Personal Finance

Money makes the world go round. And it makes your world easier—especially if you have some and manage it wisely. At its very essence, managing money wisely—or not—is known as personal finance.

For some people, making smart money choices is easy. For others, not so much. But, never fear, the experts from Credit.com can help. In the personal finance section, find everything you need to know about personal finance and how to start making your money work better for you.

Just What Is Personal Finance?

Personal finance is how you manage your money—how you spend it or hold on to it. It’s about what you make and how you navigate everything from the dreaded “b” word—budgeting—to spending, saving, borrowing and investing your hard-earned cash.

Income and Debt

You can’t manage your personal finances unless you have money. Income is money. Money comes from a job for most of us, unless you’re an heir or heiress. Odds are you’re not.

Even if you’re lucky enough to make more than the median household income reported in 2017 of $60,366, you have responsibilities that suck your income away.1 And then you’ve got debt—rent or a mortgage, car loans and maintenance costs, insurance, groceries, utilities, credit card balances, cable TV or NetFlix, clothing and the things you don’t need but want anyway.

Debt is something owed—or lots of somethings in the case of dollars. Debt knocks when you need more money than you make—and who doesn’t. To fill the gap, you borrow against future funds, usually with a loan or credit card. When you spend more than you make and/or can repay, you fall behind. Then, debt leaves a bruise.

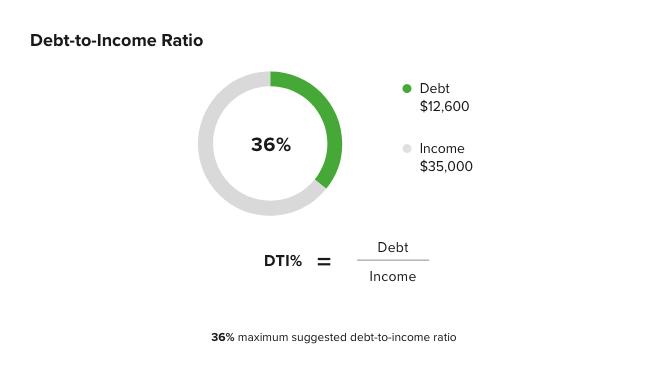

Keeping the bruises at bay means getting control of your finances getting control of your finances and balancing your debt-to-income ratio. That ratio is a comparison of the money you make to the money you own—your income versus your debts.

Lenders and credit card issuers look at your debt-to-income ratio (DTI) to decide to give you credit or a loan—or not. The lower your debt compared to your income, the less of a risk you pose to lenders.

The golden rule for debt-to-income ratio for debt-to-income ratio is 36% or less. If you make the 2017 annual median household income of $60,366, a 36% DTI means you have no more than $21,731.76 of debt in a year or no more than $1,810.98 a month.

Some Debt Is Good

While too much debt is bad, no debt can be bad too—seriously.

In addition to looking at your debt-to-income ratio, lenders and credit card issuers look at your credit and credit score—a three-digit number between 300 and 850. Your payment history on debts, like credit cards and loans, is the biggest factor in your credit score. So, you actually want debt. If you never have a loan or credit card, you don’t have a credit history or a payment history. And more oddly, without a credit history, you can struggle to get a loan or credit card. Because lenders can’t tell if you’re worth the risk.

No one said any of it makes sense.

Whether debt is good or gets the better of you depends on your debt not being more than you can pay back and still pay other expenses and needs. It’s about balancing your debt against your income.

If you have a mortgage, you want one that doesn’t tip your debt-to-income ratio past 36% when all of your other expenses are accounted for.

Credit card debt also works in your favor—just not too much of it. Learn more about debt usage below.

Bottom line: You actually want some debt, just not too much. If you struggle to keep your debt in line or you’re making due, but not setting anything extra aside, consider a budget. Even if you aren’t struggling, a budget is a valuable tool.

Budgeting

A budget is a way to keep see your income and costs in a single view or place.

It's both:

- A tool used to track what you earn—your income—against what you spend—your costs.

- A cap you set on a given expense. For example, capping a given lunch out at $15 or lunches out at $40 a week.

Once you create a budget as a tool, you see and can track your available money against needed expenses. You can then reduce expenses or increase income to gain the upper hand and shift from spending more than you earn to keeping more for yourself.

