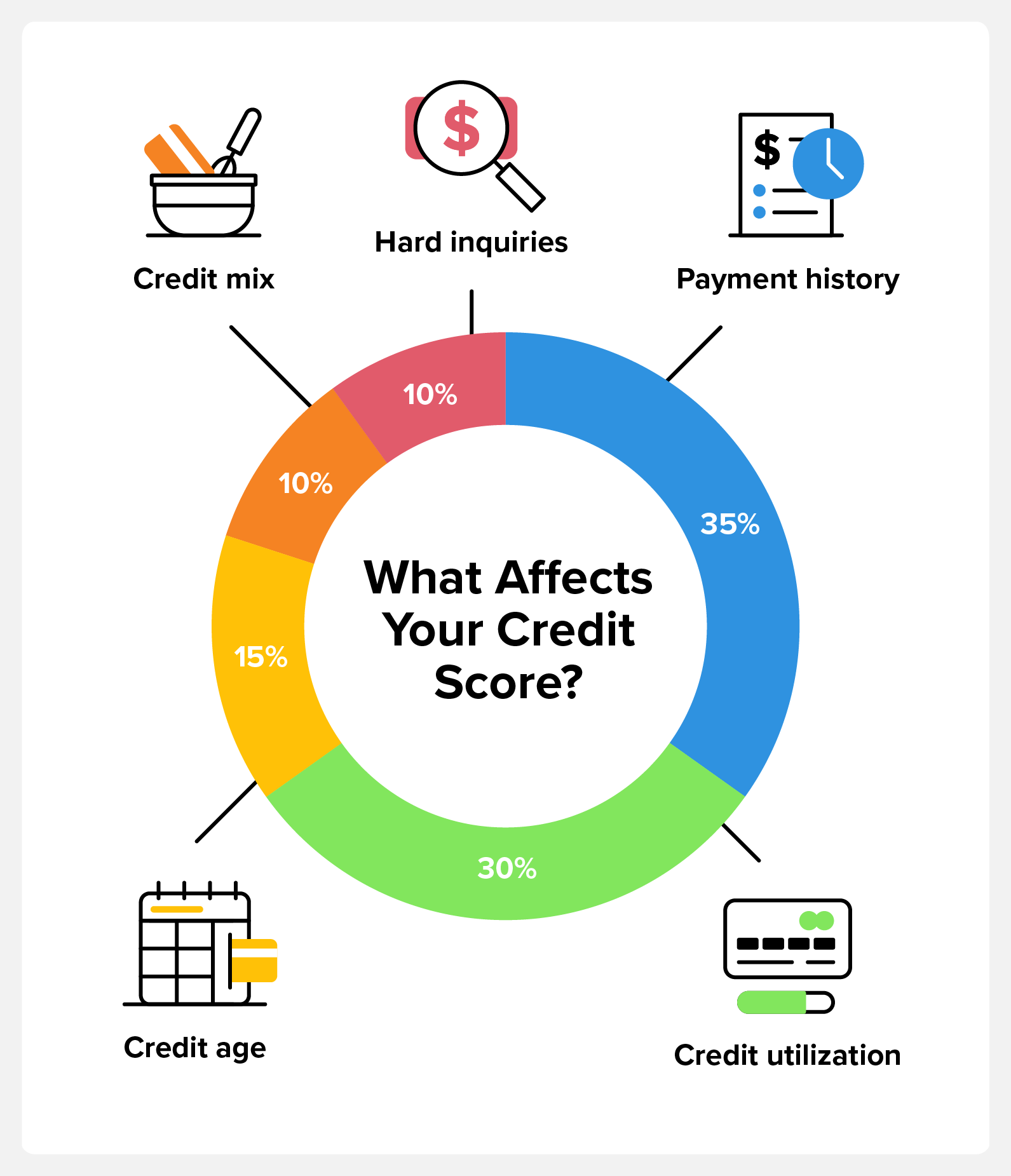

Hard inquiries aren’t the most impactful thing that affects your credit score, but they are one of the five major factors that make up your credit score. That’s because having many hard inquiries on your account looks like you’re chasing credit. Lenders don’t want to see that behavior from potential borrowers as it reduces their credibility.

Here are the five factors that impact your credit score:

- Payment history accounts for around 35% of your credit score. This factor is whether you pay your bills on time and as agreed upon.

- Credit utilization accounts for around 30%. This reports how much of your available revolving credit limit you’re actively using.

- Credit age accounts for around 15% of your score. This is how long you’ve had credit and the age of your oldest accounts.

- Credit mix makes up around 10% of your credit score. Creditors want to see that you can manage different types of accounts, such as revolving and installment accounts.

- Hard inquiries affect around 10% of your score. This is the number of recent hard inquiries on your report.