Your ideal goals as you gain the upper hand on your finances are to:

- Pay down debts o get your debt-to-income ratio and credit card utilization ratios within the 36% and 10% sweet spots.

- Create an emergency fund that equals at least 6 months of expenses if you don’t have one already.

- Make sure you set aside money for retirement if you aren’t already.

- Start saving for a home, a new car, your kid’s college education and whatever other financial goals you have.

Sometimes a budget isn’t enough. Sometimes your situation is out of your control. While a budget will help in the future, you may need help with the past. That’s when negotiating with creditors to reduce or consolidate payments might help.

Credit, Credit Scores and Credit Reports

Which comes first, your credit or your first credit card? That’s not much easier to answer than, “Which came first the chicken or the egg?”

The reality is that your credit comes after your first credit card or loan. No loans, no credit cards means no credit.

There’s credit—an advance to buy something—and then there’s your credit—aka your credit file.

Credit

Credit is essentially a loan from a bank or other financial institution, including a credit card issuer. These entities are collectively known as creditors or lenders and extend credit to you in the form of:

- Installment loans —aka installment credit—such as a mortgage or car loan

- Lines of credit or credit cardswith a maximum usable credit limit—known as revolving credit

- Credit arrangements are utilities, memberships (think gym) and service agreements (think cellphone)

- Charge cards that are like credit cards, but have to be paid in full each month

Your Credit—Your Credit Scores and Credit Reports

Your credit file is information about how you use credit—your loans and credit card. Your credit file—actually files, plural—is kept by the three major credit bureaus—Experian, Equifax and TransUnion. You have a file at each bureau. And each bureau’s file may be different because some creditors only report to some bureaus. Your credit report is an account of everything in your credit file, which includes:

- Your credit card and loan account records, including payment history, balances, credit limits and open and close dates

- Your basic information, such as name and address

- Information on applications you’ve made for credit within the last three years—called hard inquiries

- Information on your public records, if any, such as bankruptcies, tax liens and lawsuit judgments involving debts from the last 7 to 10 years

Your credit scores are calculated using the information in your credit file. A scoring model is run against your information and other peoples’ general information to essentially give you a 3-digit numerical score and a ranking, such as “good.”

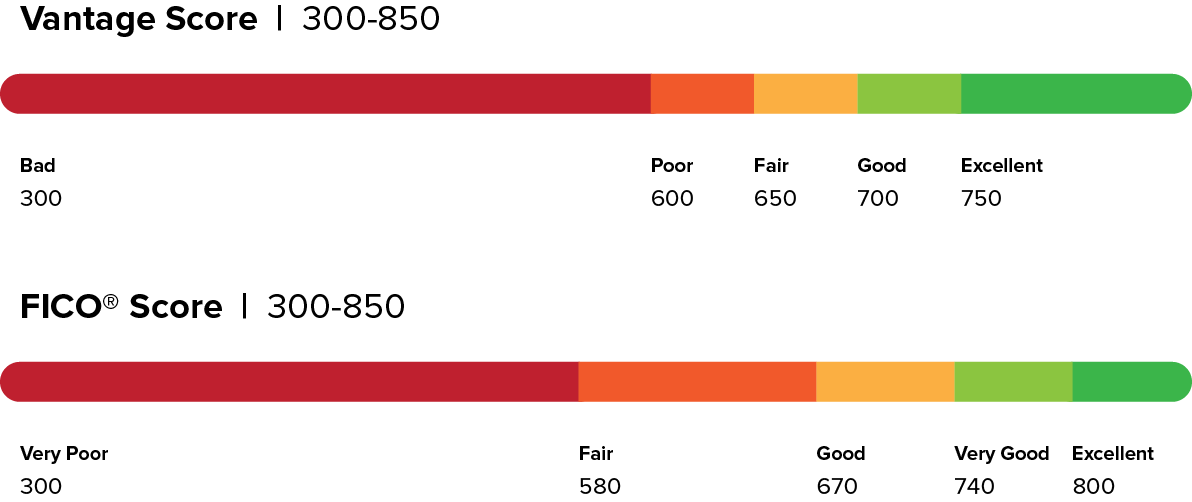

You have multiple scores and there are multiple scoring models. Each credit bureau uses different models that use different algorithms to generate a score. The FICO® Score model and VantageScore models are the most common models and scores. Scores from both range from 300 to 850 and bad or very poor to excellent or exceptional and break down as follows:

While the credit bureaus provide credit scores, so do FICO and VantageScore and other companies. Scores can even be industry-specific, such as the auto industry, the mortgage industry, and are averaged across all bureaus by some companies. Generally, all your scores are similar.

Your credit score is a bit different than the credit-based scores used by the insurance industry.

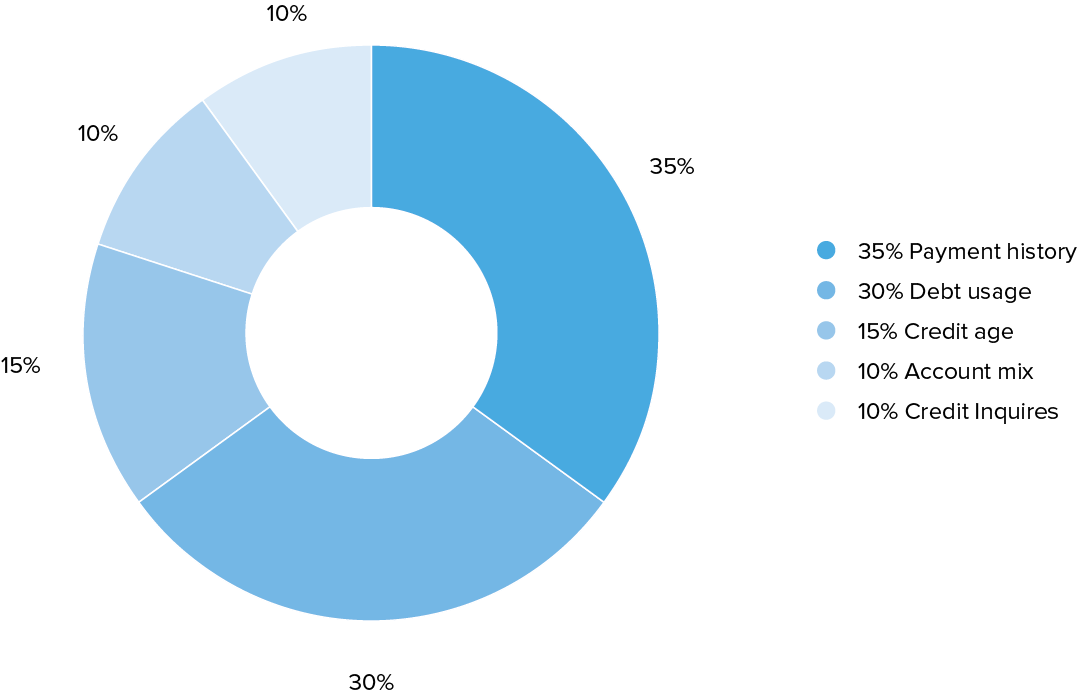

There are five main factors—or ingredients—from your credit file that make up the bulk of your credit score. Like any recipe, your score uses more of some ingredients than others.

Payment History

Payment history is just what it sounds like—your history of making payments whether on time or not. It’s the biggest ingredient in your credit score making up a full 35% of your score all by itself. Payments that matter are those reported to the credit bureaus and include credit card and line of credit payments and installment loans, such as a car payment or mortgage.

Rent and utility payments only factor in if your utility company or landlord reports your payments to the bureaus. Most don’t. But some do. You can ask your landlord to report your payments.

On-time payments help your credit score. Late payments and missed payments lower your credit score. Late payments that lead to collections, liens, foreclosures, bankruptcies and judgments hurt your score too. A negative item, like a late payment, lien and other item listed here, stay on your report for up to seven years. Chapter 7 bankruptcies stay for 10 years.

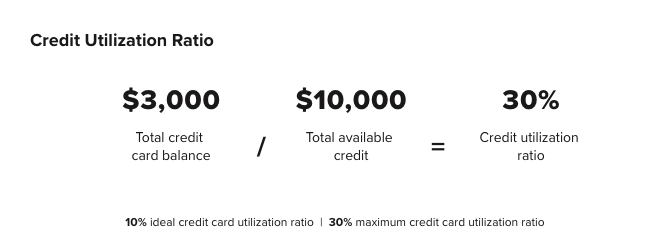

Debt Usage or Credit Utilization

Your debt usage or credit card utilization ratio is the second biggest ingredient in your score. Your ratio is the amount you’ve charged on your credit cards compared to the total credit limits on your cards. The maximum ratio that lenders and creditors like to see is 30%. The ideal is 10% or less.