Hard Inquiries vs. Soft Inquiries

Not all inquiries that show up on your credit report impact your score. Only those that evaluate your financial creditworthiness do—these are hard credit checks.

Soft inquiries, which are purely informational, have little to do with credit and don’t have the same impact. They’re also not usually visible to lenders or banks—only you.

|

Hard inquiries |

Soft Inquiries |

|---|---|

|

Affect your credit score |

Don’t affect your credit score |

|

Count against your credit score for 1 year |

Appear only to you on your credit report |

|

Occur during the approval process |

Occur during pre-approval processes |

|

Happen when you’re actively searching for credit |

Happen during noncredit screenings and background checks |

|

Require your authorization |

Do not require authorization |

Examples of Hard Inquiries

Hard inquiries happen when you apply for a line of credit that will impact your financial health. Hard credit checks will affect your credit score and stay on your credit report for a year or two, so having too many of them in a short period may hurt you in the long run.

Credit card companies, car dealerships, banks, lenders, and others may perform a hard credit check only after your written approval—you will always know when a hard credit check will happen.

Examples of things that will require hard inquiries include:

Examples of Soft Inquiries

Soft inquiries typically happen for nonfinancial inquiries and don’t affect your credit score. Typically, only you can see the soft credit checks on your report. Soft credit checks also don’t need your permission to happen. Though employers will request permission for background checks, creditors can run a soft credit pull to prequalify you for marketing purposes. Note that you do have the opportunity to opt out of those soft checks, though.

Soft inquiries happen when:

- Employers run background checks

- Credit card companies do a pre-approval process

- Utility companies screen you

- You check your credit report

Disputing Hard Credit Inquiries

You should always review the hard inquiries on your credit report to ensure that you authorized them. If you see something on your credit report that you didn’t authorize or approve, you can dispute your hard inquiry by following these steps:

- Reach out to your current lenders and confirm that they didn’t create a hard credit inquiry for your credit.

- Research the creditor that authorized the hard inquiry. Sometimes, they will remove the inquiry from your report.

- Open a formal dispute with the credit bureaus. You will normally do this by filing a dispute on an online platform.

You will generally need to wait around 30 days (give or take) before receiving a reply about your hard inquiry dispute. When the credit bureaus reach a conclusion, they will remove the hard inquiry from your credit report.

Frequently Asked Questions

How Long Do Hard Inquiries Last?

According to Experian®, hard inquiries remain on your credit report for 25 months. However, they only tend to impact your credit score in the first 12 months.

How much a hard inquiry affects your credit depends on various factors, including what your credit score was to begin with. Experian notes that a hard inquiry can bring your score down 5-10 points on average. The drop might be even less if you have excellent credit and no other issues.

How Many Hard Credit Inquiries Is Too Many?

There’s no set number of inquiries that are too many. If you suddenly have a lot of inquiries, it can look bad to potential creditors. And if you’re losing up to 10 points for each one, you could drop from excellent or good credit to fair or poor credit with just five or more inquiries.

Spacing out the inquiries and ensuring that your credit report doesn’t take a hit can help minimize these issues. It also gives your score time to recover before another inquiry.

Are Hard Inquiries Bad?

Not necessarily. They’re simply an aspect of how credit reporting works—it’s actually good that this information gets recorded. Knowing who accessed your personal credit information and why can help keep you informed on your credit application history.

That said, hard inquiries aren’t neutral. They can impact your credit, so you want to keep them to a minimal number when possible.

What Triggers a Hard Inquiry?

Any time you apply for credit-related accounts with a lender, you will trigger a hard inquiry that will appear on your credit report. It’s important to remember that you will always authorize hard credit checks, so be mindful of how you space them out and what loans you need at what times.

Minimize Your Hard Inquiries

So, how do you reduce the impact of hard inquiries on your credit score? Nowadays, it can be challenging to go through life without ever applying for credit. But you can follow the steps below to reduce how hard inquiries impact your score:

- Don’t spread out loan shopping: Credit scoring models know that you’ll want to shop around for the best rates. Because of that, multiple applications for credit during short periods can appear as a single inquiry on your credit report.

- Don’t apply without confidence: Understand your credit score and what type of credit you are likely to qualify for, and only apply when you need the credit. Otherwise, you’ll rack up hard inquiries for no reason.

- Manage other aspects of your score responsibly: Make payments on time, keep your credit utilization low, and manage multiple types of accounts well. These all have more impact on your credit score than hard inquiries.

- Keep tabs on your credit report: The last step in minimizing hard inquiries is tracking your report and score. Check your credit regularly to see where you stand and whether potential mistakes could bring down your score.

You can check your Vantage 3.0 score with Credit.com’s free Credit Report Card or get many versions of your FICO® Score with ExtraCredit®. Neither of these options constitutes a hard inquiry, so using them won’t hurt your credit.