Say you have three credit cards with a combined credit limit of $10,000. A credit card utilization ratio of 30% means you haven’t charged more than a total of $3,000 across all the cards. 10% is no more than $1,000 on all the cards combined.

Credit Age

Credit age is a lesser ingredient in your score. It makes up roughly 15% of your final score.

Credit age isn’t how long you’ve used credit , but how long ago—in years and months—the oldest recorded account on your credit file was opened. Your score also factors in the average age of all your accounts.

Accounts can be open and in use, unused or closed. Accounts closed by your creditor due to a lack of payment or other delinquency come off your credit file in seven years. Accounts you close by choice may come off your file or stay on it indefinitely. Typically though, an account you close falls off your file in 10 years.

A tip: Before choosing to close a credit card or line of credit, consider the impact on your score. Closing a revolving credit account lowers your credit limit and can increase your credit utilization. So, you might be better off leaving unused accounts open.

Account Mix

The mix of account you have makes up 10% of your score’s recipe. Your account mix has ingredients of its own. You want revolving credit accounts, installment loans and maybe even open credit.

- Revolving credit accounts include credit cards and home equity lines of credit.

- Installment loans are loans with a fixed payment schedule for a set term or number of years and include mortgage loans, home equity loans, auto loans, student loans, personal loans and credit builder loans.

- Open credit, such as a store charge card , rent or utility payment, is an account that should be paid in full each billing cycle.

There’s no magic formula for account mix. Creditors simply want to see that you’ve successfully handled a variety of types of credit.

Credit Inquiries

The final factor in your credit score is credit inquiries. Credit inquiries happen when you or a business accesses your credit report.

There are soft credit inquiries soft credit inquiries and hard inquiries . A hard inquiry happens when you apply for a credit card or loan and the creditor looks at your credit file. Each hard credit inquiry reduces your credit score by five or ten points for one to two years.

Soft inquiries happen when you or a prospective employer look at your credit. Soft inquiries don’t affect your credit score or go on your credit file.

A tip: Credit scoring models view multiple inquiries for a single loan type in a short timeframe as a single inquiry. So, if you’re looking for a mortgage, car, student or personal loan and need to apply for more than one, apply for multiple loans in a two week period.

Watch Your Credit

It’s important to keep an eye on both your credit score and your credit reports.

You can get a free copy of your credit reports from each of the three bureaus annually through AnnualCreditReport.com. The goal of checking your reports is to ensure that the information is accurate and actually yours. If you find an error, you can file a dispute with one or more of the credit reporting bureaus to try and have the error removed from your file. You can also turn to a credit repair company or credit lawyer for help.

You can get a free copy of your credit scores from a variety of places. And you can get your free Experian credit score only here on Credit.com or directly from Experian itself. You can also get your FICO score and Experian credit report on Credit.com for $1.

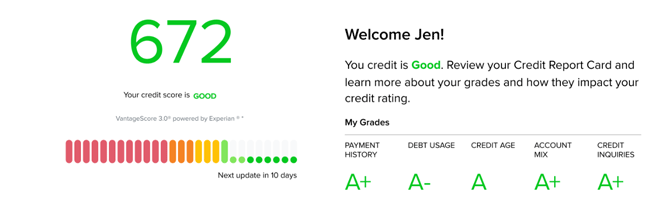

Your score on Credit.com is updated every two weeks and includes a free credit report card that shows you how you’re doing in each of the five factors that go into your score and what you can do to improve each factor if needed.

Keeping an eye on your score can alert you to any changes that indicate potential identity theft and other issues and let you act sooner than later.

Credit Cards and Loans

Credit cards and loans are go-to resources when you can’t afford to pay the full price of an item today and instead, need to pay it off over time. Loans tend to be used for major purchases while credit cards are used for smaller purchases.

Use cards and loans wisely and debt doesn’t take a bite out of your credit or your pocketbook. Use them poorly—intentionally or out of necessity—and debt takes a bite out of your credit score and your income.

Loans—aka installment loans—include mortgages, auto loans, student loans and personal loans. These loans have a set monthly payment for a set number of months (known as the loan term). The annual percentage rate or APR can vary—known as a variable rate or APR—but these loans often have a fixed-rate that stays the same for the term of the loan. With a few exceptions, your payments go toward the interest on the loan first and then toward the principal as the loan’s term matures.

Student loans are one of the biggest contributors to debt for many people—44 million in 2019.5 Student loan debt in the U.S. in 2019 hit an all-time high of $1.5 trillion.5 Defaulting on any loan can hurt your credit. Defaulting on a student loan can be disastrous and like any missed payment hurt your credit. Defaulting on a federal student loan can even result in your tax refund being taken to pay your student loan debt.

Credit cards are a form of revolving credit where you have a credit line you can spend against. Another form of revolving credit is a home equity line of credit (HELOC). Credit cards and HELOCs can have fixed or variable APRs.

Credit cards require you pay a minimum monthly payment. Balances are charged interest as an APR that breaks down into a period daily rate charged for each day of the month or billing cycle. Interest is charged on any balance that carries over to the next month. In other words, you can pay interest over and over on the same money spent. That’s one of the reasons Americans have an average credit card balance of $4,293.4

Here’s how it works. Your card’s APR is 20.24%. If you charge $500 and make a monthly payment of $50, you carry over $450. The next month, your balance is $458.31—$450 plus the interest of $8.31. You pay another $50 minimum payment, leaving $408.31 on your account. You’re now charged 6.79 in interest—and you’ve now paid interest on a carried-over balance twice and have racked up more than $15 in interest payments. Not bad for a few months, but keep charging so your balance goes up and interest payments can easily start getting the better of your budget.

Both loans and credit cards come into play with your debt to income ratio. And ironically, it can be hard to get a loan or credit card if you haven’t had a loan or credit card—because then you have no credit history. Similarly, fail to make your loan or credit card payments on time and that late payment is reported to the credit bureaus and your payment history gets dinged and your credit score drops. With a lower credit score, you may struggle to get a credit card or loan or pay higher interest on ones you can get. And round it goes.

Bottom line: Your credit and credit score affects your ability to get a loan or credit card and how much interest you pay for either. To protect your chances of getting a loan or card the best interest rate:

- Make your payments regularly and on time

- Keep your debt-to-income ratio and credit-card utilization ratio in the optimal percentage ranges as noted above

- Have a healthy mix of both loans and credit cards over the course of your life

Savings

Savings accounts and investment and retirement accounts aren’t included in your credit file or score. Ironically, you can have a huge net worth with money stashed away all over the place and still have a poor credit score.

Nonetheless, savings and related accounts are key to your financial security. And unless you win the lottery—and good luck with that—you want some money set aside, at the very least, in an emergency fund.

Sadly, in February 2019, The Washington Post reported that the Federal Reserve found that 4 out of 10 U.S. adults didn’t have enough set aside to cover an unplanned expense of just $400.2

It’s advisable to keep enough in savings to cover three to six months of expenses—that’s your emergency fund. If your monthly expenses for rent, groceries, gas, utilities, your phone and other items are $2,500, that means you want at least $7,500 in a savings account.

On top of that, you want to add money you’re saving for a down payment on a home or a car or that next trip to Paris. That’s assuming you don’t have a high debt load that’s causing your debt to grow and grow from interest charges. If you do, use your extra to pay off debt first and then save for long-term goals after your debt’s reduced.

Ideally, you want your emergency savings in a savings account you can access at any time. You can choose a traditional savings account, which may net a compound interest rate of as little as .10%. That’s the national rate at publishing time and comes from traditional banks and credit unions paying savings interest rates as low as 0.01% to up to 1.5%.3

Alternatively, you can choose a high-interest savings account or money market that pays 2% or more. A certificate of deposit (CD) is another option that might earn you more interest than a traditional savings account. But, CDs come with a maturity date at the end of your term. Withdrawing money early can result in a penalty and loss of interest on some of your deposit

Investments and Retirement

Investing is the next step after saving—think of investing as putting your savings on steroids. And retirement happens to everyone. Are you financially ready to retire?

Make retirement a priority over investing. And start as early as you can. If your company offers a retirement plan, like a 401K, take advantage of it. Even if you only put in 1% of your income, that’s something. And that money earns interest and grows for you over time.

Employer-sponsored plans are usually pre-tax plans. That means money is put into the plan before your taxes are taken out. You then pay taxes on the money after you retire and start withdrawing funds from the plan. Pre-tax plans lower your annual tax bill. A note of caution though, many financial planners suspect that tax rates may go up in the future, which might mean a higher tax burden later on. The solution, an after-tax or post-tax retirement savings option, such as an individual retirement account or IRA. There are pre-tax IRA options as well.

If your employer doesn’t offer a retirement plan, you might consider an IRA or annuity, you can have one of these or both in addition to your employer’s retirement plan. A Roth IRA is another retirement tool as are more traditional investment accounts, such as mutual funds. Both Roth IRAs and mutual funds are after-tax accounts. While IRAs and Roth IRAs are intended for retirement, mutual funds can be used for retirement and other investment purposes.

Other investment options you might consider outside of mutual funds and beyond a typical savings account include certificates of deposit or CDs, stocks, bonds, variable life insurance policies and others. Most of these options differ from a savings account in that you commit to leaving your money in the account for a given time before you can take the money and any interest earned out.

Whatever you do, avoid using your retirement savings for pre-retirement needs. If you do dip into your 401K or IRA, you pay a penalty.

Insurance

Life comes with necessary evils. Insurance, like income, is one of them. Although getting an income is more fun than giving it to an insurance company.

If you have a car, you need car insurance. And you want to include that insurance payment in your budget. If you have a home, you need homeowners insurance. Your mortgage company demands it.

Oddly, your credit can impact what you pay for car insurance and homeowners insurance. But, not the kind of credit that affects the interest rate you pay on the loan for that car—at least not entirely.

Your credit rating that affects what you pay for insurance is your credit-based score as opposed to your credit score. Where allowed, insurance companies look at your credit-based score to predict how likely you are to file an insurance claim. (Some states prohibit the use of scores to determine rates, including California, Hawaii and Massachusetts.)

Your credit rating that affects what you pay for insurance is your credit-based score as opposed to your credit score. Where allowed, insurance companies look at your credit-based score to predict how likely you are to file an insurance claim. (Some states prohibit the use of scores to determine rates, including California, Hawaii and Massachusetts.)

Your credit-based insurance score—aka insurance risk score—is not your FICO score or VantageScore credit score. It’s calculated using some of the information in your credit reports that generate your FICO and VantageScore credit scores, but other information is left out.

Information used to calculate your credit-based score includes payment history, credit age, credit inquiries, outstanding debt and account mix. Information not used includes income, medical collections, age, income, gender, race, religion, marital status and geographic data.

Credit-based insurance scores are three-digit numbers that look similar to regular credit scores. And a good auto insurance credit score is a higher one just like with regular credit scores.

Taxes

Like debt, Uncle Sam can bite. And like insurance, income taxes are a necessary evil. Taxes are money you pay to the government and most likely your state. If you work for an employer, your employer takes your taxes out of your paycheck. You then file your taxes annually and get any money back that you overpaid as a tax refund or pay taxes if you still owe Uncle Sam.

If you freelance or are self-employed, you have to pay Uncle Sam yourself and can do so quarterly or annually. Although, quarterly estimated taxes are recommended. You also want to account for your taxes in your budget.

The amount of tax you pay is determined by your income and the tax bracket you fall in, which is based on your income, marital status and other factors.

Taxes are a part of your personal finances. You want to take advantage of tax deductions to maximize your refund. And if you’re due a refund, a good use for it is to pay off debt, add it to your emergency fund or a savings or investment account.

More on Personal Finance

Credit.com offers tools and information to help you with your personal finances, financial planning and management including:

- Personal Finance Learning Center

- Managing Debt Learning Center

- Credit Card FAQ Center

- Mortgage Learning Center

- Loan Learning Center

- Tax Learning Center

- Personal Finance Calculators

1 U.S. Census Bureau, Household Income; 2017, American Community Survey Briefs

2 The Washington Post, “Does America have a savings crisis?”

3 National savings rate average from the FDIC.gov website as of 3/18/2019.

4 Experian, “A Look at U.S. Consumer Credit Card Debt”

5 Forbes, “Student Loan Debt Statistics In 2019: A $1.5 Trillion Crisis”